As I shared last month, IPO activity, particularly for tech companies, screeched to a halt at the start of the year.

In fact, not a single tech company went public in the first quarter.

But we’re finally starting to see signs of life…

In April, cyber-security firm Secureworks Corp (NASDAQ:SCWX) priced its IPO at $14 per share.

Granted, the company originally planned to price shares in the $15.50 to $17.50 range, so it wasn’t a runaway success. But simply getting a tech IPO done – not to mention having share prices hang close to the deal price in the aftermarket – is undeniable progress.

Then, last week, Twilio – a cloud communications platform, which has raised $233 million in venture capital funding to date – publicly filed for an IPO. The company could go public before the end of June on the New York Stock Exchange under the ticker “TWLO.”

“It feels like a concert where the headliner is running late and the crowd has been getting antsy,” says Atish Davda, CEO at EquityZen. “Finally, Twilio walks onstage and gives everyone a reason to calm down.”

Indeed. So when will it be time to transition to crowd-surfing in the excitement of a genuine IPO comeback?

Believe it or not, the supposedly lazy days of summer hold the key.

No Vacation Plans Here

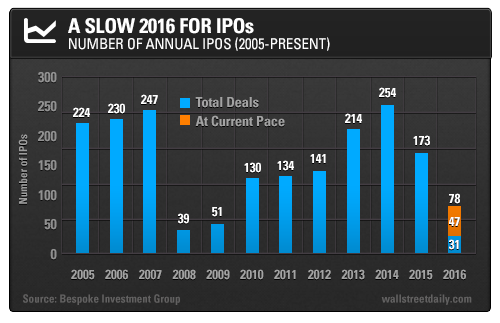

While this has been the worst year for IPOs since the 2009 recession – and the third worst year since the dot-com days – we’re coming off a strong May.

In fact, May marked the best month for IPO activity since October 2015. A total of 16 IPOs were priced, raising $3 billion.

Nevertheless, we’re still way behind the average IPO volume at this point in the year, as you can see in this chart from Bespoke Investment Group.

If the pace of deals doesn’t quicken, we’re on track for just 78 total IPOs this year.

No doubt, many pundits will dismiss the May rebound as too little, too late. Why?

Because the infamous “summer doldrums” are bound to overtake the IPO market, as bankers and investors go on vacation.

Or so the reasoning goes, anyway.

But don’t be fooled into believing everything you read or hear in the coming days.

“The facts do not support this myth about Wall Street,” writes John E. Fitzgibbon, Jr. of IPOScoop.com.

According to his number-crunching, the IPO market is clearly “open for business” in the summer:

- Over the last 16 years, 27% of the 2,929 U.S. IPOs occurred during June, July, and August.

- During the summers of 2005 and 2015, 35% or more of the IPOs in those years came to market.

In other words, the “summer quarter” isn’t any slower for IPOs.

Rather, the historical averages indicate that it’s actually a slightly busier time. And in some years, like 2005 and 2015, it’s a much busier time.

And that’s why the timing of the Twilio news is so important…

The Next Big Step for the IPO Market

While Twilio’s IPO won’t single-handedly open the floodgates, it will influence how many other companies seek to go public this summer.

If the deal does well and the markets hold up, other companies are bound to move forward with IPO plans.

Heck, we’re already seeing Twilio’s positive impact.

In the wake of Twilio’s SEC filings, there are now rumblings that security software firm Blue Coat Systems is considering officially filing for an IPO.

If so, Blue Coat promises to carry even more influence on the IPO market than Twilio, as it would be a much bigger deal at a reported $500 million. By comparison, Twilio plans to raise up to $100 million.

Add it all up, and a strong debut for Twilio would lay the foundation for a summer of higher IPO activity. And a strong summer would set the stage for a strong second half of the year, too.

With that in mind, I’ll break down the prospects for Twilio’s IPO in my next column, based on my time-tested methodology. So stay tuned.