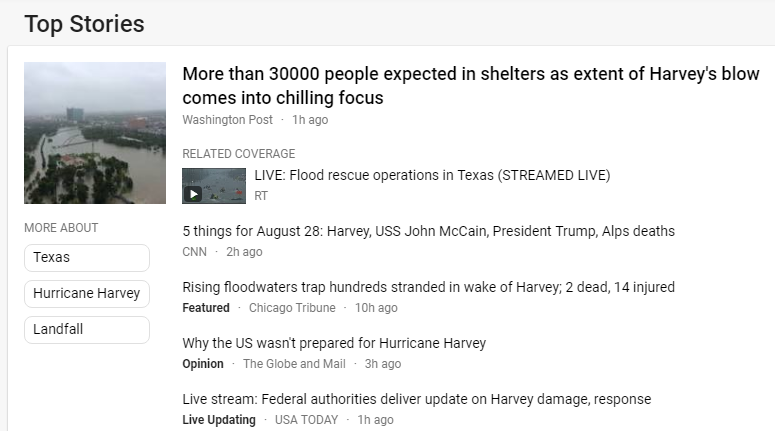

We’ve all seen the tales and photographs of death and destructions from Harvey…….

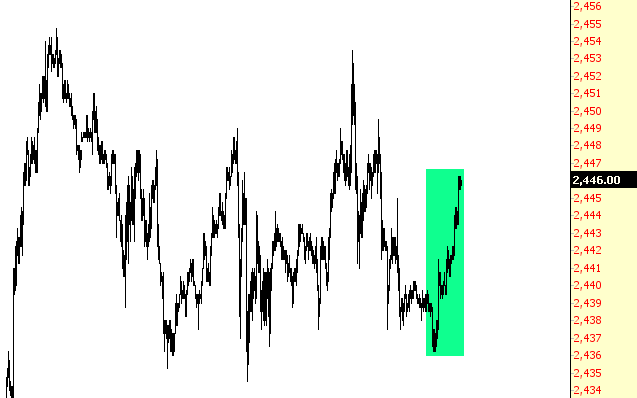

…..which, naturally, in this psychotic market of hours, has meant equities have been creeping up all night long……

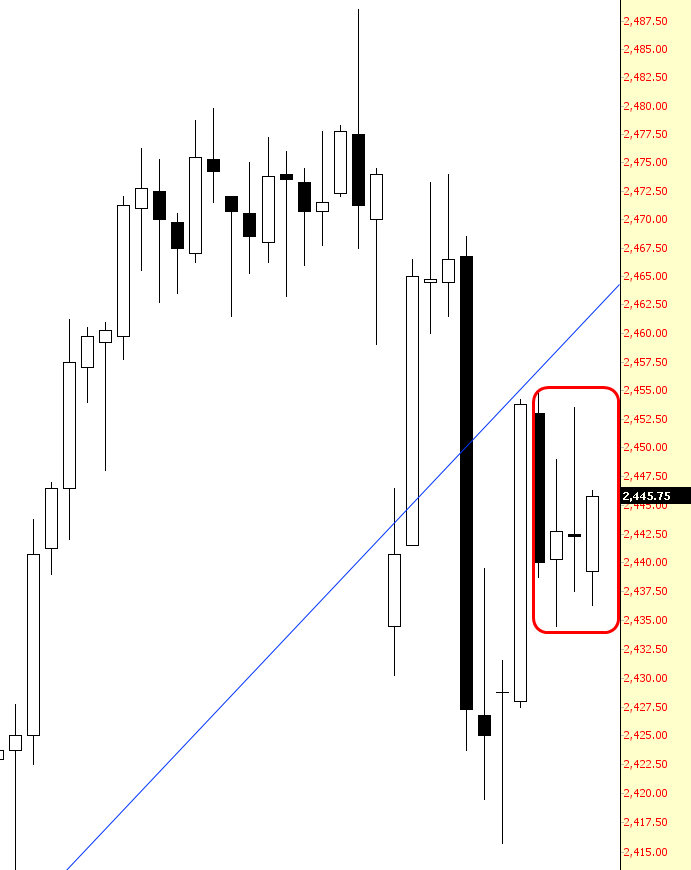

……leading, as shown below, to a bullish engulfing candlestick pattern. Now, the ES is only up 0.17% as I’m typing this, but it’s up nonetheless, having shaken off an equally modest rest number early in the session. We’ve been stuck around 2445 for nearly a week now, as the market has returned to its boring self, after some excitement early in August.

It’s all become a tiresome drag once more, and it’s up to our goofy leaders to do something irrational enough to get volatility cooking again. In the meanwhile, shuttered processing facilities in Texas have convinced the market that crude is going to be piling up, unrefined and unused, for an indeterminate amount of time, leading crude oil to more weakness.

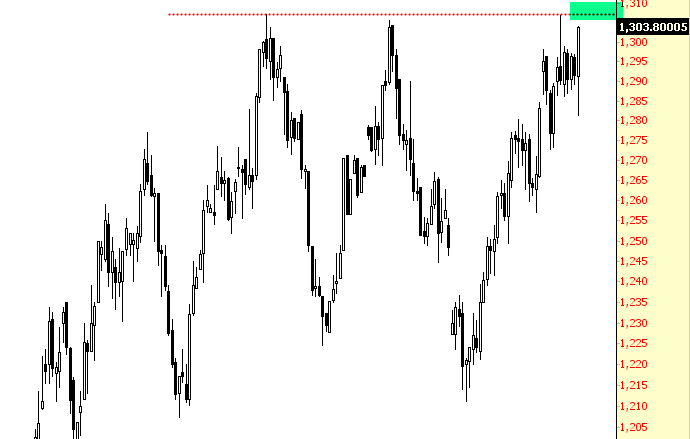

Of special interest to me is gold, toward which I began feeling more bullish last week. The crucial barrier is around $1305, which has been its failure point all year long. If we can break that, you’re going to see much more enthusiasm behind the metal’s ascent. I’m long JNUG.