The Children’s Place Retail Stores (NASDAQ:PLCE)

Consumer Discretionary - Specialty Retail | Reports May 17, Before Market Opens

Key Takeaways

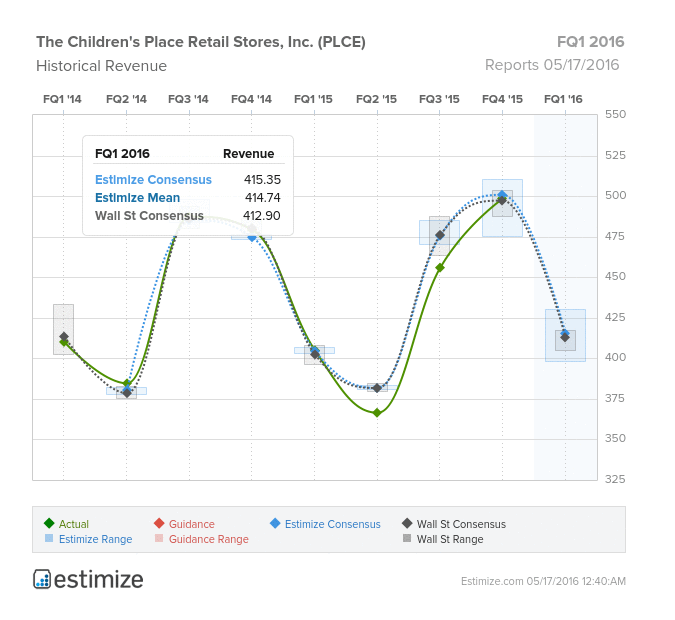

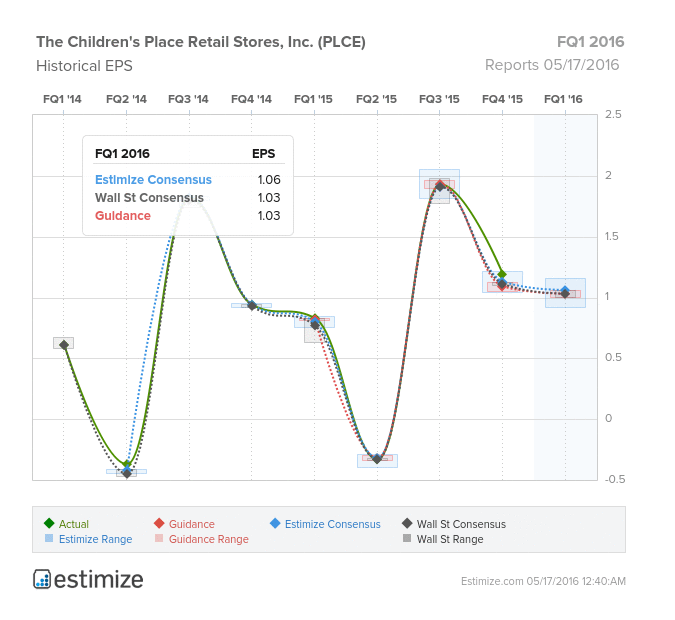

- The Estimize consensus is looking for earnings per share of $1.06 on $415 million in revenue, 3 cents greater than Wall Street on the bottom and $3 million on the top.

- So far Q1 is off to a strong start with comparable store sales running at 9.7% through the first 6 weeks.

- Q4 2015 was the first quarter that revenue growth turned positive in nearly 2 fiscal years

Clothing retailer The Children’s Place, is scheduled to report first quarter earnings Tuesday, before the market opens. The company capped off 2015 with strong fourth quarter results that featured positive revenue growth for the first time in 2 fiscal years. Much of 2015 was devoted to implementing a new strategy that would deliver growth on both the top and bottom line. Expectations are high that this momentum will carry over into the first quarter and throughout 2016. So far, Q1 is off to a strong start with comparable store sales running at 9.7% through the first 6 weeks.

The Estimize community is looking for earnings per share of $1.06, 28% higher from a year earlier and 3 cents greater than the Wall Street consensus. Revenue is expected to come in at $415 million, a 3% increase from $405 million posted in Q1 2015. On average, shares see positive movements through and following earnings, which should give a marginal boost to shares which are already up 24% year to date.

The Children’s Place turnaround has been built on four strategic initiatives: superior product, technology, growth through alternate channels, and store fleet optimization. The success of these initiatives delivered positive comparable sales last year and margin improvements. Consistent with its store optimization, the company closed 16 stores during Q4 2015 and 32 during 2015. Furthermore, the company opened 4 new domestic stores and continues to expand its international presence

While the outlook for 2016 appears promising, weak economic and spending conditions poses a legitimate threat. An established global footprint and growing currency headwinds could take their toll on earnings in the short term.