We’ve followed the small business optimism and consumer sentiment indicators as a good barometer for the “mood” around the economy. However, these aren’t always great predictors of future economic growth.

The economy and markets have risen quite substantially over the last few years, even though these sentiment indicators have been below their historical averages for most of the time. As the old saying goes, actions speak louder than words. So it's good to follow what investors are really doing with their money, as opposed to what they are saying/predicting.

Enter credit spreads. Credit spreads are the difference between the interest rate on corporate bonds compared to treasury bonds. Treasury bonds are widely considered the safest debt in the world since the US can never default because we issue debt in US dollars.

For investors to invest (or loan) to corporations, they must be compensated for some amount above where treasury rates are. The extra compensation varies, and is based on how well the company’s financial position is and the length of the loan. For example, Apple (NASDAQ:AAPL) is a much better-run company than a business on the pink sheets.

So investors would want to be compensated much more (with a higher rate of interest on the loan), to loan money to that company on the pink sheets, as the risk of not getting their principal back is much greater than a loan to Apple.

There are two basic categories when analyzing credit spreads. Investment grade (think Apple), which are usually well-run blue chip companies. And then high yield (or junk bonds), which often have high debt loads and low profits, or no profits at all.

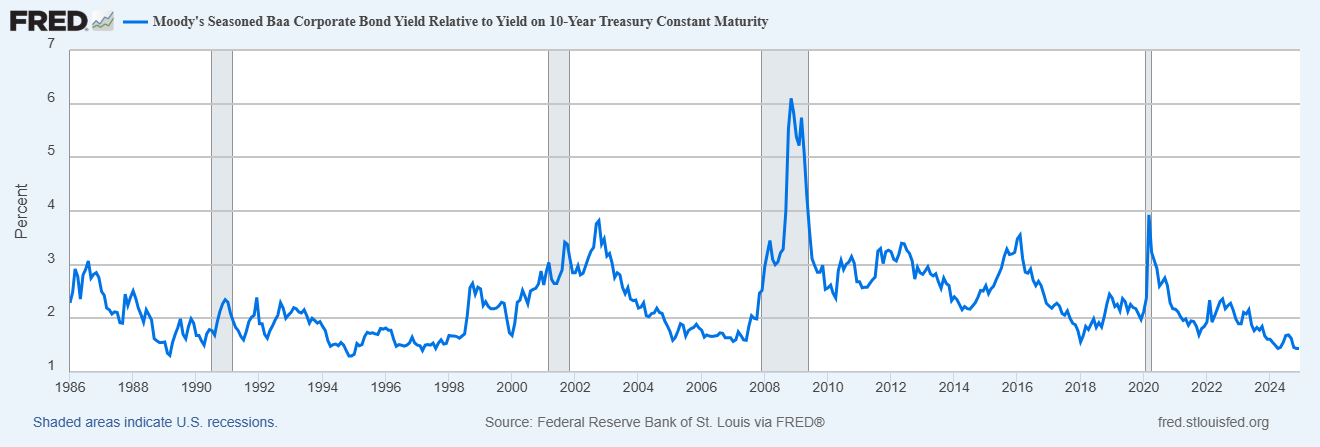

The first chart above shows the credit spread between investment-grade bonds over treasury bonds. As a whole, investors are getting 1.44% in investment-grade debt over treasury debt. This is well below the historical average of 2.99% and one of the lowest levels recorded in the index's almost 40-year history.

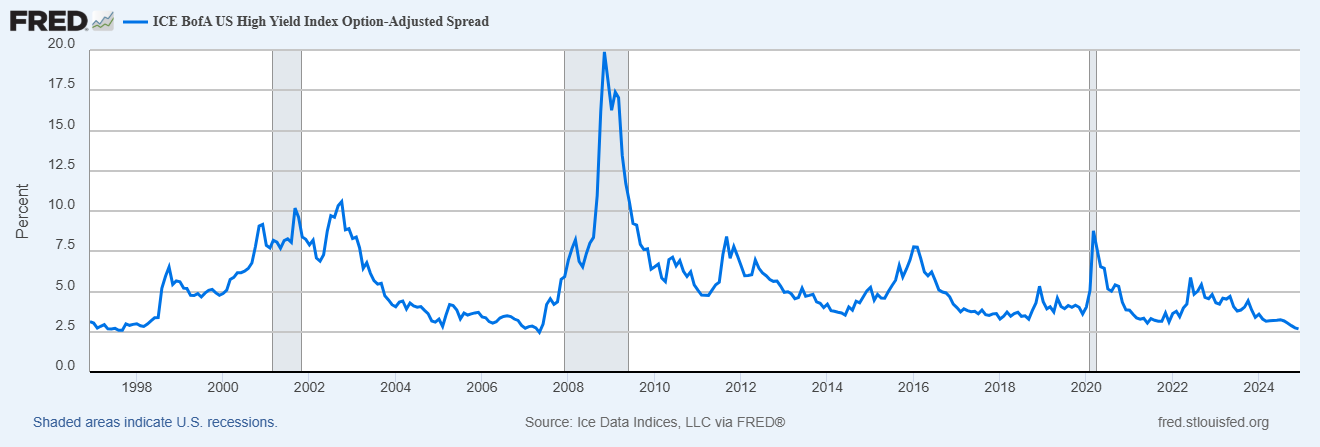

Next, we look at the high-yield (junk) bond credit spread, which is also near an all-time low, currently at 2.68% above current treasury rates. Also well below the historical average of 5.30%.

These are very positive signs. It means investors are quite confident in the economy over the near term, and they are willing to accept below-average rates of extra compensation for the additional risks being taken. When there is stress in the financial system, and liquidity dries up, investors will demand even more compensation for taking on those added risks.

When you hear the term “spreads are blowing out” it refers to credit events, like in the late 90’s, 2008, and COVID, where there are spikes in the rate of extra compensation (as shown in the charts above) that company’s must pay to get loans.

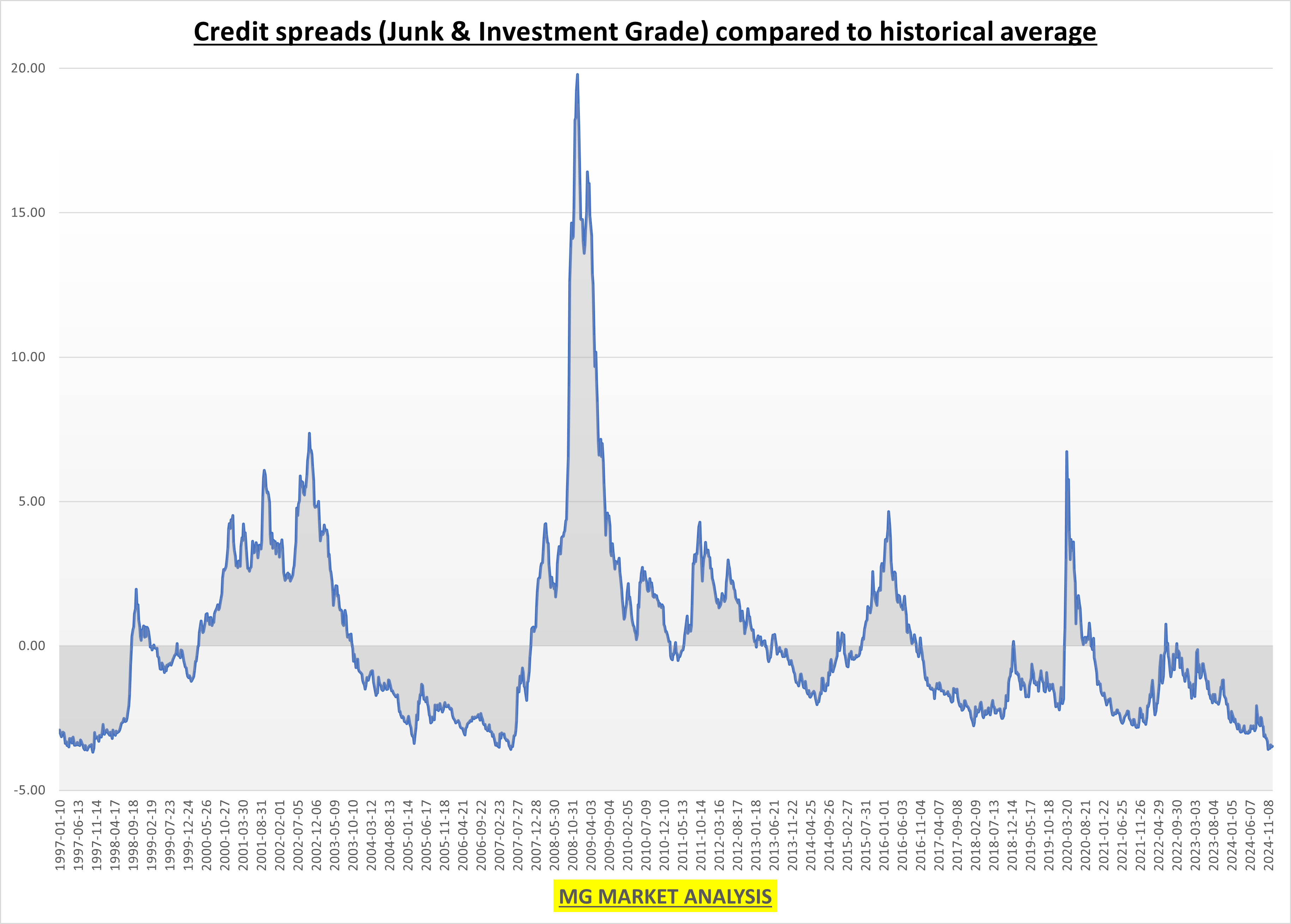

I keep an index which basically compares where both credit spreads are compared to their historical averages. This is another chart which is basically inverted, meaning the lower it goes, the better it is. It currently stands at -3.47%. Confirmation that credit markets are still in good shape. If/when this indicator gets back above +0.15% (historical average), it would be a caution sign to me and I’d be looking for other indicators to confirm the increase in recession probabilities.

Like any one economic or market indicator, there is no holy grail. There are times when it has given false positives (index spiked without a recession) such as during the Euro debt crisis in 2010-2015, and there are times when markets get blindsided (such as during COVID) when current readings were signaling no stress.

You have to look at the “preponderance of evidence” when analyzing markets and determining recession probability. But when credit spreads spike, its a sure sign of stress in the system. Can investors be overconfident in the future? Absolutely. Things can change in an instant.

Low credit spreads aren’t great for those investors in corporate debt. Although corporate debt isn’t as sensitive to future fluctuations in interest rates as treasuries are. You generally want to wait for spreads to widen to find good values. But since we can’t time such events, all we can do is take what the market gives you. If you are a bond investor looking to put new money to work, it may be best to allocate more towards treasuries for the time being, until spreads widen enough to make it more worth your while.