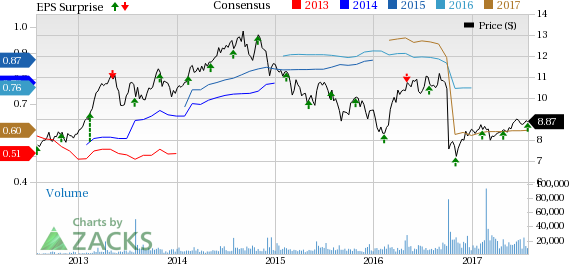

Cousins Properties Incorporated (NYSE:CUZ) reported second-quarter 2017 funds from operations (FFO) per share of 16 cents, surpassing the Zacks Consensus Estimate of 15 cents. However, the figure compared unfavorably with 21 cents recorded in the year-ago period.

The quarter witnessed considerable improvement in rental property revenues, which aided results to quite an extent. However, an increase in expenses was a headwind.

Total revenue for the quarter came in at $119.0 million, compared with $48.3 million reported in the prior-year period. Additionally, rental property revenues were $114 million compared with $46.5 million in the year-ago quarter.

Note: All EPS numbers presented in this write up represent funds from operations (FFO) per share.

Quarter in Detail

Cousins Properties leased or renewed 341,008 square feet of office space in the quarter. Same property net operating income, on a cash basis, rose 8.6% year over year. Moreover, second generation net rent per square foot (cash basis) increased 13.5%.

Total costs and expenses came in at $110.1 million, increasing significantly from the prior-year quarter.

Cousins Properties exited the quarter with cash and cash equivalents of $16.4 million, as against $35.7 million recorded as of Dec 31, 2016.

2017 Outlook

Cousins Properties projects 2017 FFO per share in the range of 58–63 cents per share. The Zacks Consensus Estimate for the year is currently pegged at 60 cents.

The company has narrowed its current year net income guidance to the range of 43–48 cents per share from 41–49 cents.

The company increased estimates for fee and other income to the range of $18.5–20.5 million. Also, the company has increased estimates for general and administrative costs to the range of $26–$28 million.

In Conclusion

The company’s diversified portfolio, presence of high-end tenants in its roster, and opportunistic investments in best sub-markets should help it in keeping the growth momentum alive.

However, intense competition, high dependence on its office portfolio and further hike in interest rates remain the key concerns.

Currently, Cousins Properties has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The company’s shares have gained nearly 4.2% year to date, outperforming the 3.2% growth of the industry it belongs to.

We now look forward to the earnings releases of other REITs like HCP, Inc. (NYSE:HCP) , Federal Realty Investment Trust (NYSE:FRT) and GGP Inc. (NYSE:GGP) . HCP, Inc. is slated to report results on Aug 1, while Federal Realty Investment Trust and GGP Inc. are slated to report results on Aug 2.

Note: FFO, a widely used metric to gauge the performance of REITs, is obtained after adding depreciation and amortization and other non-cash expenses to net income.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

General Growth Properties, Inc. (GGP): Free Stock Analysis Report

Federal Realty Investment Trust (FRT): Free Stock Analysis Report

HCP, Inc. (HCP): Free Stock Analysis Report

Cousins Properties Incorporated (CUZ): Free Stock Analysis Report

Original post