Even solid AAA lose grounds to Germany

The debt crisis keeps worsening. ECB buying continues to be reluctant and during this week Italian and Spanish 10-year bond yields have been flirting with 7% – a level that has previously been thought of as the point of no return. Moreover, it now only seems a matter of time before the margin requirement for Spain will be increased by the London Clearing House, which in turn will lead to further selling pressure.

Even more concerning, the contagion from the euro crisis is now spreading to the very

core of eurozone countries. France and Austria have been seeing a significant further

sell-off and are now facing 10-year funding costs double as high as Germany’s.

Lately even the best among the remaining AAA-rated countries in the eurozone have

been losing ground to Germany. Finland is trading 31.5bp wider, while The Netherlands is trading 24.4bp wider compared to the end-October level.

In comparison, the Nordic countries outside the eurozone are trading unchanged or

tighter to Germany over the same time span. Hence, it now seems that the market is

attaching not only a credit premium between the individual countries, but also a credit

premium on the euro itself. Hence, one might wonder whether at some stage German

yields will start to rise because of this.

Funding stress intensifying

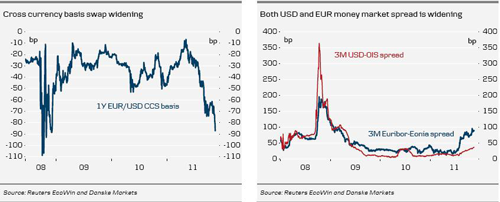

At the same time the funding stress has been intensifying after Fitch warned that the

European debt crisis could turn into a bigger problem for US banks. The USD fixings have been moving consistently higher over the past couple of months and the market is pricing a further worsening. The funding stress is also visible in the EUR/USD cross currency basis swap, which has widened further as well. In EUR the money market squeeze worsened measurably later in the week, which in turn led to wider swap spreads and higher swap rates.

Not even a string of surprisingly encouraging US data has been able to loosen up the negative sentiment. US 10-year bond yields are once again trading below 2.00% and the equity market is under pressure.

Over the past week there have been some signs that the sentiment in hardline countries is changing. The German Economic Council has suggested an European Redemption Pact and one of its members, Peter Bofinger, publicly suggested that the ECB should set an upper limit for sovereign bond yields (Strategy: What ECB could do to alleviate the market stress).

There seems to be political will, but the big problem is that the political process cannot keep up with the market pace. Therefore, in our view, increased and more explicit ECB involvement is the only real circuit breaker at the current stage. We think this is likely to happen eventually, as stress levels in financial markets become unacceptably high and as the German reluctance to use ECB’s balance sheet is likely to soften up, as it becomes clear that the country is facing a hard recession together with the rest of Europe.

Unless measures are taken to alleviate the funding pressure, there is a real risk that EUR swap spreads widen so much that the outright level of EUR swap rates could move higher even with a deteriorating economic outlook.