Investing.com’s stocks of the week

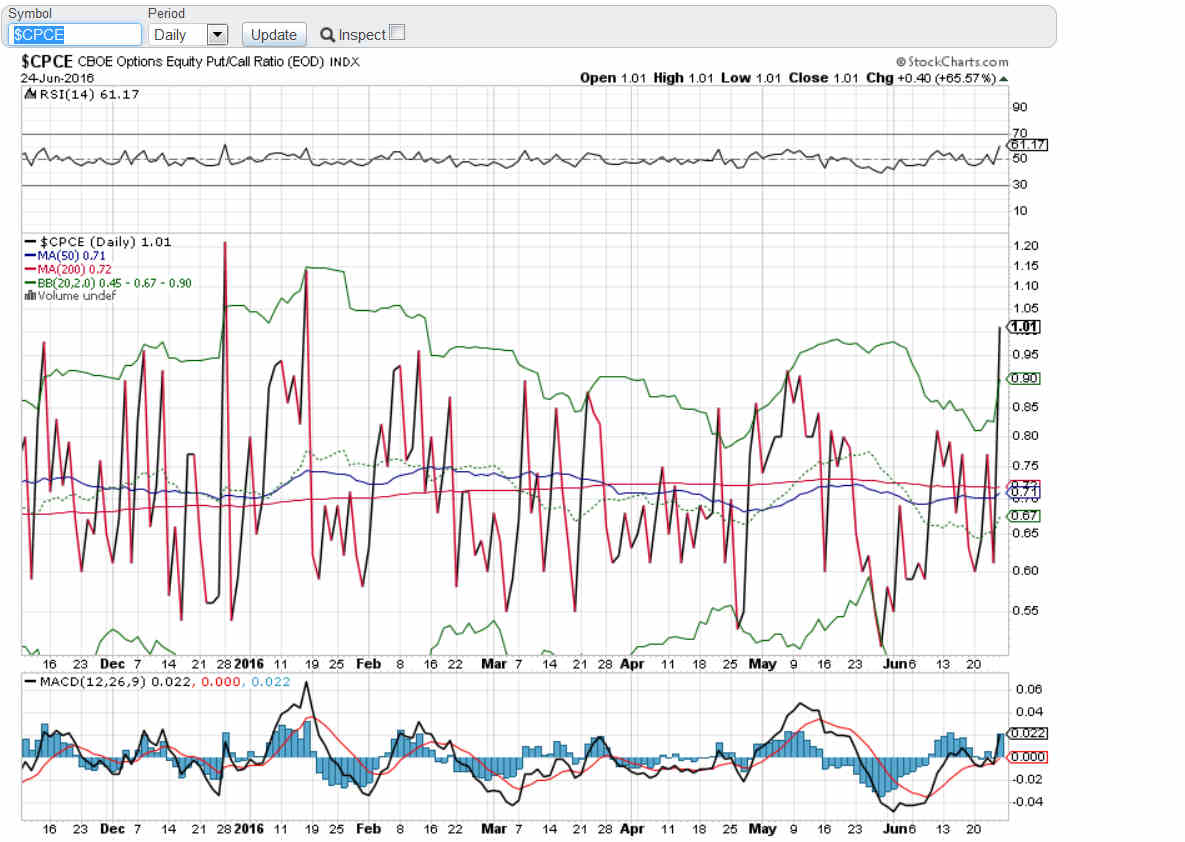

CPCE Spiked Through Its Top Bollinger Band on Friday – That Would Usually Be Followed by a Strong Price Move Up

The CBOE Equities Put-Call Ratio (CPCE) put in a big spike up on Friday, up through its top Bollinger Band. This is a strong set-up for a big move up in price.

The CPCE isn’t up there on its own. The SPDR S&P 500 (NYSE:SPY) put-call ratio put in a good jump as well, and the CPCI is still high from several days ago.

The principle is that everyone and his mother has already bought protection, so there’s nowhere for the market to go but up. Last night on Twitter, 20 different traders told me why the signal wouldn’t work this time (Brexit, etc.), but they’ve told me the same thing every time this signal has triggered.

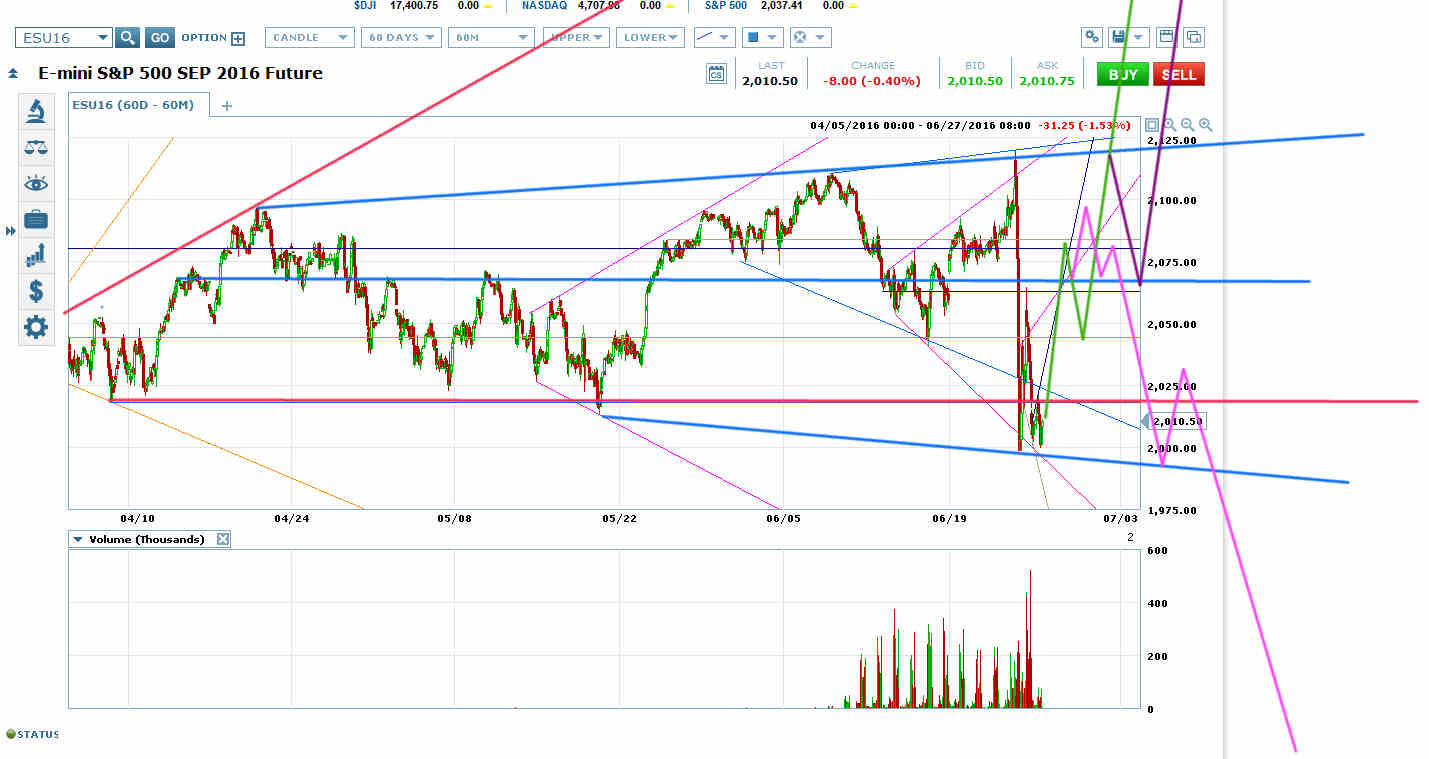

When ES broke out of its Brexit falling megaphone (orange on chart above) without having completed an inverse head and shoulders (H&S) bottom inside the formation, it was likely to megaphone its way to at least a retest of the low (and usually a slightly lower low), and it has done that.

Right now ES is putting in a bottoming megaphone (blue) within a right shoulder megaphone (silver) that will likely work the price back up to at least its orange falling megaphone retrace target of 2100.

Flat-Bottomed Megaphone (Red) vs Megaphone (Blue)

The ES 60-minute chart is ambiguous. It can be seen as a flat-bottomed megaphone with a likely fake breakout downwards. That would likely be followed by a breakout upwards for a surge at least 125 points higher.

The chart also qualifies as a Sornette melt-up set-up, which is essentially a shallow megaphone that breaks out upwards without a retrace to VWAP.

Another way of looking at the chart is as a topping megaphone or complex head and shoulders that is about to put in a right shoulder with a top at 2100 (pink scenario).

So 2100 is a critical decision point.

ES has confirmed a 5-year rising megaphone (silver on chart above) on its daily and weekly charts. So if the H&S set-up completes, we can expect a pullback to roughly the rising megaphone bottom at 1900-ish. Usually the bottom would get broken a bit on that move.

Otherwise we can expect the price to take off into a melt-up that would usually top with a head and shoulders formation. If the H&S completes inside the rising megaphone with a right shoulder that’s a bounce off the rising megaphone bottom, it would usually be a strong set-up for a retrace to the rising megaphone bottom.

If the H&S fails to complete inside the rising megaphone, it would usually lead to a prolonged sideways move with at least a retest of the top and usually a slightly higher high before a larger correction.