The lubricant for economic growth in consumer economies has been credit. My position is that credit cannot grow forever at a rate faster than economic growth as it will constrain the future GDP growth rate.

Follow up:

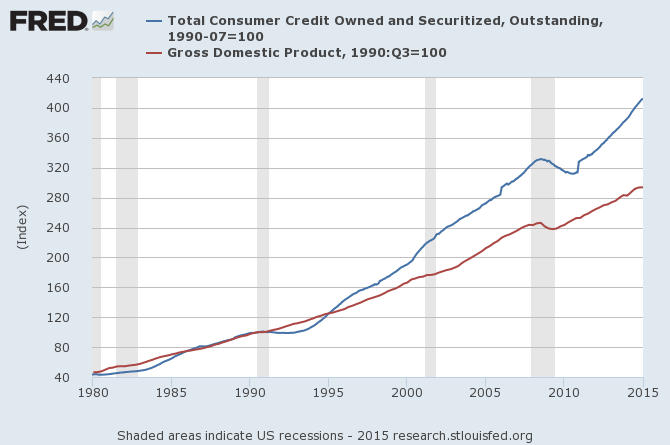

Consumer Credit Outstanding (blue line) and GDP (red line) Indexed to 3Q1990

Credit is a double edged sword. It allows consumers to purchase items with money they do not have (economically positive), while the counter dynamic reduces real disposable income to pay the interest and principle. Generally I view interest paid as a tax on spending - and paid as homage to the financial system for use of a product before one can really afford it.

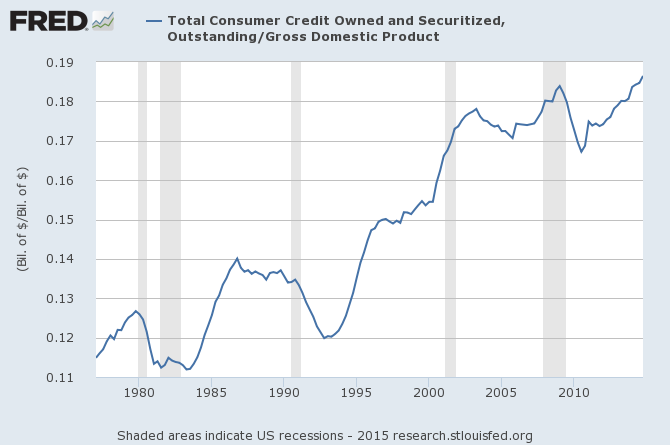

Proportion of GDP Growth Attributable to Consumer Credit (change in $$ of consumer credit divided by $$ change in GDP)

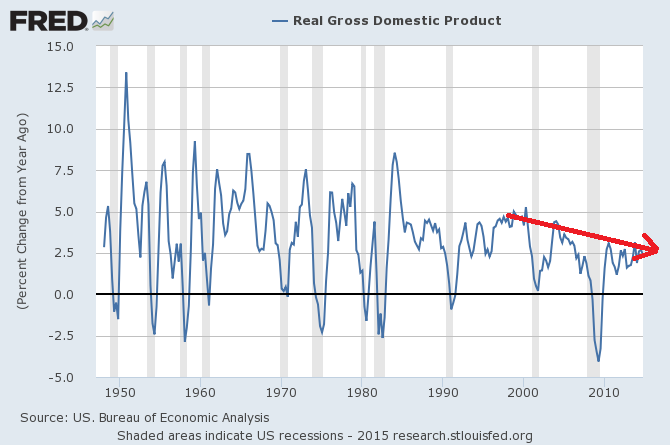

Currently 18.6% of GDP growth is from the growth of consumer credit. Note that this does not include mortgages. This level is historically high - but can be accommodated because of the ultra-low interest rates on non-revolving consumer loans today. What happens when (if) interest rates rise and the consumer cannot borrow at the low rates? Answer = spending will slow. This continues to be the "defect" in modern monetary theory - low interest rates once installed cannot be removed without economic growth consequences.

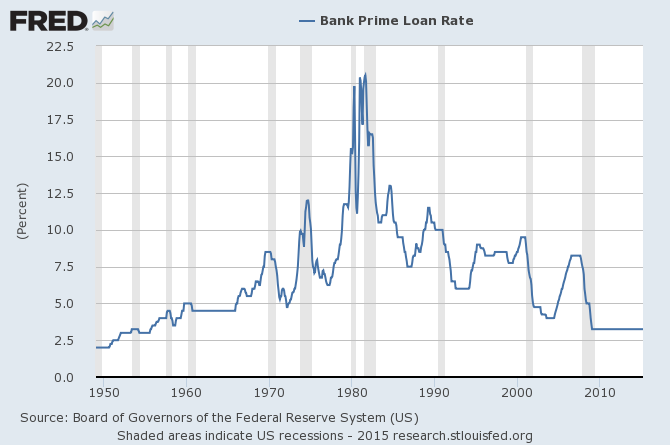

It is easy to lower rates to stimulate the economy but unless the economy is beginning to overheat - raising of rates will only retard an under-performing economy.

Many believe that the current low interest rates are a post Great Recession phenomenon - but the Great Moderation has been underway since the 1980s, and one of its components has been a continued moderation of interest rates which supported economic growth (consumer spending). Unfortunately, there was an opposite effect as debt mounted and economic growth slowed. It is not a stretch to have an opinion that low interest rates over time will lower spending. A simple proposition is that low interest rates stimulate excessive borrowing and eventually that runs out of headroom when it pushes up against the ceiling of all future income.

There is no evidence that low interest rates stimulate an economy when implemented for long periods of time.

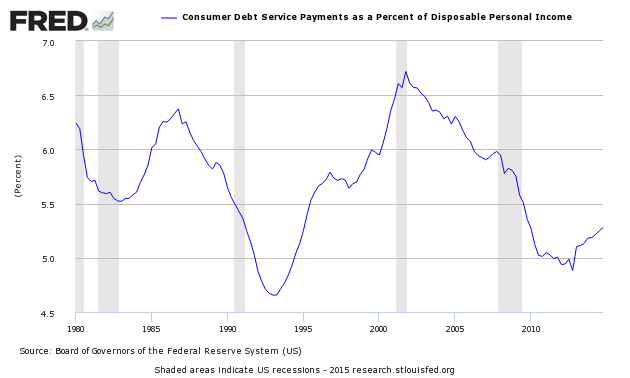

A Look at Consumer Ability to Repay Credit

There is a logical maximum level of debt load a consumer can carry, as monthly credit account payments plus necessary month outlays (such as food, transportation, shelter and clothing) cannot exceed disposable income.

Currently the debt payments relative to disposable income are under average historical levels but growing. This is an interesting situation as one can visualize the knock-on effects of the Federal Reserve raising interest rates from their current zero bound. It will be difficult for consumers to add debt when interest rates rise. The current low debt service payments will rise even if no additional debt is incurred.

One must continue to wonder whether the Fed can successfully leave its zero interest rate policy. A 25 basis point raise may have little economic effect - but 100 basis points likely will have consequences. It seems that strong economic growth would be the only elixir that would allow interest rates to return to more normal levels without serious consequences.

Can you see that strong economic growth?

Other Economic News this Week:

The Econintersect Economic Index for May 2015 is indicating growth will continue to be soft. The tracked sectors of the economy are relatively soft with most expanding but some contracting. The effects of the recently solved West Coast Port slowdown (a labor dispute which had been going on for months) and weather related issues are no longer evident in the raw data. Therefore, the economic slowdown forecast last month is cyclic and not resulting from transient causes.

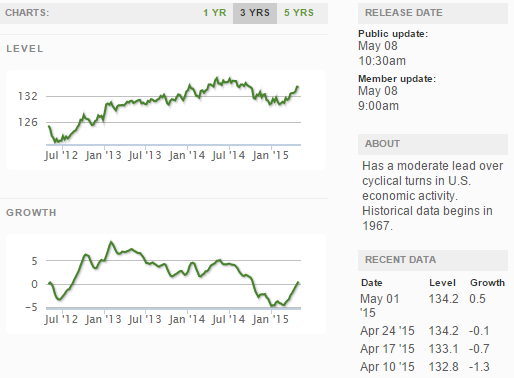

The ECRI WLI growth index remains slightly in negative territory which implies the economy will have little growth 6 months from today.

Current ECRI WLI Growth Index

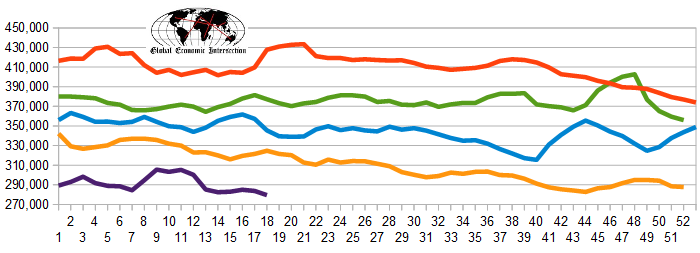

The market was expecting the weekly initial unemployment claims at 275,000 to 285,000 (consensus 280,000) vs the 265,000 reported. The more important (because of the volatility in the weekly reported claims and seasonality errors in adjusting the data) 4 week moving average moved from 283,750 (reported last week as 283,750) to 279,500. The rolling averages have been equal to or under 300,000 for most of the last 7 months.

Weekly Initial Unemployment Claims - 4 Week Average - Seasonally Adjusted - 2011 (red line), 2012 (green line), 2013 (blue line), 2014 (orange line), 2015 (violet line)

Bankruptcies this Week: Corinthian Colleges, AVT, Magnetation

Click here to view the scorecard table below with active hyperlinks

Weekly Economic Release Scorecard: