Crown Castle International Corp. (NYSE:CCI) , a leading wireless communication tower operator, reported impressive financial results for the second quarter of 2017. The company’s top as well as bottom line surpassed the Zacks Consensus Estimate.

Wireless services are rapidly gaining ground courtesy of additional features and capabilities. Buyout of wireless towers also bodes well. Much of the infrastructure and upgrades require effective site management of cell towers and equipment.

Crown Castle efficiently addresses this opportunity since over 90% of its quarterly revenues come from wireless service providers like Verizon Communications Inc. (NYSE:VZ) , AT&T Inc. (NYSE:T) and T-Mobile US Inc. (NYSE:T) . The company currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Net Income

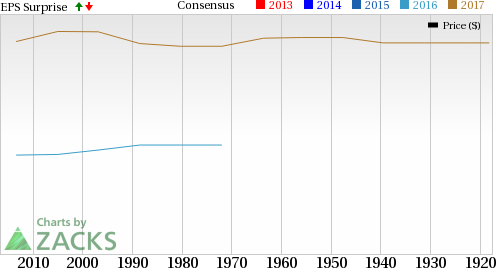

Crown Castle reported quarterly earnings per share of $1.20, beating the Zacks Consensus Estimate of $1.15. Likewise, GAAP net income rose a whopping 49.4% year over year to $112.1 million.

Revenues

Total revenue in the second quarter increased 7.9% year over year to $1,038.3 million, beating the Zacks Consensus Estimate of $1,036 million. Site Rental Segment quarterly revenues were $868.8 million, up 8% year over year. Network Services Segment quarterly revenues were $169.5 million, up 7.4% year over year.

Operating Metrics

Quarterly operating income came in at $258.5 million compared with $231.2 in the year-ago quarter. Total operating expenses rose to $779.8 million from $731.2 million in the year-ago quarter. Operating margin in the reported quarter was 24.9% compared with 24% in the year-ago quarter. Quarterly adjusted EBITDA was approximately $588.5 million, representing a year-over-year increase of 7.1%.

Cash Flow

In the first half of 2017, Crown Castle generated $934.1 million of cash compared with $918.2 million in the year-ago period. Free cash flow, in the reported period was $370.7 million compared with $525.2 million in the year-ago period.

Balance Sheet

At the end of the first half of 2017, Crown Castle had cash and cash equivalents of approximately $199.7 million on its balance sheet compared with $567.6 million at the end of 2016. At second-quarter 2017 end, debt and other long-term obligations totaled approximately $13,841.3 million, up from $12,069.4 million at the end of 2016.

Third-Quarter 2017 Outlook

For the third quarter of 2017, Crown Castle expects Site Rental revenues in the range of $888-$893 million. Site Rental cost of operation is projected in the band of $275-$280 million. Adjusted EBITDA is anticipated between $600 million and $605 million. Interest expense (inclusive of amortization) is estimated at $142–$147 million. Meanwhile, FFO (funds flow from operation) is anticipated in the $404–$409 million band. AFFO (adjusted FFO) is projected in the $447–$452 million range, while net income is projected in the range of $90–$110 million.

Full-Year 2017 Outlook

Crown Castle has raised its outlook for 2017. The company expects Site Rental revenues in the range of $3,504–$3,529 million. Site Rental cost of operation is projected in the $1,071–$1,096 million band. Adjusted EBITDA is anticipated between $2,389 million and $2,414 million. Interest expense (inclusive of amortization) is estimated in the $552–$582 million range. FFO is projected at $1,623 –$1,653 million. AFFO is expected between $1,813 million and $1,838 million. Net income is anticipated between $426 million and $476 million.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana. Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Crown Castle International Corporation (CCI): Free Stock Analysis Report

AT&T Inc. (T): Free Stock Analysis Report

Verizon Communications Inc. (VZ): Free Stock Analysis Report

T-Mobile US, Inc. (TMUS): Free Stock Analysis Report

Original post