Markets will continue to monitor Brexit developments and whether there is any breakthrough in the negotiations between PM May and Labour leader Jeremy Corbyn .

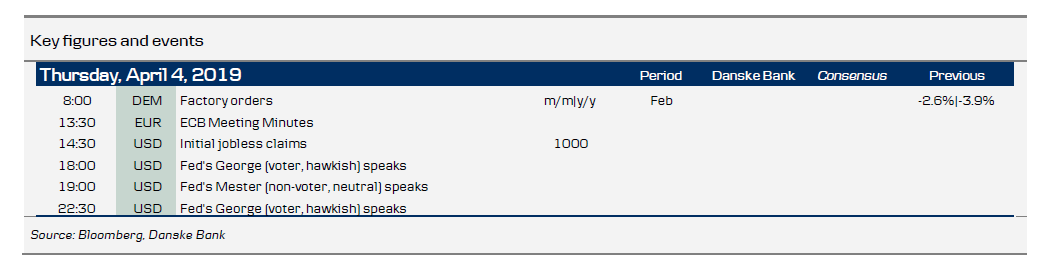

In the euro area , we get minutes from the March ECB meeting , where the ECB announced a new series of TLTRO3, opened the door for further easing and extended the forward guidance to rates to the end of 2019. We are particularly interested in the details of the discussion of the TLTRO3 announcement from members of the Governing Council. Judging from recent communication, the ECB has become increasingly concerned about the side effects of a prolonged period of negative rates on bank profitability. However, we do not expect a discussion on a tiered deposit system to already have taken place. At 08:00 CEST, we also get German factory orders for February, which we will monitor given the weakness seen in the German manufacturing sector lately.

In the US , Fed's Mester and Harker are speaking in the evening.

Selected market news

Despite a late rally in the US session sending S&P500 to the highest close since early October, risk sentiment in the Asian session has been fairly mixed this morning. 10Y Treasury yields continue to hover just above 2.50%, EUR/USD is little changed (see FX section) and Brent Crude remains below USD70/bbl.

Late yesterday evening, the UK House of Commons narrowly backed a bill to stop a no-deal exit by 313 votes to 312. The legislation was opposed by May and the Conservative group of hard brexiteers who want a clean break with the EU on 12 April. The bill will now move to the upper chamber of Parliament to be completed today. GBP was little changed.

The vote followed the kick-off of historical cross-party negotiations between May and Corbyn that has infuriated many pro-Brexit Conservatives and which yesterday led to the resignation of two ministers. Both parties stated the initial talks were "constructive" yet also "inconclusive". Both sides are preparing for a full day of negotiations today. A key topic will be that of the customs union, which the Labour Party would like but which in many ways invalidates the arguments of a Brexit in the first place, see this FT article on the pros and cons of a customs union.

According to Bloomberg , the US is said to be setting 2025 targets for China to fulfil trade pledges, which should involve commitments on commodity purchases and allow US companies to wholly own enterprises in China. The trade negotiations continue in Washington today.

In Norway , house price data from Real Estate Norway showed a March rise of 0.3% m/m s.a. This was slightly higher than most Nordic houses had called for yet in line with Norges Bank's revised projection (see chart ). Generally, there is still a widespread expectation among economists that house prices will rise modestly this year as higher supply, higher mortgage rates, lower population growth and tight regulation are countered by a strong rise in real disposable income growth and high activity. We still pencil in the next rate hike from Norges Bank in June and another one in December this year.

Fixed income markets

Yesterday, the Core-EU markets were selling off with the Bund yield trading just above 0% on the back of improved economic data a possible deal on a Brexit deal as well as some more optimism on a possible US-China trade deal.

Today, France and Spain are selling bonds. France will tap EUR 7.5bn to 9bn in the long end of the curve, the 10Y, 15Y and 30Y segments, while Spain will tap in EUR 2.5bn to 3bn in the 3Y and 10Y segments. Given the change in sentiment it will be interesting to see the demand for the long end, especially in France. We do expect to see solid demand at the Spanish auction as it is a small auction.

Yesterday, we published our bi-weekly on the Danish fixed income market, where we look at the carry relative to the prepayment risk in high-coupon callable mortgage bonds (2.5% and 3% callables) as well as the being long 5Y DKK swaps versus 5Y EUR swaps. Furthermore, we did not like to go short DGBs even at these tight spread levels, see more in Reading the Markets Denmark, 3 April 2019.

FX markets

European currencies were generally bid yesterday as European and Chinese data surprised on the upside with notably EUR/JPY and EUR/CHF jumping on the back ofcontinued improvement in risk sentiment. The stream of Fed speakers continues today, but more noteworthy were comments from Trump advisor Kudlow on too tight monetary policy warranting ‘50 bps to be taken back’; this together with weaker-than-expected US data kept USD under pressure. Today focus in majors on ECB minutes from the early March meeting which saw the ECB adopt a clear easing bias; a tiered deposit system was likely not discussed at the meeting but could make room for rates to stay low for an extended period – and if the minutes strike a tone explicit along those lines it should keep a lid on EUR/USD. We still target 1.13 in 1M.

EUR/SEK sits quietly in the 10.40-50 range, as it has done since mid-March and it will probably take some macro mover for this pattern to break. On that note, we anticipate no major data-driven SEK movers until next week’s inflation print. For today, we have a large dividend flow to look forward to: Volvo, with a total dividend of SEK 20.3bn, of which approx. SEK 8.7bn is distributed to foreign investors. This should however not be a major driver for the SEK, as we have previously argued (see FX Strategy - Dividends, Seasonality and the SEK).