The 2011 article P/E: Future On The Horizon by Advisor Perspectives contributor Ed Easterling provided an overview of Ed's method for determining where the market is headed. His analysis was quite compelling. Accordingly I include the Crestmont data to my monthly market valuation updates.

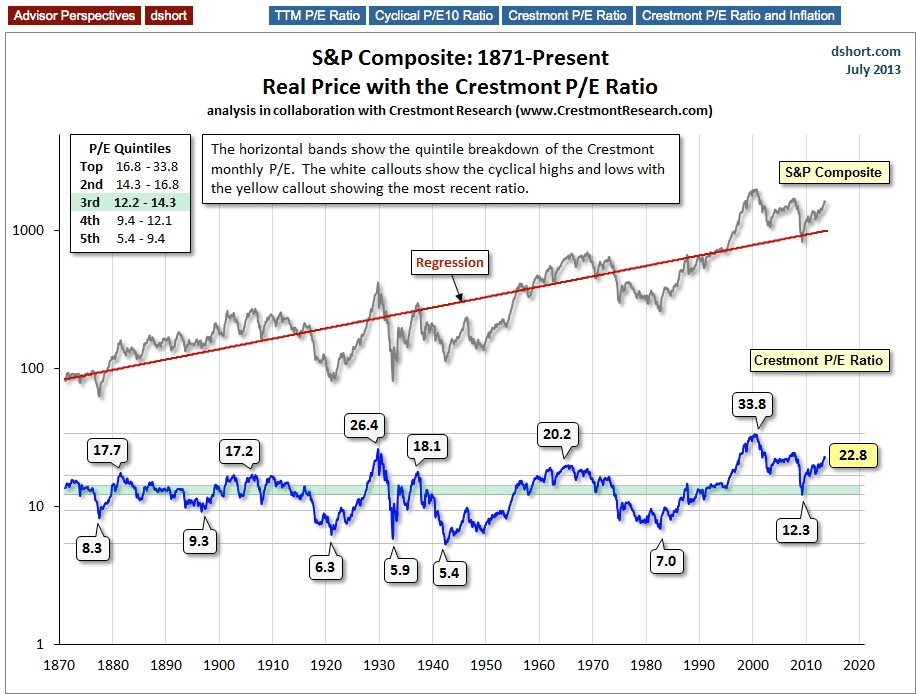

The first chart is the Crestmont equivalent of the Cyclical P/E10 ratio chart I've been sharing on a monthly basis for the past few years.

The Crestmont P/E of 22.8 is 66% above its average (arithmetic mean) of 13.8. This valuation level is similar to the 62% we see in the latest S&P Composite regression to trend update and higher than the 39% above mean for the Cyclical P/E10 (more here).

The Crestmont P/E of 22.8 puts the current valuation at the 95th percentile of this fourteen-decade series.

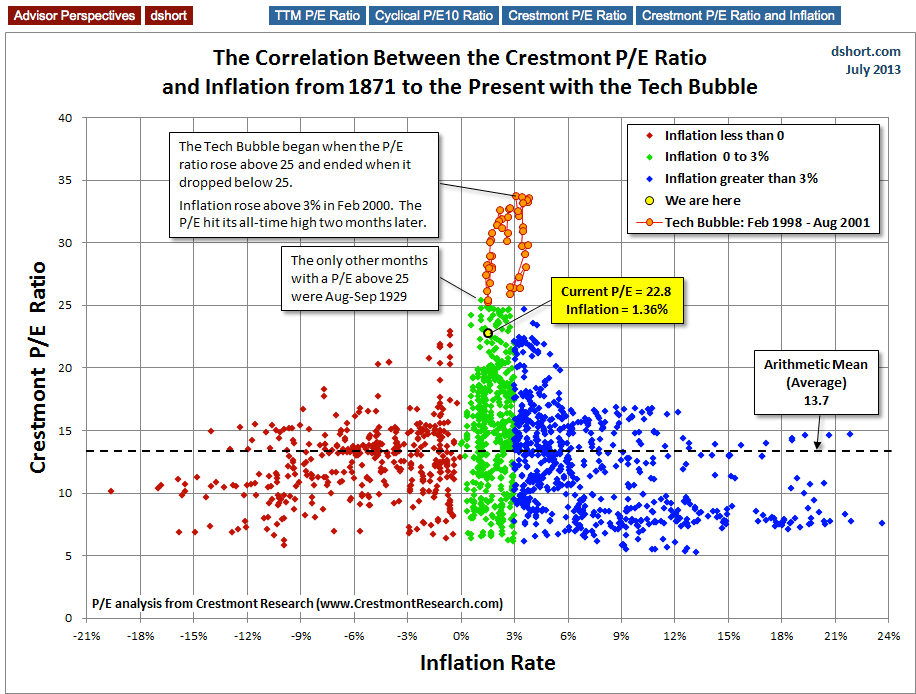

Because inflation is a key driver for direction of P/E multiples, I occasionally update this chart twice a month if the mid-month release of the Consumer Price Index marks a significant change in the annualized rate of inflation.

For a better understanding of these charts, please see Ed's two-part commentary here:

And these articles explore key concepts for investment expectations and planning.

- What "Secular Cycle" Means

- Nightmare on Wall Street: This Secular Bear Has Only Just Begun

- Game Changer: Market Beware Slower Economic Growth