Seems like every part of the market is at a crossroads. The equities market has been moving sideways at all-time highs for 6 months. Some indicators are positive and others support a bear case. U.S. Treasuries are vacillating as the players twitch back and forth on when a rate hike will be coming. Foreign markets are looking like a break-out to new all-time highs one day and then pulling back the next.

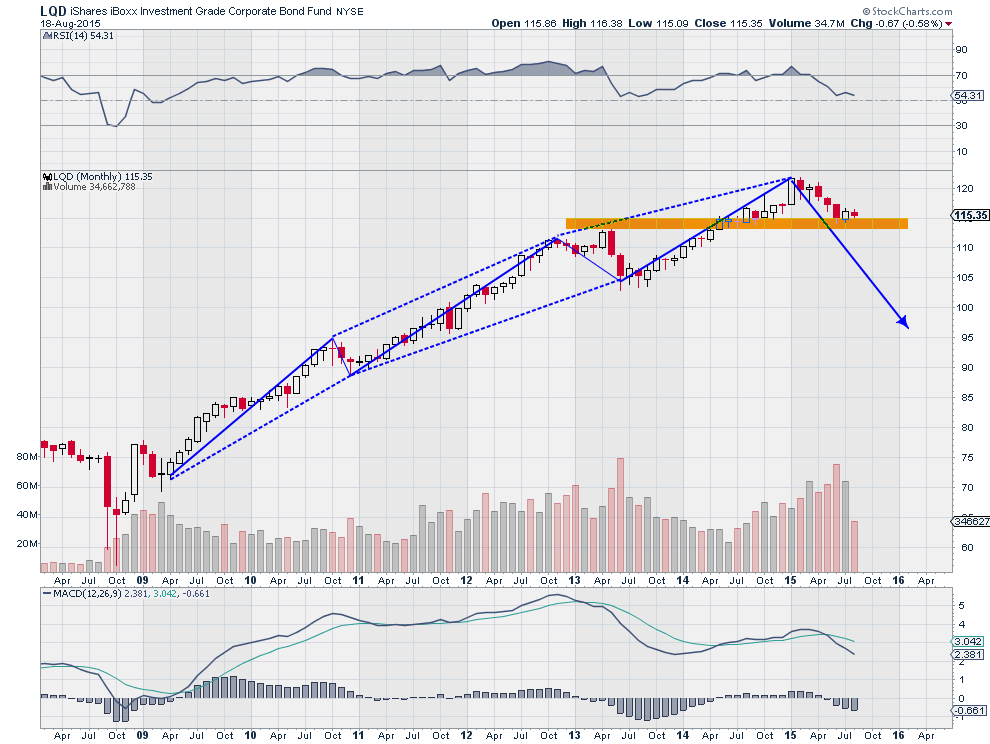

But for today the segment to watch are investment grade corporate bonds. The chart below, of the iShares iBoxx USD Investment Grade Corporate Bond ETF(NYSE:LQD), shows three areas where the bullish vs bearish debate is playing out. Let's start with the price action itself. Since the October 2009 low there have been a series of moves higher followed by pullbacks.

This closely follows the pattern of a three-drive, a corrective harmonic. It would look for a move lower of at least 38.2% of the full run. That is back below the 2013 lows. The other side of the story is the support that has become apparent around the 115 level. A reversal back higher here would be bullish. The declining volume at the base supports this.

The RSI is the next place to look. Here the momentum indicator is near the mid-line, and about to make a lower low. A breakdown and continuation supports the bearish case. But it is in the bullish zone still, supporting the upside. And a lower low that reverses would set up a positive RSI reversal looking for new all-time highs in price.

Finally, the MACD has crossed down and is falling. This is bearish, but it is not making a new low yet. Without that, a reversal back higher would be hard to sell short.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.