- German exports have risen for two months running; three is a lot to hope for

- US jobless claims are expected to tick higher – the first increase in a month

- Employee hiring has slumped to an eight-month low in the US

- The US Bloomberg Consumer Comfort Index could straighten out 'mood metrics'

Thursday’s economic calendar includes the monthly update on Germany’s foreign trade numbers, a release that may influence expectations for a scheduled speech today by European Central Bank president Mario Draghi at 0700 GMT. Later in the day we’ll see new weekly US numbers on jobless claims and the Bloomberg Consumer Comfort Index.

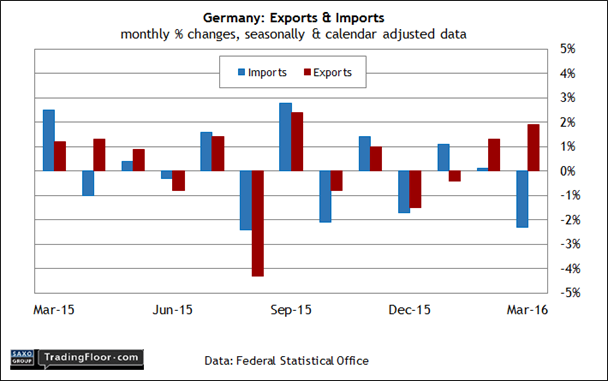

Germany: Foreign Trade (0600 GMT): Europe’s leading export machine posted firmer numbers in the last two months of the first quarter. In February and March, seasonally-adjusted exports posted solid gains, the first back-to-back monthly advances in nearly a year.

Is this a sign that foreign trade is heating up for Europe’s largest economy? In search of an answer, the crowd will be keenly focused on today’s monthly update.

One reason for keeping expectations in check is this week’s news that factory orders in Germany dropped 2% in April, the biggest monthly decline in nearly a year.

The slide was due to a hefty fall in demand among countries outside the Eurozone, noted Carsten Brzeski, the chief economist at ING Bank. “There is little reason to see a quick brightening of the outlook for German industry. Instead, the outlook will remain mixed,” he told Reuters.

A degree of support for anticipating no more than modest foreign demand can be found in last week’s survey data for German manufacturers in May. New business continued to firm, but "subdued demand from international markets [is] hindering a stronger expansion", a Markit economist observed.

The cautious analysis on foreign markets for German companies implies that the two-month run of higher exports may be due to reverse in today’s results.

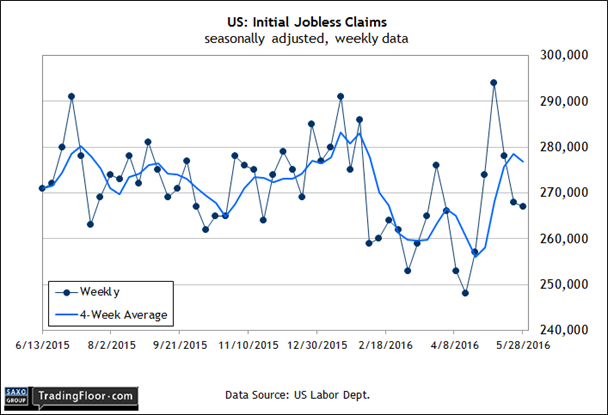

US: Initial Jobless Claims (1230 GMT): Job openings in the US increased in April, matching the highest level since 2000, the first year for this data set, according to yesterday's update from the US Labour Department. That’s an encouraging sign, although there’s a caveat: hiring slumped to an eight-month low.

The backtracking in hiring may be due to challenges in finding qualified workers as opposed to macro weakness. Nonetheless, news of weaker hiring will keep the crowd on edge in the wake of last Friday’s news of a sharp slowdown in the growth rate of nonfarm payrolls in May.

Today’s weekly data on jobless claims, however, is still expected to favour the optimistic view for the labour market outlook. The last three updates on this front have been upbeat following a three-week spike through early May that, at the time, looked troubling. But recent numbers suggest it was noise.

Today’s update is projected to post a modest rise. Econoday.com’s consensus forecast sees claims advancing 3,000 to a seasonally adjusted 270,000, which would mark the first weekly increase in a month.

But that still leaves claims close to multi-decade lows. Nonetheless, the sight of a rise, however slight, won't do much to reverse anxiety over the surprisingly soft payrolls data for May.

Short of a sharp gain, however, today’s claims don’t look set to change anyone’s perception of the labour market. That may or may not be a good thing, depending on your expectations going into this release. But for the moment, it’s reasonable to assume that the claims release will be a non-event.

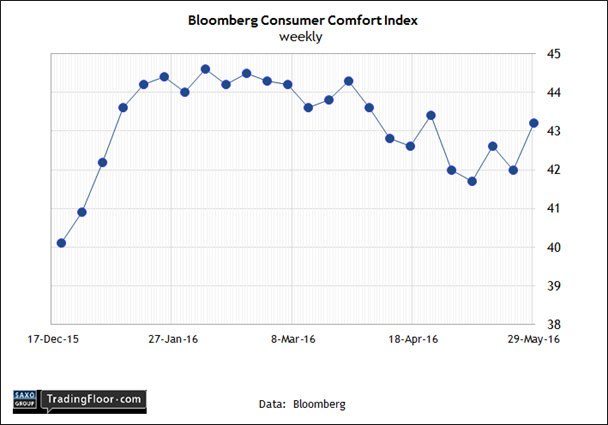

US: Bloomberg Consumer Comfort Index (1345 GMT) : The May numbers that track the mood among US consumers is sending mixed messages. The Conference Board’s Consumer Confidence Index ticked lower again last month. In contrast, the University of Michigan’s Index of Consumer Sentiment benchmark (UoM-CS) posted a solid advance in May.

"There have only been four prior months since the January 2007 peak in which the Sentiment Index was higher than in May 2016," said the economist who oversees the UoM-CS data.

The view was more reserved for the Conference Board’s data. “Expectations declined further, as consumers remain cautious about the outlook for business and labour market conditions,” said the consultancy's director of economic indicators.

Perhaps today’s weekly estimate of consumer attitudes via the Bloomberg Consumer Comfort Index can help sort out the muddle. On the plus side, BCCI increased to 43.2 – a five-week high for the period through May 29, according to last Thursday’s release. It didn’t hurt that a solid April report on consumer income and spending was published two days earlier.

It’ll be interesting to see if the BCCI can continue to recover its lost ground in March and April. If so, we’ll have a bit more support for thinking that the upbeat view via the UoM-CS figures accurately reflects the mood on Main street.

Disclosure: Originally published at Saxo Bank TradingFloor.com