Fast Stab Lower vs Up Into Fast Top vs Up Into Prolonged Topping

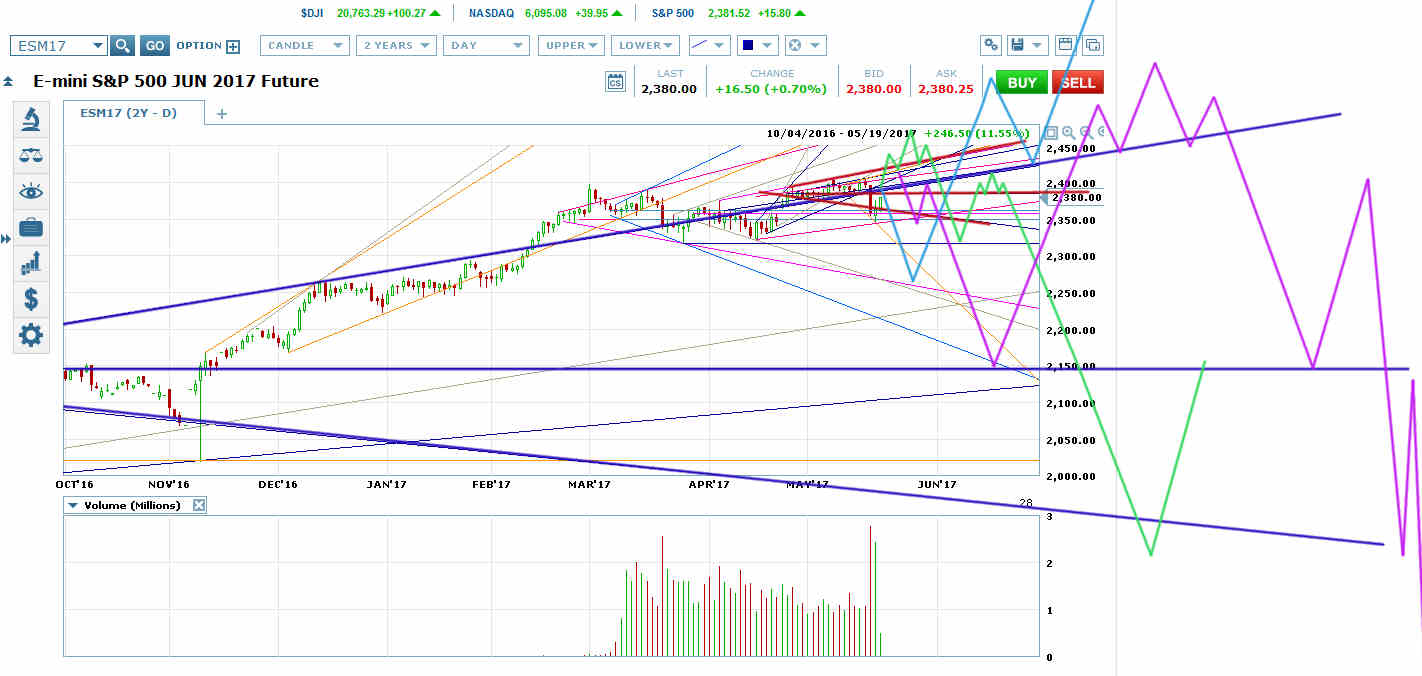

ES is Headed Up to its Red Megaphone VWAP and a Retest of the Inside of its Navy Blue Megaphone Top

ES is headed up to its red megaphone VWAP and a retest of the inside of its big navy blue megaphone top. If it reverses there, it will likely take out the March 27 low.

That kind of fast stab at the navy blue megaphone VWAP that fails to get there would be a perfect set-up for a breakout upwards from the megaphone into a melt-up (light blue scenario).

See the melt-up set-up I posted recently for iShares Russell 2000 (NYSE:IWM).

If ES breaks through the navy blue megaphone top it’s still working on a topping pattern before a plunge to at least VWAP and possibly the megaphone bottom and beyond.

The purple scenario represents the kind of fast top that could reverse at VWAP back to the navy blue megaphone top before a huge move down. (I missed a mandatory bounce in that scenario, but you get the idea.)

The green scenario represents the kind of prolonged topping process that would usually lead all the way to a trip to the navy megaphone bottom and then back to its top.

Neely and Corzine

In the IWM post I link to a post about Glenn Neely’s public call for a crash. Yesterday I saw that Jon Corzine, the Democrat bundler who took down MF Global along with hundreds of millions of dollars in customer accounts, was trying to set up a third hedge fund to bet on a Trump crash.

When you start getting lots of people making public calls for crashes, especially for bad reasons, you often get melt-ups instead.