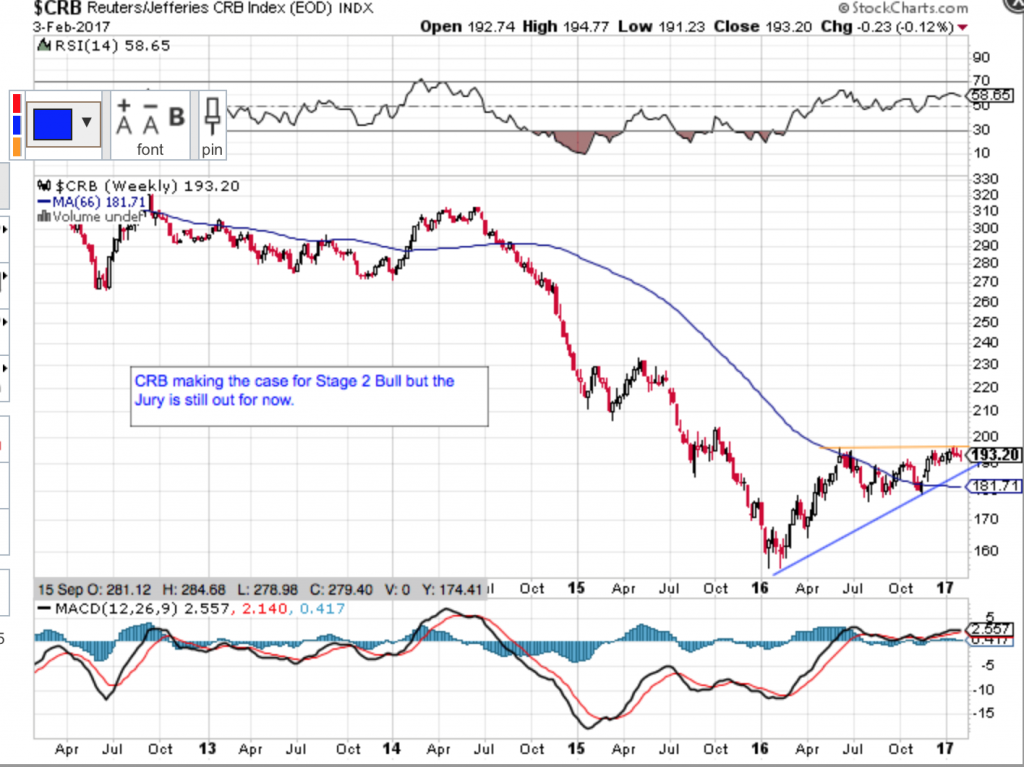

If you are going to trade the commodity sector, you had best follow the USD, which is why I do. If I am correct that the USD’s longer 15 Year Super Cycle will be topping in 2017, then the Commodities Index or CRB will be a fun sector/index on which to focus.

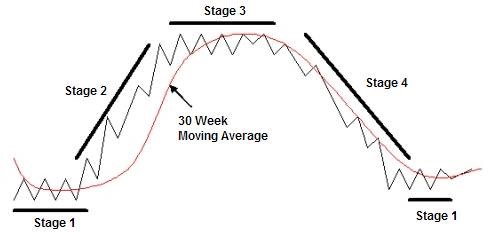

With respect to Weinstein’s 4 Stage Model, here is a great site that is the best I have found that covers his model quite well.

(4 Stages: 1 = Basing, 2 = Bull, 3 = Topping, 4 = Bear)

If the USD is topping then inflation will start to show up in the CRB with gold and silver leading the way.

So with that as background, let's examine the broader CRB using Weinstein’s 4 Stage Model. I show the CRB in Stage 1 Basing, but making the case for an emerging Bull commodities market.

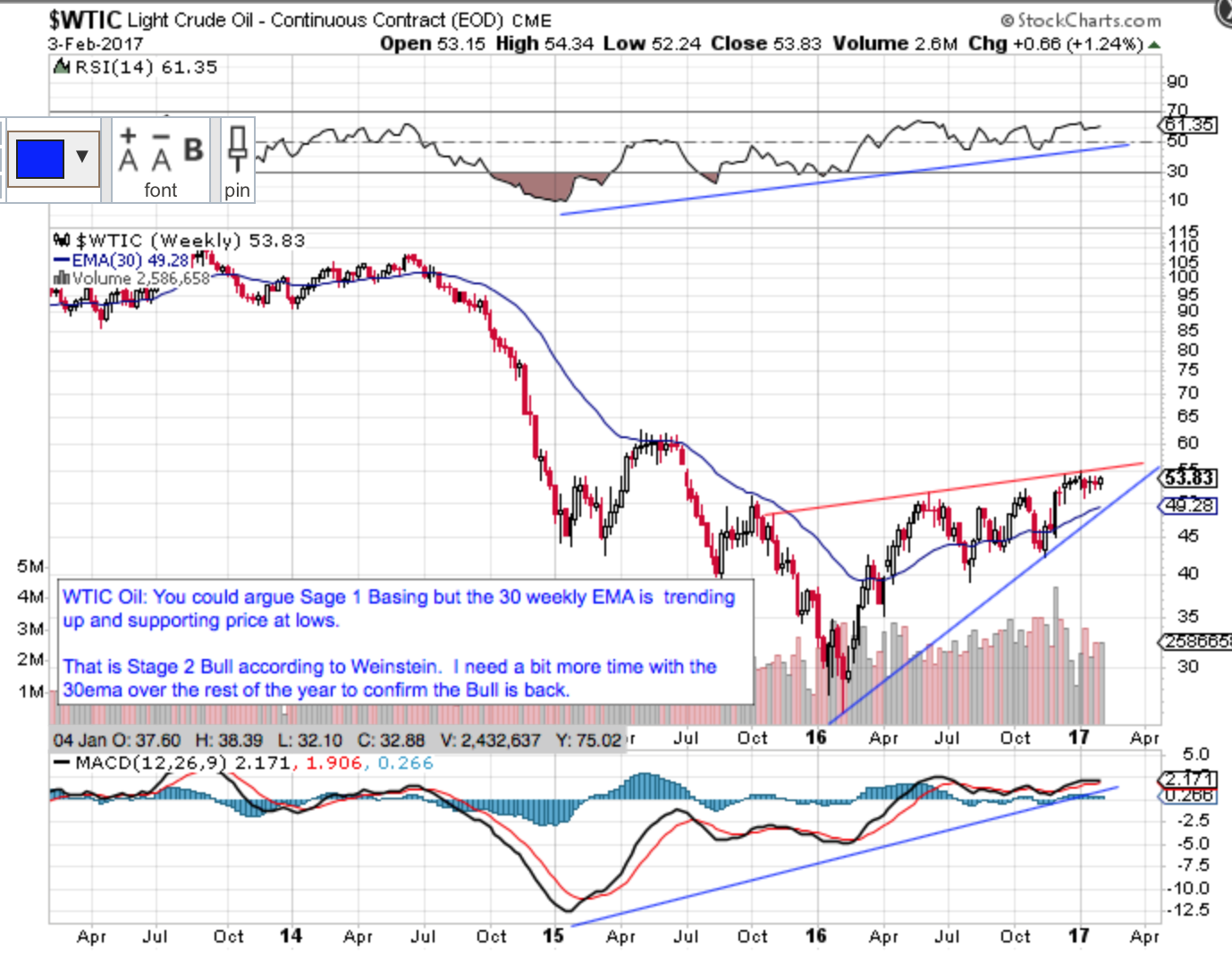

Next are smaller charts showing my 4 Stage analysis for the CRB’s various components:

- Oil: Either Basing in Stage 1 or early in Stage 2 of a new Bull. Looks more like Basing to me.

- NatGas: Looks like Stage 2 Bull but Price needs to continue to find support near the weekly 30ema

- Copper: Big move here but could also be part of the Basing of challenging the 30 and 66 EMAs.

Soft Commodities:

- Sugar: Stage 2 Bull to me

- Coffee: Coffee can be very choppy for short periods so a long term stage analysis may not apply

- Soybeans, Corn and Wheat: All three are Still Basing in Stage 1 for now