It’s Friday in the Wall Street Daily Nation!

That means the long-winded analysis is out. (Hallelujah!)

And some carefully selected charts are in. (Amen!)

So without further ado, check out these snapshots of the big thorn stuck in small business’ side… a “sell in May” update… and, as I promised yesterday, one of my favorite stocks to own during this economic recovery.

Move Government, Get Out the Way!

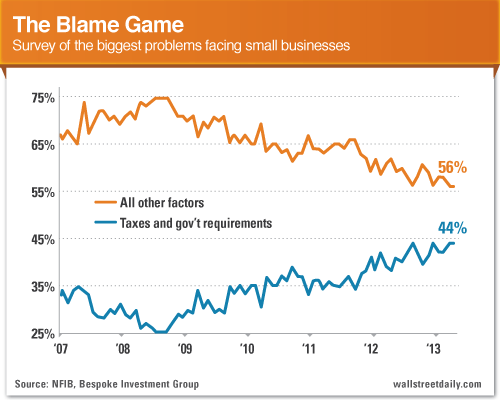

I’ve featured the NFIB Small Business Optimism Index here before.

So what does the latest reading tell us? In short, Washington is still a major problem.

The number of businesses citing poor sales as their biggest concern keeps falling. But the number of those that blame taxes and government red tape keeps climbing.

In fact, 44% of small business owners rank these two factors as their biggest problems. Mind you, that’s almost double the low hit in September 2008.

Maybe President Reagan was on to something when he warned: “The nine most terrifying words in the English language are: ‘I’m from the government and I’m here to help.’”

Let’s all do our part to help Washington get the message.

Copy and paste this chart into an email to your elected representatives with a simple message (from the wise words of Ludacris): “Get out the way!”

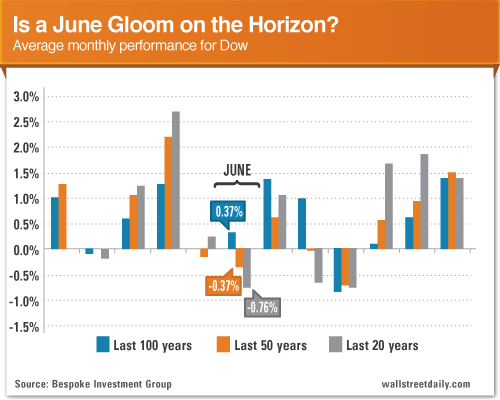

Sell in May? Nope! How About June?

I hate to say “I told you so.” But… I told you so!

On May 1, I warned: “Selling in May and going away is not all it’s cracked up to be.”

And sure enough, the market kept on rallying. As I write, the S&P 500 Index and Dow are both up about 3%, while the Nasdaq is up about 4%.

So what’s in store for June? A little gloom – that is, if history is a reliable guide.

Although the Dow averaged a gain of 0.37% in June over the last 100 years, it’s only delivered positive returns 48% of the time, according to Bespoke Investment Group.

If we focus on the last 50 and 20 years, the average performance is even weaker. The Dow actually averaged declines of 0.37% and 0.76%, respectively. And it only posted positive returns 46% and 40% of the time.

Now, if that has you thinking about ditching stocks to sidestep the potential selloff, might I suggest an alternative?

For instance, a stock that’s uniquely positioned to buck the trend…

You Might Be a Redneck If…

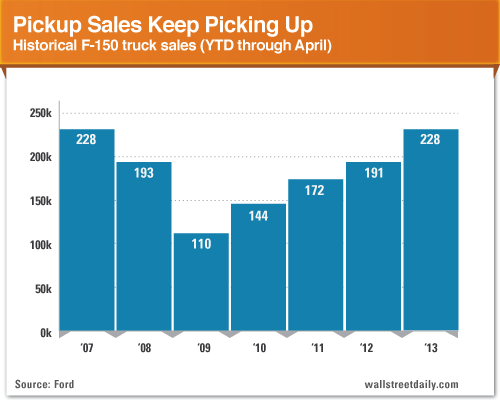

If you live anywhere in the South, you might be accused of being a redneck if you own a pickup truck. (I know, because it’s happened to me.) Chances are, though, that you’re a small business owner, too.

As I’ve noted before, small business owners account for a large portion of pickup sales, particularly Ford (F) F-Series trucks. That means, by gauging sales of F-Series trucks, we can track the health of the economy.

And there’s no mistaking the underlying trend…

Year-to-date through April, Ford has sold just as many F-150 trucks as it did right before the recession hit. And there’s more road ahead.

So much so, that Ford is planning to boost North American production to meet the demand.

Tack on the fact that sales in Europe are bottoming out, and Ford is certainly in store for an earnings boost.

My conservative estimate calls for the company to earn $2 per share in 2014, which would represent a 41% increase over the consensus estimate for this year.

Given that stocks ultimately follow earnings – and that Ford is trading on the cheap at less than 11 times earnings, compared to 16.8 times for the S&P 500 Index – shares could easily rally another 50% from current levels.

Throw in a modest 2.7% dividend yield, and what’s not to like?

You might be a redneck if you drive a pickup. But you’d be a pretty darn smart redneck if you also owned a few hundred shares of Ford.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Crooked Politicians, “Redneck Intelligence” And Stock Market Seasonality

Published 05/31/2013, 03:39 AM

Updated 05/14/2017, 06:45 AM

Crooked Politicians, “Redneck Intelligence” And Stock Market Seasonality

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.