Crown Holdings, Inc. (NYSE:CCK) delivered fourth-quarter 2018 adjusted earnings per share of $1.00, up 19% year over year. Earnings were in line with the Zacks Consensus Estimate.

On a reported basis, earnings were 40 cents per share against a loss of 67 cents in the prior-year quarter.

Net sales in the quarter rose 26% year over year to $2,734 million, which missed the Zacks Consensus Estimate of $2,778 million. The sales upside was driven by positive impact of the Signode acquisition, improved beverage can volumes and pass through of higher material costs to customers, partly offset by unfavorable currency translation. Global beverage can volumes grew 5% year over year in the fourth quarter.

Cost and Margins

Cost of products sold rose 26% year over year to $2,224 million. On a year-over-year basis, gross profit improved 28% to $510 million and gross margin increased 18.7% from 18.3% in the year-ago quarter.

Selling and administrative expenses flared up 61% year over year to $156 million. Adjusted segment operating income increased 14% year over year to $279 million in the reported quarter. Operating margin came down to 10% from 11% in the year-ago quarter.

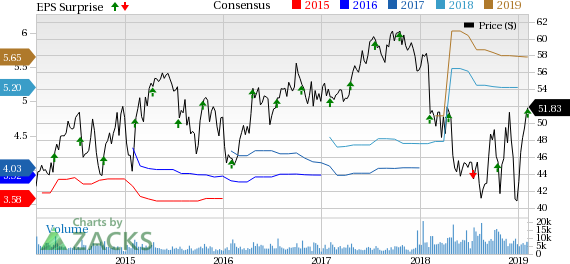

Crown Holdings, Inc. Price, Consensus and EPS Surprise

Segment Performance

Net sales at the Americas Beverage segment were $804 million, up 5.5% from $762 million in the prior-year quarter. Segment operating profit declined 7.8% to $118 million from $128 million in the year-earlier quarter.

The European Beverage segment’s sales fell 9% year over year to $295 million. Operating income dropped 65% year over year to $13 million.

Revenues at the European Food segment decreased 9% year over year to $417 million. Segment operating profit went down 38% year over year to $26 million from $42 million.

Revenues at the Asia-Pacific segment improved 4.5% year over year to $326 million. Operating profit went up to $49 million from $44 million in the prior-year quarter.

Revenues at the Transit Packaging segment totaled $595 million. Operating profit was $80 million.

Financial Update

Crown Holdings had cash and cash equivalents of $607 million at the end of the fourth quarter compared with $424 million at the end of the prior-year quarter. The company reported cash flow from operating activities of $571 million in fiscal 2018, compared with cash usage of $250 million in the prior fiscal.

Adjusted free cash flow was $661 million in the fourth quarter compared with $297 million in the prior-year quarter. As of the quarter-end, Crown Holdings’ long-term debt increased to $8,517 million from $5,217 million as of the year-ago quarter end.

Crown Holdings commenced production at a new one-line beverage can plant in Yangon, Myanmar, in July. The first line of the beverage can plant in Valencia, Spain, began operations in October, with the second line scheduled to begin in February. Last December, the company commenced one-line beverage can plant in Parma. The company also started operations on the third beverage can line at its existing plant in Phnom Penh, Cambodia, in January 2019. During fourth-quarter 2019, the company will begin a new one-line beverage can plant operations in Rio Verde, central Brazil.

2018 Results

Crown Holdings reported adjusted earnings per share of $5.20 in 2018, up 23% from $4.24 in the prior-year. Earnings matched the Zacks Consensus Estimate.

Sales increased 28% year over year to $11.15 billion. The top line lagged the Zacks Consensus Estimate of $11.21 billion.

Outlook

Crown Holdings projects adjusted earnings per share in the band of $5.20-$5.40 for 2019. Adjusted earnings per share for first-quarter 2019 are estimated in the range of $1.00-$1.10.

Share Price Performance

In the past year, Crown Holdings’ stock has depreciated around 0.7% against the industry’s 18.9% gain.

Zacks Rank & Stocks to Consider

Crown Holdings currently carries a Zacks Rank #4 (Sell).

A few better-ranked stocks in the Industrial Products sector are Axon Enterprise, Inc (NASDAQ:AAXN) , Alarm.com Holdings, Inc. (NASDAQ:ALRM) and EnerSys (NYSE:ENS) . While Axon and Alarm.com currently flaunt a Zacks Rank #1 (Strong Buy), EnerSys carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Axon has an expected earnings growth rate of 14.5% for 2019. The company’s shares have rallied 105.9% in the past year.

Alarm.com has an expected earnings growth rate of 7.8% for 2019. The stock has climbed 84% in a year’s time.

EnerSys has an expected earnings growth rate of 9.5% for 2019. Its shares have gained 25.5% in the past year.

Zacks' Top 10 Stocks for 2019

In addition to the stocks discussed above, wouldn't you like to know about our 10 finest buy-and-holds for the year?

From more than 4,000 companies covered by the Zacks Rank, these 10 were picked by a process that consistently beats the market. Even during 2018 while the market dropped -5.2%, our Top 10s were up well into double-digits. And during bullish 2012 – 2017, they soared far above the market's +126.3%, reaching +181.9%.

This year, the portfolio features a player that thrives on volatility, an AI comer, and a dynamic tech company that helps doctors deliver better patient outcomes at lower costs.

See Stocks Today >>

Crown Holdings, Inc. (CCK): Get Free Report

Alarm.com Holdings, Inc. (ALRM): Free Stock Analysis Report

Enersys (ENS): Get Free Report

Axon Enterprise, Inc (AAXN): Get Free Report

Original post

Zacks Investment Research