According to the textbook prescription, the ideal time to cut government spending and tighten monetary policy is when the economy begins to approach full employment and the first signs of excessive inflation appear. Economists call this kind of preemptive policy countercyclicalas it helps to keep an impending boom from running out of control. On the other hand, premature tightening when a recovery is still incomplete is procyclical. A procyclical policy makes slumps deeper, recoveries slower, and booms hotter than they would be if the economy were left to its own devices.

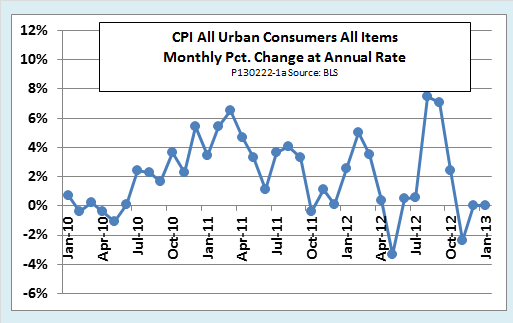

This week’s news from Washington suggests a turn from countercyclical to procyclical in macroeconomic policy. Today’s inflation report from the Bureau of Labor Statistics only adds to that impression. As the following chart shows, the headline inflation rate, as measured by the change in the consumer price index for all urban consumers, remained at zero in January for the second month in a row. If we include a 0.2 percent monthly decrease in November, which cancelled out a 0.2 percent increase in October, inflation has been flat for four months now.

To be sure, the headline inflation rate is not the whole story. The all-items CPI remained unchanged in January, in part, because of a drop in energy prices and an end to a ten-month string of increase in food prices. If we strip out volatile food and energy prices, the resulting core CPI increased by 0.3 percent in January. If it had continued for a full year, that would come out to a 3.7 percent annual rate. However, there is little indication that market participants are interpreting the uptick in core inflation as more than a blip. The Cleveland Fed’s estimate of ten-year inflation expectations at 1.5 percent, remains very close to its lowest level over the past two decades.

Meanwhile, all signs point to a pending tightening of fiscal and monetary policy.

As far as fiscal policy is concerned, all eyes are focused on the package of across-the-board spending cuts known as the sequester, which will come into effect on March first if nothing is done. Yes, another midnight deal could modify the sequester, but fiscal policy will be tightened in any event for the simple reason that both parties want it thus. The only difference between them is that the Republicans want tightening via spending cuts alone, while the Democrats would like to throw some tax increases into the mix.

Over at the Fed, the indications of a change in monetary policy are more subtle. Don’t expect a dramatic boost to interest rates any time soon. Still, the pendulum does seem to be swinging away from the strongly accommodative quantitative easing of the past few years.

Inflation, as measured by the CPI, is not the worry. According to the minutes of their January meeting released this week, most members of the policy-setting Federal Open Market Committee expect inflation to run at or below the Fed’s target of 2 percent for the foreseeable future. Only a few members see any upside risk to prices in the medium, or even the long term. However, several participants in the January meeting expressed concern that the Fed’s huge portfolio of securities could expose it to a risk of large capital losses in the event of a future reversal of policy. A few others expressed concerns that the Fed’s program of large-scale asset purchases could lead to the disruption of financial markets.

What lies behind least some of these concerns is a fear of asset bubbles. These are sharp increases in the prices of securities, real estate, or global commodities that can occur even when consumer price inflation remains low. Usually, they pose the greatest risk when the economy is running at or above its level of potential GDP, as during the dot.com bubble in the 1990s and the housing bubble in the early 2000s. Today, at least as measured by the Congressional Budget Office, the U.S. economy is still well below potential GDP but not everyone trusts those estimates. The FOMC minutes tell us that some members noted “uncertainties concerning both the level of, and the source of shifts in, potential output.” It is worth noting that the concern over asset bubbles is shared by some private observers, including Nouriel Roubini.

The recently-released FOMC minutes summarize the concerns of its members in this key sentence:

A number of participants stated that an ongoing evaluation of the efficacy, costs, and risks of asset purchases might well lead the Committee to taper or end its purchases before it judged that a substantial improvement in the outlook for the labor market had occurred.

In the Fed’s closely guarded language, “a number of participants” is more than “several” or “a few.” Market participants considered that implied that the Fed’s determination to stick with aggressive accommodation until labor market conditions improve is weakening. These days, in monetary policy, when actual changes in interest rates are unthinkable, subtle signals what the Fed is likely to do in the future take on added importance. Monetary economists such as Michael Woodford consider such “forward guidance” to be the main channel through which the Fed can affect the economy when interest rates are at or near zero - as they are now.

The bottom line: All of this week’s news: flat inflation, the looming sequester and the increasing caution of forward guidance from the Fed - point to a distinct procyclical turn in macroeconomic policy. That may or may not mean an actual return to recession, but if not, gains in output and employment are likely to come even more slowly this year than last.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

CPI Inflation Stuck At Zero As Fiscal And Monetary Policy Threaten

Published 02/23/2013, 05:44 AM

Updated 07/09/2023, 06:31 AM

CPI Inflation Stuck At Zero As Fiscal And Monetary Policy Threaten

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.