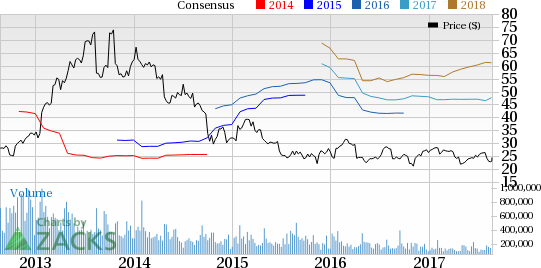

Cree Inc. (NASDAQ:CREE) reported non-GAAP earnings of 4 cents per share in the fourth quarter of fiscal 2017. The figure missed the Zacks Consensus Estimate by a penny and was significantly down from 19 cents reported in the year-ago quarter.

The massive decline can be attributed to lower revenues, which totalled almost $359 million, down 7.6% year over year. The figure was slightly better than the Zacks Consensus Estimate of $350 million.

Cree reported earnings of 50 cents per share on revenues of $1.47 billion in fiscal 2017.

Cree is focused on expanding capacity at Wolfspeed. Management is also on the lookout for acquisitions that will expand its lighting portfolio. Share repurchase despite the $200 million program is not a priority.

The company has lost 12.8% of its value year to date versus the 6.3% decline of its industry.

Quarter Details

Cree has three reportable segments – Lighting Products, LED Products and Wolfspeed.

Lighting Products revenues were $154.7 million, which accounted for 43.1% of total revenue and was down 22.1% on a year-over-year basis.

LED Products revenues were $143.4 million, almost flat on a year-over-year basis and accounted for 40% of total revenue. Cree stated that supply and demand balance improved compared with the previous quarter. Management cited improving demand for lighting and video screen applications.

Cree recently started shipping its first automotive LED components to a Tier 1 forward lighting supplier. The company is engaged with several projects that are expected to contribute meaningfully over the next 18 months.

Wolfspeed revenues surged 30.2% year over year to $60.8 million and accounted for 16.9% of total revenue. Management stated capacity constraint at Wolfspeed. The company achieved additional throughput in the reported quarter due to productivity improvements, which drove top-line growth.

Non-GAAP gross margin was 28%, which contracted roughly 280 basis points (bps) on a year-over-year basis. Segment wise, Lighting Products, LED Products and Wolfspeed gross margins contracted 200 bps, 630 bps and 510 bps, respectively.

Research & Development (R&D) and Sales, general & Administrative (SG&A), as percentage of revenues, increased 30 bps and 20 bps, respectively.

Non-GAAP operating margin contracted 470 bps from the year-ago quarter.

Balance Sheet & Cash Flow

Cree exited fourth-quarter fiscal 2017 with cash, cash equivalents & short-term investments of $610.9 million. Inventory days on hand declined 5 days from March to 98 days at the end of June. Cree’s near-term inventory target is 90-100 days.

During the fourth quarter, cash from operations was $53 million and capital expenditures were $34 million including patents, which resulted in free cash flow of $19 million.

During fiscal 2017, the company spent $104 million to repurchase 4.4 million shares.

Guidance

For the first quarter of fiscal 2018, Cree expects revenues in the range of $353-$367 million. Non-GAAP earnings are projected in the range of 2-6 cents per share.

Lighting revenues are projected to decline sequentially due to anticipated flat commercial revenues as well as seasonally lower consumer sales. LED revenues are projected to be in the same range as of the fourth quarter. Wolfspeed business is now anticipated to grow more or less 4% more or less, as productivity gains offset near-term factory capacity constraints.

Non-GAAP gross margin is targeted at approximately 29%, slightly up sequentially. The expansion is expected be driven by incremental improvement in lighting and Wolfspeed margins, partially offset by lower LED margin. Lighting margins are anticipated to improve due to operating improvements and a higher mix of commercial sales.

Non-GAAP operating expenses are projected to be more or less $101 million, which increases sequentially primarily due to cost associated with Wolfspeed factory expansion, incremental legal costs on defensive IP cases, and CEO search cost.

For fiscal 2018, Cree projects capital spending of almost $220 million primarily related to expansion of Wolfspeed's production capacity. The company targets 2018 free cash outflow of $20 million due to the Wolfspeed’s capacity expansion related investments, which are expected to eliminate current capacity constraints.

Zacks Rank

Currently, Cree has Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology space are Applied Optoelectronics (NASDAQ:AAOI) , FormFactor (NASDAQ:FORM) and Vishay Intertechnology (NYSE:VSH) . While Applied Optoelectronics and FormFactor sport a Zacks Rank #1 (Strong Buy), Vishay carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here..

Long term earnings estimates for Applied Optoelectronics, FormFactor and Vishay are currently pegged at 17.50%, 16.00% and 18.10%, respectively.

4 Surprising Tech Stocks to Keep an Eye on

Tech stocks have been a major force behind the market’s record highs, but picking the best ones to buy can be tough. There’s a simple way to invest in the success of the entire sector. Zacks has just released a Special Report revealing one thing tech companies literally cannot function without. More importantly, it reveals 4 top stocks set to skyrocket on increasing demand for these devices. I encourage you to get the report now – before the next wave of innovations really takes off.

FormFactor, Inc. (FORM): Free Stock Analysis Report

Applied Optoelectronics, Inc. (AAOI): Free Stock Analysis Report

Vishay Intertechnology, Inc. (VSH): Free Stock Analysis Report

Cree, Inc. (CREE): Free Stock Analysis Report

Original post

Zacks Investment Research