The following exclusive interview of Jean-Sébastien Lavallée, President & CEO of Critical Elements Corp, was conducted by phone and email over the four days ended December 17th. All dollar amounts are in CAD$.

Critical Elements Corporation (TO:CRE) is a junior lithium company with a promising project in northern Quebec, backed by the its Preliminary Economic Assessment, “PEA. Lithium is one of the only metals/minerals experiencing increased demand, as evidenced by higher lithium carbonate & hydroxide prices this year. Critical Elements is in the right place at the right time, poised to advance its Rose Lithium-Tantalum project. Management believes that the Company has been de-risked due to the recent signing of a comprehensive Collaboration Agreement with a leading global chemical company.

Management has been resolute in keeping equity dilution to a minimum. For instance, cash burn is just $125k per quarter. Critical Elements is in discussions with various parties regarding a potential capital raise that, if consummated, is expected to include a meaningful debt component. Further evidence of a strong management team can be found in the hiring of Mr. David J. Buckley as Chief Processing Operator.

Mr. Buckley has very extensive experience in the lithium space. Most recently, from 2006 to 2015, he was Senior Process Engineer for Rockwood Lithium Inc, where he was heavily involved in end-products including lithium carbonate, hydroxide & chloride. Prior, Mr. Buckley was Process Engineer for FMC Lithium from 1992 to 2004.

“With his many years of experience in the lithium processing industry with companies like FMC and Rockwood, Mr. Buckley brings expertise to the proper execution of each step necessary for the successful ramping up of lithium carbonate production at the Rose Lithium-Tantalum project, with anticipated optimal capital and operating costs,” said Jean-Sébastien Lavallée, President & CEO.

Please describe Critical Elements Corp. to readers unfamiliar with the story

Critical Elements Corp. (TSX-V: CRE) (US OTCQX: CRECF) is an emerging specialty metals (lithium, tantalum, rare earths) company focused on the Rose Lithium-Tantalum project in northern Quebec. Besides battery-grade lithium, the project benefits from a rare source of low-iron spodumene concentrate, ideally suited for the Glass & Ceramic markets. As well, we hope to become one of the few new sources of conflict-free tantalum in the world. The project is supported by roughly $200 million of key infrastructure, including a road with 100 Metric tonne “Mt” capacity. There’s a nearby airport, power line, and Hydro-Quebec camp 30 kms away. Therefore, a significant amount of infrastructure that we would have had to build is readily available. Our PEA spotlights a high purity, low-cost lithium [99.98% Purity] opportunity with a post-tax NPV(8%) & IRR of $279 million & 25%, and a pre-tax NPV(8%) & IRR of $488 million and 33%.

Most important, we recently struck a Collaborative Agreement with a leading, global chemical company. This agreement includes a 100% take-or-pay off take clause. The agreement grants the Partner an option to buy a 25% direct interest in the Rose Lithium-Tantalum project for 25% of the cap-ex. Our Partner will contribute valuable technical assistance and commercial knowledge through to commercialization.

Critical Elements’ September 9th announcement of a, “collaboration agreement” with a leading chemical company, including 100% take-or-pay off take, was terrific news. Do you believe this development is reflected in the share price?

By avoiding dilutive financing as much as possible, we have run the company in a very lean fashion. As a result, there’s a lack of awareness of the investment opportunity offered by Critical Elements. With ongoing achievement of important milestones, we hope that the investing public will recognize our Company’s undervaluation.

We have set high performance standards and remain intently focused on reaching them. Every step of our plan has been successfully accomplished so far. In addition to Mr. Buckley, we are working on hiring key executives with long time experience in lithium carbonate & hydroxide processing.

Our collaboration agreement is more like a partnership in that we will share technical & commercial knowledge from the Feasibility stage on through to production. This agreement is with a company that enjoys worldwide freight and distribution power. We believe this agreement represents a tremendous vote of confidence in our project and management team.

Investors might not appreciate these important distinctions that greatly de-risk our project.

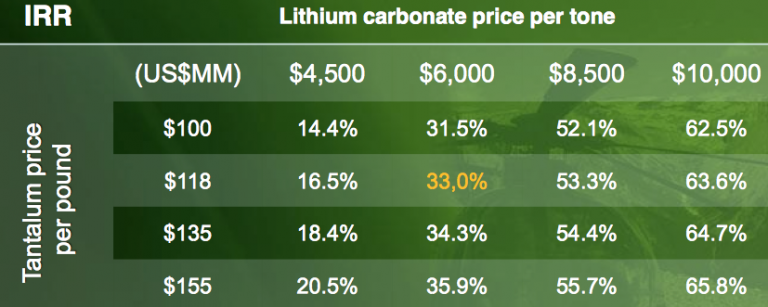

Critical Elements’ PEA shows a pre-tax NPV(8%) of $488 million & IRR of 33%, but at a moderately higher lithium carbonate price, the NPV more than doubles. Are current lithium prices above or below the base case assumption?

Following discussions with producers, consumers & industry consultants, and supported by the announcement by FMC Corp (N:FMC) of a 15% across the board increase in prices, we estimate the lithium carbonate price is around US$ 7,500/Mt, 25% above the long-term assumption in our PEA. A price of US$ 7,500/Mt implies a post-tax IRR of about 35% and NPV(8%) of roughly $500 million. Like most PEAs, we believe that ours is fairly conservative. The assumed FX rate we used is at parity between the US$ & C$. However, if today’s C$ 0.73 FX rate were to be incorporated, the NPV(8%) (in Canadian dollars) would be considerably higher. The chart below shows the pre-tax IRR. The PEA’s base case is 33.0%.

Can you give readers a snapshot of Critical Elements’ most recent Capital Structure?

We have 125.7 million common shares outstanding [basic market cap. $20.8 million at 12/16/15 close] + 7.7 million options at a weighted average strike price of $0.21 (range $0.15 to $0.30) + 6.4257 million warrants at a weighted average strike price of $0.365 (range $0.35 to $0.375). We have 140 million fully-diluted shares. The Company’s fully-diluted Enterprise Value, “EV” [fully-diluted market cap plus debt minus cash] = $23.1 million + zero debt – $4 million (pro forma cash from the exercise of options & warrants) = $19.1 million. Critical Elements’ EV is trading at [$19.1 million divided by the PEA’s NPV(8%) of $279 million ] = 7% of the base case NPV for our Rose Lithium-Tantalum project alone.

What portion of Critical Elements’ combined Indicated & Inferred resources are included in the PEA? In what ways, if any, do you think that select components of the PEA could be conservative?

The PEA only includes the Indicated resource, leaving a lot of room to increase our mine life with additional drilling. We believe we could convert some of the Inferred resource into the Indicated category to add mine life, but at this stage, 17 years is plenty. We also have a number of other exploration prospects sporting positive grab samples, trenching and drill results. The assumed CAD$/US$ FX rate has moved markedly in our favor. The assumed lithium price in the PEA of US$ 6,000/Mt is below the current spot price. We have made notable improvements in our recoveries since the PEA was delivered.

There’s fear among investors that they will endure death by a thousand equity raises. Can you comment on possible equity dilution?

Since we’ve been developing the Rose Lithium-Tantalum project, management has worked hard to minimize equity dilution and to ensure that dollars spent on the project are well allocated. Management is taking the time necessary to avoid the mistakes of others and to do the right things, step by step. We are fortunate to be in discussions with various funding parties, allowing us to possibly execute a financing package consisting of both debt and equity capital. To be clear, we have nothing definitive to say at this time.

I would be remiss if I did not point out that management and family members own about 18% of outstanding shares. Adding to that amount, the top five shareholders accounts for a total of 38% of outstanding shares. Our interests are entirely in line with that of our shareholders. We want to benefit directly from an increase in the share price reflecting the company achieving milestones. The avoidance of equity dilution is very important to all of us.

Access to infrastructure is vital, it can make or break a project. How is Critical Elements positioned in this regard?

We have strong access to infrastructure, giving us an advantage over many projects around the world. A road and power line are already on site, and there’s a nearby airport and mining camp. Given the collapse in oil, precious & base metals, manpower is not only available, but available on favorable terms. Importantly, that includes a range of consulting groups, contract miners and equipment leasing firms.

On page 15 of the Company’s corporate presentation there’s an operating flow sheet. How complex is it compared to that of peer lithium projects?

Yes, I’m glad you asked that. The flotation flow sheet is standard and simple. We are not a technology oriented company, so we are pleased that we don’t have to deal with technology risk in our processing designs. Our flow sheet is nearly the same as lithium operations in Australia. In addition, the quality of our resource gives us the opportunity to potentially generate cash flow earlier in the process. Our tantalite concentrate by-product is expected to be extracted at the first processing step. After that, we intend to produce low-iron lithium concentrate for the Glass & Ceramic markets. 12-18 months later, we hope to start producing battery-grade lithium carbonate. This makes a big difference in the cash flow schedule and would reduce the risk of our lithium carbonate plant ramp-up by self-funding a portion of the cap-ex.

What’s your team’s view on tantalum demand? Is the potential contribution to the Rose Lithium-Tantalum project’s economics significant?

The demand for tantalum is increasing about 4% annually. The actual demand is around 4 million pounds, of which 20% comes from scrap and 50% from the Democratic Republic of Congo. Critical Elements hopes to be one of the few new, economically viable sources of conflict-free tantalum in the world. The revenue split between lithium/tantalum is about 80%/20%. Our tantalite is deposit is one of the larger potential sources, and we have been approached by many end-users.

We and others believe that lithium & tantalum are poised to be in high demand. We have seen for the last 5 years a shift in global commodity demand, where new technologies and applications demand higher performing materials. This is driven by the consumer’s desire for smaller, better, improved power performance.

On page 4 of the corporate presentation it says, “very high purity, battery-grade deposit of lithium carbonate.” Is the purity higher than that of peer projects?

The 99.98% purity speaks for itself. This high purity outcome was achieved with little filtration and no further processing… Yes, our Rose Lithium-Tantalum project has high purity lithium, but it’s important to also understand that purity is not the only specification to look at. The amount and mix of impurities is also a key component in the success of a project. As noted, Rose has very low levels of iron, uranium & thorium.

Can you please comment on the reported recoveries of lithium & tantalum, again in the context of peers?

If we compare the recoveries achieved during our testing to that of peers, in many cases we are well above them. Our spodumene recovery is around 90% at a grade of 6.4% Li2O and we had a 94% recovery on the carbonation process for Li2CO3. The industry average is around 80% for spodumene and 85% for carbonation. As for tantalum, it’s normally a by-product with industry recoveries of about 45%-50%. We have achieved recoveries averaging 77.6%. So bottom line, we have about 20%-25% higher recoveries than anyone in the lithium & tantalum space.

As mentioned, your resource has low uranium, thorium & iron content. We know that low iron is advantageous, what about the low levels of uranium & thorium?

For the electronics & technology markets, end-users cannot tolerate radioactive material. Very low levels of uranium & thorium in a tantalum-rich carbonate is the exception, not the rule. This is a key differentiating factor in our favor.

Low iron content is not merely an advantage, it’s a pre-requisite in enabling us to sell spodumene concentrate into the Glass & Ceramic sectors. This activity could possibly generate early cash flow to help fund subsequent stages of our ramp-up. Regarding uranium & thorium, several tantalum projects in west Africa that have been stopped due to higher levels of these contaminants.

Do you have any final thoughts to share with readers?

In a nutshell, our company has received multiple confirmations that our lithium resources are top-tier quality, with the best metallurgy. As per our PEA, the Rose Lithium-Tantalum project carries strong economics with ample in-place infrastructure. Importantly, we have a leading, global chemical company as a partner for 100% off take on all of our products. There are a number of catalysts to watch for next year. I believe that Critical Elements Corp. has a very attractive valuation, or EV, of just $20 million. So we are very enthusiastic about 2016.

Thank you for your time Jean-Sébastien. An interesting story, in one of the very few metals/minerals sectors to show a pulse.

Disclosures: Critical Elements Corp. (TSX-V: CRE) (US OTCQX: CRECF) has a small market cap. Small market cap stocks are highly speculative and volatile, not suitable for all investors. I, Peter Epstein, own shares and stock options in Critical Elements Corp. Mr. Epstein, CFA, MBA is not a licensed financial advisor. Readers should take that fact into careful consideration before buying or selling any stocks mentioned.