The BLS released its measure of the CPI today. The Atlanta Fed also released its "Sticky Price" CPI. Let's analyze.

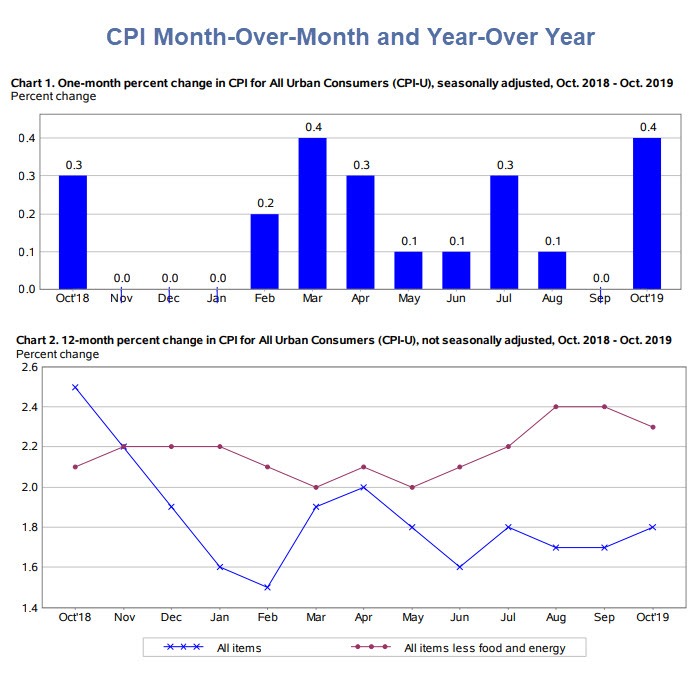

Consumer prices jumped a higher than expected 0.4 percent today according to the BLS Consumer Price Report for October, primarily due to energy.

Key Points

- The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.4 percent in October on a seasonally adjusted basis after being unchanged in September, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 1.8 percent before seasonal adjustment.

- The energy index increased 2.7 percent in October after recent monthly declines and accounted for more than half of the increase in the seasonally adjusted all items index; increases in the indexes for medical care, for recreation, and for food also contributed. The gasoline index rose 3.7 percent in October and the other major energy component indexes also increased. The food index rose 0.2 percent, with the indexes for both food at home and food away from home increasing over the month.

- The all items index increased 1.8 percent for the 12 months ending October, a slightly larger rise than the 1.7-percent increase for the period ending September. The index for all items less food and energy rose 2.3 percent over the last 12 months. The food index rose 2.1 percent over the last 12 months, while the energy index declined 4.2 percent over the last year despite increasing in October.

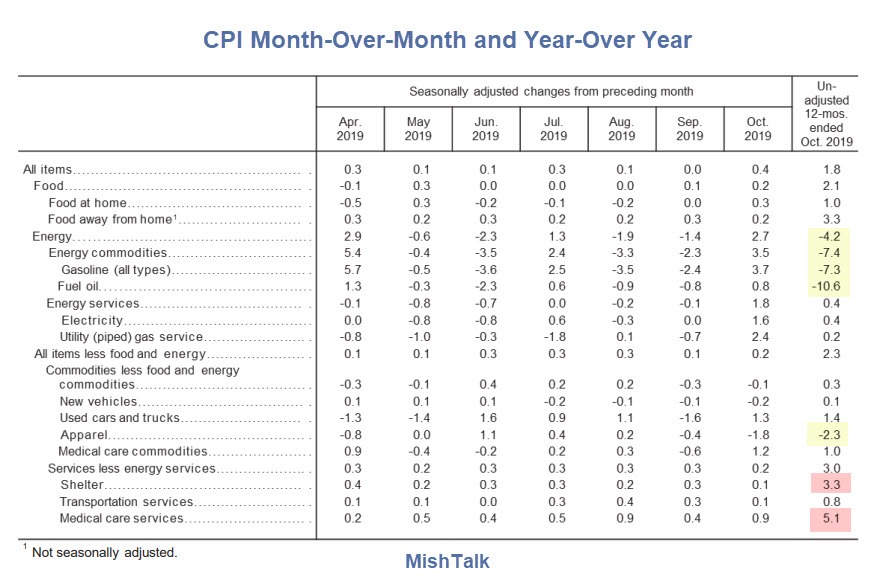

CPI Items

I don't doubt declining energy prices. Gasoline is easy to measure. I don't doubt apparel prices are falling either.

For anyone wanting to buy a home, the CPI is grossly distorted but the latest figures would seem reasonable. The problem is the BLS does not factor in home prices so there has been massive understatement for years in shelter costs.

The same applies to medical care services. Anyone buying their own insurance will tell you what they pay has gone up 20% or more. For many, the cost of insurance is up 100-300% over the past few years.

The BLS conveniently averages all those on Medicare and Medicaid while simultaneously ignoring what corporations pay, and while also assuming the quality of care is up.

The whole thing is a joke, and a sorry one at that for anyone in school, anyone wanting to buy a home, or anyone buying their own health care insurance.

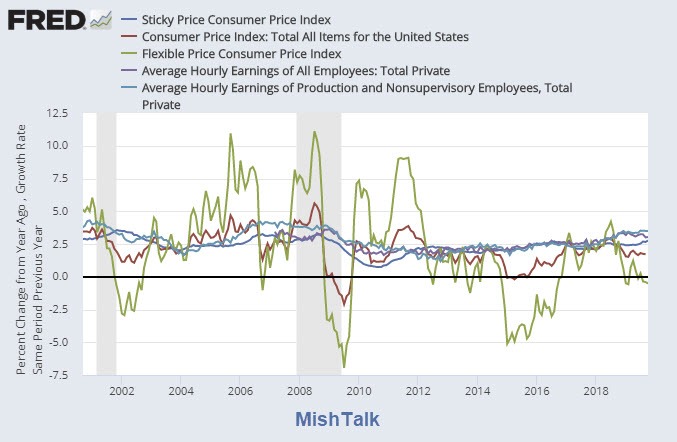

Sticky and Flexible Prices

The Atlanta Fed measures Sticky Prices (prices which move slowly) and Flexible Prices (which change fast). Apparel is an example of something that moves slow and energy is an example of something whose price changes frequently.

- The Atlanta Fed's sticky-price consumer price index (CPI)—a weighted basket of items that change price relatively slowly—rose 3.3 percent (on an annualized basis) in October, following a 2.4 percent increase in September. On a year-over-year basis, the series is up 2.8 percent.

- On a core basis (excluding food and energy), the sticky-price index rose 3.5 percent (annualized) in October, and its 12-month percent change was 2.7 percent.

- The flexible cut of the CPI—a weighted basket of items that change price relatively frequently—increased 7.9 percent (annualized) in October, and is down -0.5 percent on a year-over-year basis.

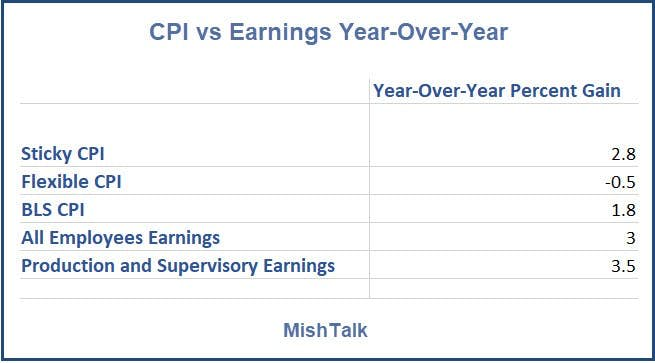

Year-Over-Year Comparisons

- If you are a production and supervisory worker, allegedly you are 4.0 PP ahead of the Flexible CPI, 1.7 PP ahead of the BLS CPI, and 0.7 PP ahead of the sticky CPI.

- If you are a the average worker, allegedly you are 3.5 PP ahead of the Flexible CPI, 1.2 PP ahead of the BLS CPI, and 0.2 PP ahead of the sticky CPI.

Congratulations!

Congratulations are due because as noted in Labor Productivity Dives as Unit Labor Costs Soar, you are gaining despite your anemic productivity.

Unfortunately, the Decline in Profit Margins and Investment Suggests Recession Due Now.