Next PLC (LON:NXT) was upgraded by analysts at Credit Suisse Group to a "neutral" rating in a note issued to investors on Thursday, MarketBeat.com reports. The brokerage currently has a GBX 4,100 ($50.39) price objective on the stock, down from their prior price objective of GBX 4,600 ($56.53). Credit Suisse Group's price target suggests a potential upside of 0.37% from the company's previous close.

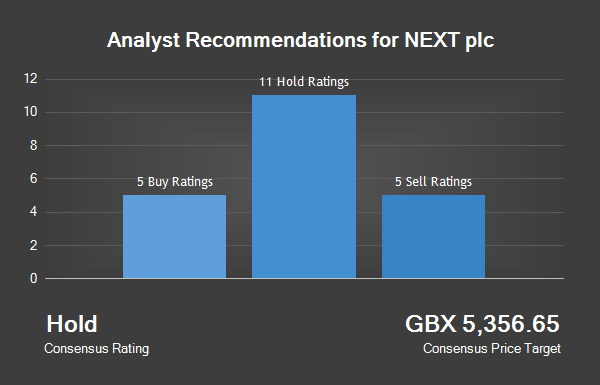

Other equities research analysts have also issued reports about the stock. Morgan Stanley reaffirmed an "equal weight" rating and set a GBX 5,500 ($67.59) price objective on shares of NEXT plc in a report on Friday, September 16th. Canaccord Genuity cut their price objective on shares of NEXT plc from GBX 5,350 ($65.75) to GBX 5,125 ($62.98) and set a " hold" rating for the company in a report on Thursday, November 3rd. Deutsche Bank AG reaffirmed a "buy" rating and set a GBX 5,950 ($73.12) price objective on shares of NEXT plc in a report on Thursday, November 3rd. BNP Paribas increased their price objective on shares of NEXT plc from GBX 4,900 ($60.22) to GBX 5,600 ($68.82) and gave the company an "underperform" rating in a report on Friday, September 9th. Finally, Beaufort Securities reaffirmed a "buy" rating on shares of NEXT plc in a report on Thursday, November 3rd. Four analysts have rated the stock with a sell rating, twelve have issued a hold rating and five have issued a buy rating to the stock. NEXT plc has an average rating of "Hold" and a consensus price target of GBX 5,331.65 ($65.52).

NEXT plc (LON:NXT) opened at 4085.00 on Thursday, MarketBeat.com reports. The firm's market cap is GBX 5.92 billion. NEXT plc has a 12 month low of GBX 3,550.00 and a 12 month high of GBX 7,110.00. The firm's 50 day moving average is GBX 4,912.44 and its 200-day moving average is GBX 5,027.10.

NEXT plc Company Profile

NEXT plc is a United Kingdom-based retailer offering clothing, footwear, accessories and home products. The Company's segments include NEXT Retail, a chain of over 500 stores in the United Kingdom and Eire; NEXT Directory, an online and catalogue shopping business with over four million active customers and international Websites serving approximately 70 countries; NEXT International Retail, with approximately 200 mainly franchised stores; NEXT Sourcing, which designs and sources NEXT branded products; Lipsy, which designs and sells Lipsy branded younger women's fashion products, and Property Management, which holds properties and property leases which are sub-let to other segments and external parties.