The shares of Hershey Company (NYSE:HSY)stock are up 3% to trade at $145.03 today, after earlier nabbing a record high of $145.15. The gap higher comes after Goldman Sachs (NYSE:GS) raised its rating to "neutral" from "sell," while hiking its price target all the way to $142 from $86. The analyst in coverage waxed optimistic about reports of Hershey's price increase on its single-serve chocolate.

The upgrade comes a little over a week away from Hershey's second-quarter earnings report, set for before the open on Thursday, July 25. As Hershey's turn in the earnings confessional looms, options bulls have come out of the woodwork today in droves.

More specifically, Hershey has seen almost 9,800 call options change hands today -- 12 times what's typically seen at this point, and volume pacing for the 100th percentile of its annual range. Leading the charge are the August 145 and 135 strike calls, and there are also new positions being opened at the weekly 7/26 147-strike call. Buyers of those calls expect HSY to soar the day following its earnings report, when the options expire.

Looking at Hershey's earnings history, the stock has closed higher the day after earnings in three of the past four quarters-- including a 4% surge in late April and a 7.4% bump a year ago this time. Over the past two years, the shares have swung an average of 3.8% the day after earnings, regardless of direction. This time around, the options market is pricing in a larger-than-usual 5.7% swing for Friday's trading.

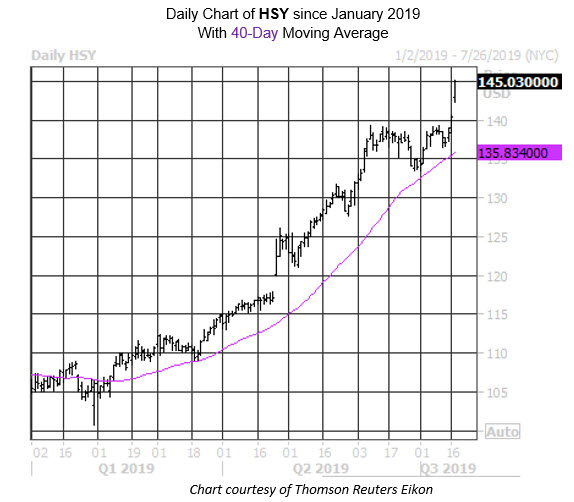

Today's positive price action -- on track to be its fourth-straight win -- helps HSY break out of a month-long consolidation below the $141 level. And despite a downgrade last month, Hershey stock found support at its ascending 40-day moving average.