Why the U.S. dollar still reigns supreme

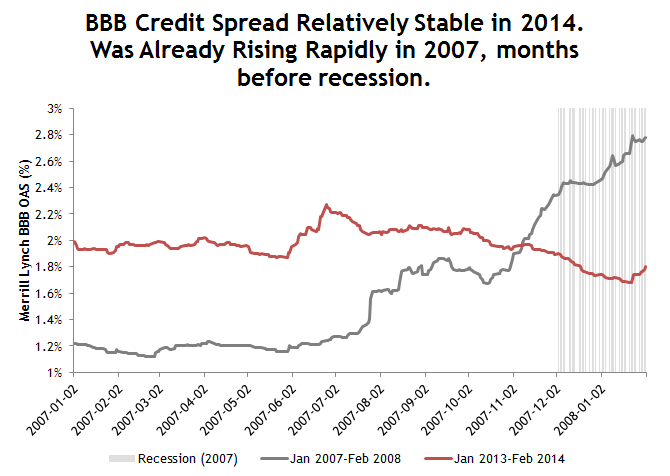

Even though equity markets have struggled to start the year, it should be comforting to note that credit markets have remained relatively calm. Credit spreads are one of the best ways to measure market risk tolerance, and in the last few weeks credit spreads have been pretty stable. Since the beginning of the year, the spread between investment grade corporate bonds and Treasuries has risen only slightly and is still lower than where the spread was at the beginning of 2013.

In contrast, when the last recession started in December of 2007, credit markets had already been selling off (credit spreads rising) for nearly five months even as equities continued to rally. This time around credit spreads don’t seem to be flashing warning signals, indicating that perhaps credit guys aren’t too concerned with the economic picture.

When it comes to forecasting recessions, credit markets are generally thought to be a little more accurate than equity markets, because credit investors are more focused on creditworthiness in the here and now. Additionally, fixed income markets are particularly good at digesting macroeconomic data because of the impact of these factors on interest rates. Some bond guys will also claim that credit analysts are just plain smarter than equity analysts. I’m not sure whether that’s true, but I will say that I did spend the first few years of my career on a credit desk, so…