The world markets are moving upwards amid hopes for a trade truce between China and the US. An additional reason for optimism was the news that China was removed from the list of potential currency manipulators on the eve of the deal. There are also reports in the press about China’s promise to buy industrial and agricultural goods, energy and services for a total of $200 billion during the next two years.

These are very significant commitments, and many observers fear that China will be unduly burdened if there is no relief for exports, and this could be not very easy due to the yuan.

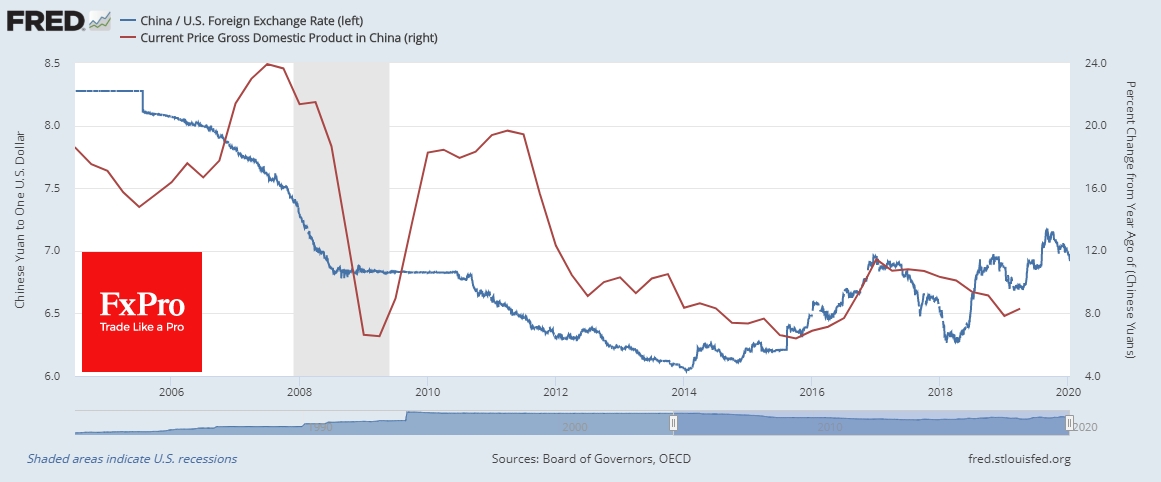

The Chinese yuan has been rising steadily against the greenback in recent months, reaching 6.88 against the dollar due to the news of progress in the trade negotiations, offsetting the weakening on the background of fears, when USD/CNH rose to 7.20. However, as many believe, the higher renminbi rate is part of the deal. And the big question is how far China should go in strengthening its exchange rate.

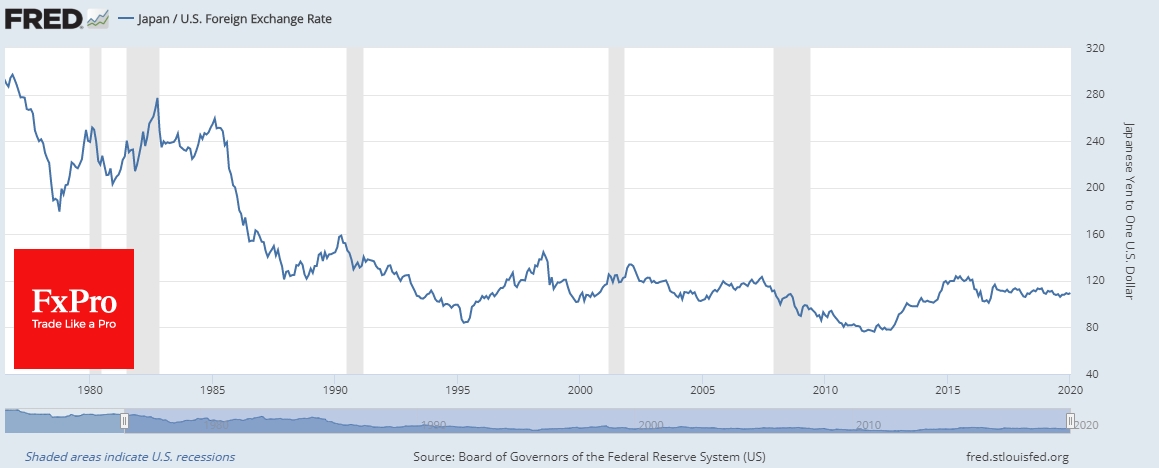

In the 1980s, Japan was at the place of China at the moment. The agreement of the world’s largest central banks of that time, the so-called Plaza Accord, gave rise to a robust and lasting trend of weakening the American currency to all its major competitors. But for Japan, it was comparable to economic suicide. The sharp currency appreciation turned Japan into a zombie-economy and turned the reaction of the currency market to the crisis upside down.

Now Japanese yen is snowballing during the economic downturn, which further undermines the export-oriented economy. We also see that the high exchange rate has collapsed inflation, which cannot be revived even by the ultra-soft monetary policy of the Central Bank.

However, then Japan was much more politically dependent on the US than China is now. This helps Chinese markets grow with the yuan, not to fall in response to its growth. Moreover, a positive backdrop, including an increase in mutual trade between the two largest economies and the appreciation of the Chinese currency, helps world markets to support risk demand, while waiting for further de-escalation of trade disputes.

In our opinion, it is worth watching closely the dynamics of the currency market, which may become an important indicator of future economic trends and set the tone of trading platforms. So far, we see a relatively cautious reaction of AUD/USD, which is considered as an indicator of Asian investors’ sentiment – the pair is still below 0.700, near the lows since 2009. Besides, EUR/USD is moving very cautiously inside the descending channel, staying away from a trade truce celebration. However, before that, it was delighted to playback the news from this front.

The FxPro Analyst Team