Consulting services provider CRA International, Inc. (NASDAQ:CRAI) reported second-quarter GAAP earnings of $3.8 million or 44 cents per share compared with $5.2 million or 59 cents in the year-earlier quarter. The year–over-year decline in GAAP earnings despite top-line growth was primarily due to high operating expenses.

Non-GAAP earnings in the reported quarter were $4.1 million or 48 cents per share compared with $3.5 million or 40 cents in the year-ago quarter. Adjusted earnings beat the Zacks Consensus Estimate of 42 cents.

Inside the Headlines

Non-GAAP revenues in the second quarter increased 13.4% year over year to $93.6 million. The rise was driven primarily by broad-based growth in its Energy, Forensic Services, Life Sciences and Marakon Practices and strong contributions by its Antitrust & Competition Economics practice. International operations grew of 8.9% year over year. Reported revenues exceeded the Zacks Consensus Estimate of $90.2 million.

GAAP gross profit in the reported quarter was $28.3 million compared with $24.7 million in the year-ago quarter. Adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) increased 7.3% year over year to $15.4 million.

The company has been very active with its restructuring efforts and remains on track to curtail its expenses by eliminating excess office space capacity and better rationalizing the remaining office space. CRA International further aims to achieve growth organically in the coming quarters through new engagements and several cross-selling opportunities.

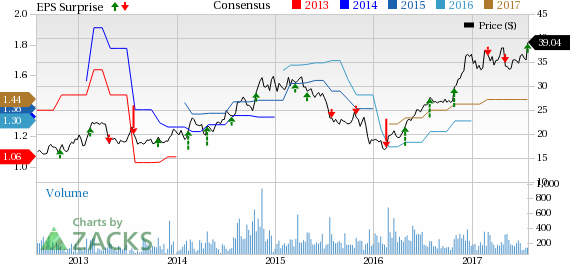

CRA International,Inc. Price, Consensus and EPS Surprise

Balance Sheet and Cash Flow

As of Jul 1, 2017, CRA International had cash and cash equivalents of $14.7 million while its long-term liabilities were $25.4 million. Cash used in operating activities for the quarter were $8.5 million compared with $5.1 million in the year-ago quarter. At quarter end, the company had $11.5 million of borrowings under line of credit.

Outlook

Based on its strong performance in the first half of the year, CRA International raised its guidance for 2017. The company expects non-GAAP revenues from $360–$370 million on favorable growth dynamics. Non-GAAP adjusted EBITDA margin is expected in the range of 15.8–16.6%.

Despite performing well, the company remains cautious on the uncertainties around global economic conditions and short-term challenges resulting from the integration of incoming consultants that could affect its business. Fluctuations in foreign currency exchange rates remain an additional concern.

CRA International currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the industry include Exponent, Gartner and NV5 Global.

Exponent, Inc. (NASDAQ:EXPO) which delivered an average positive earnings surprise of 10.14% in the last four quarters, carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Gartner, Inc. (NYSE:IT) carries a Zacks Rank #2 (Buy) and delivered an average positive earnings surprise of 4.58% in the last four quarters.

NV5 Global, Inc. (NASDAQ:NVEE) carries a Zacks Rank #2 and came up with an average positive earnings surprise of 1.82% in the last four quarters.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early. See Zacks' 3 Best Stocks to Play This Trend >>

Gartner, Inc. (IT): Free Stock Analysis Report

CRA International,Inc. (CRAI): Free Stock Analysis Report

Exponent, Inc. (EXPO): Free Stock Analysis Report

NV5 Global, Inc. (NVEE): Free Stock Analysis Report

Original post