100% Normal And To Be Expected

In this week’s video we noted that markets would be easy if they went up every day during a bull market and down every day during a bear market (see clip). As humans, when we see bearish charts, we tend to expect the market to drop every day. Since we know markets do not work that way, it is prudent to remind ourselves that any sharp drop (correction/bear market) is typically accompanied by sharp countertrend moves.

Mental Preparation Important

If we know a countertrend move falls into “normal” territory, it is easier to filter out the noise when the next one begins. Right now, the stock market is in a downtrend. We assume it will remain in a downtrend until proven otherwise. Therefore, any initial rally in 2016 will be treated as a countertrend rally (aka noise) until the data proves otherwise.

If Stocks Bounce

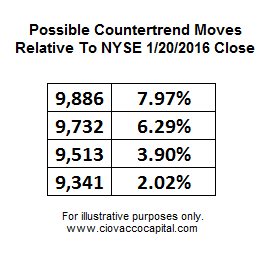

The table below shows some reasonable levels that the NYSE Composite Stock Index could rally back to, along with the percentage gain from the close on January 20, 2016. The purpose here is not to predict, but rather to become mentally prepared for an inevitable countertrend rally that will occur at some point in the coming days/weeks/months.

Four Levels That Have Been Relevant In The Past

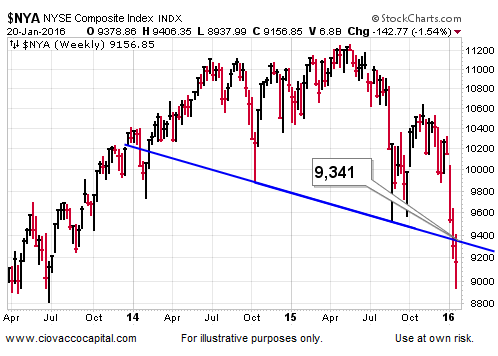

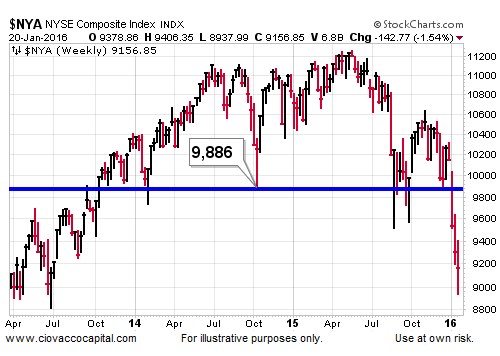

The chart below shows what may be a neckline on a weekly head-and-shoulders pattern. The pattern is described here relative to a similar pattern in 2008. It should be noted that as long as the market stays below the neckline, stocks remain vulnerable to dropping further before any countertrend move. As of January 20, the market remains below the neckline.

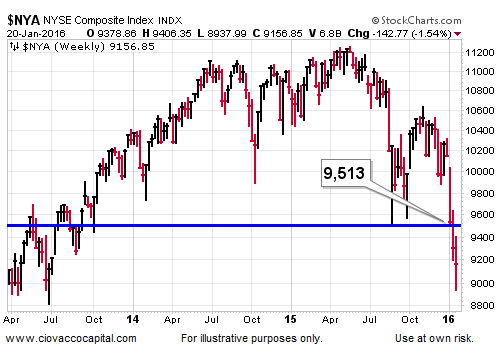

Weekly lows in August 2015 and January 2016 both occurred near 9,513 on the NYSE Composite Stock Index.

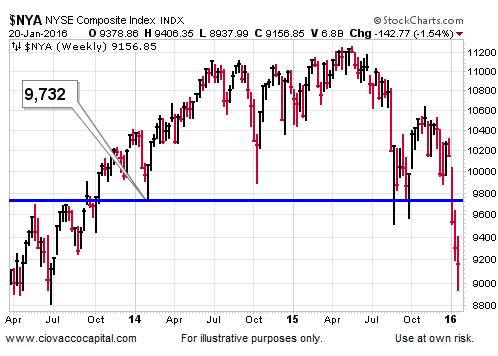

9,732 was relevant in early 2014 and again in late 2015; it may be relevant again, but this time “what once was support may now act as resistance”.

9,886 found buying support after a sharp drop in October 2014; it may be relevant again, but this time “what once was support may now act as resistance”.

Stocks Continue To Drop Scenario

If the breach of the neckline, shown in the first chart above, holds, stocks could continue to fall further as they did in 2008. Since studies have shown predictions about where stocks will be in several weeks or several months tend to be no better than a coin flip, we will continue to monitor and adjust rather than anticipate and hope.