The Swiss franc has been making some solid gains against the US dollar over the past few weeks and despite its valiant efforts, the USD seems to be losing the fight. However, the positive sentiment generated by the release of the US Fed Beige Book may be the kick the dollar needs to claw back some ground. Already there has been some upside action as sentiment returns and the market swings back to the USD. Additionally, technical analysis could be signalling that the greenback still has some more ground to reclaim.

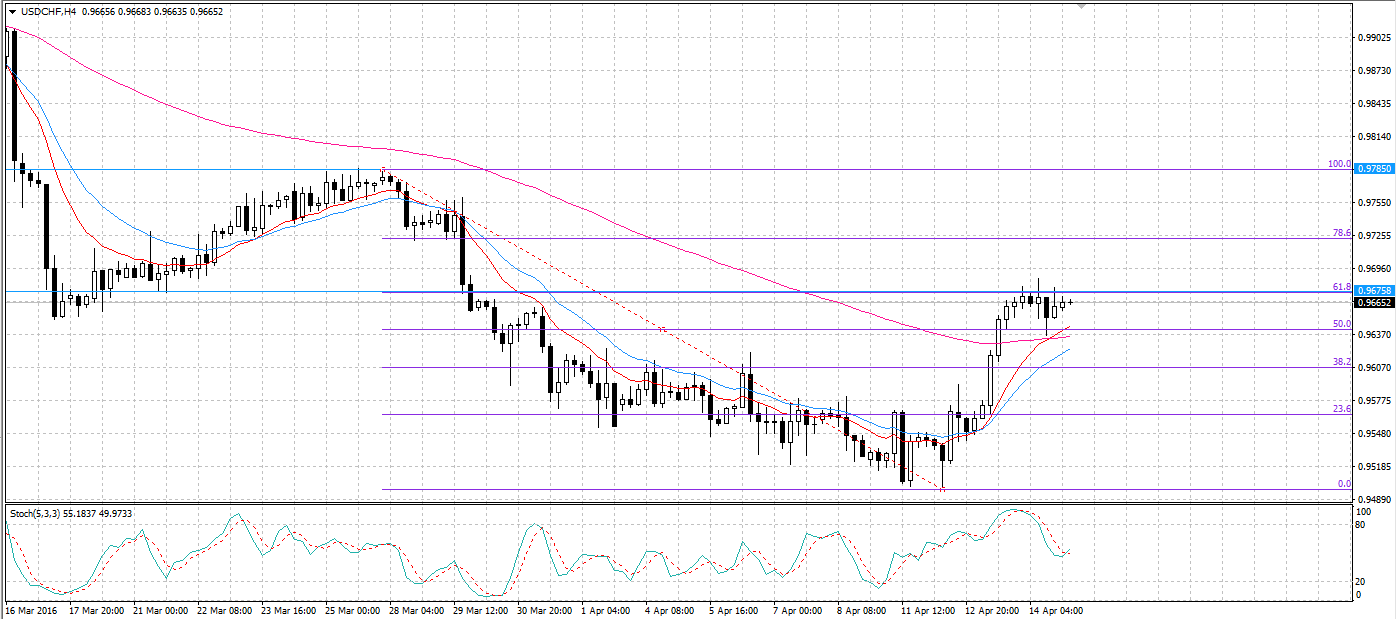

Firstly, Fibonacci retracement of the H4 chart shows the USD rally has found resistance but could still have room to move. As shown, the pair found resistance around the 61.8% Fibonacci retracement level at 0.9675. Additionally, the H4 stochastic oscillator is neutral which means the pair could go either way. However, the evidence would suggest that in the long run the pair will be more likely to see upside movement even if some retracements to the downside do occur in the short term. As a result, it is likely that resistance will be tested at 0.9785 in the near future while the 0.9502 support will remain unbroken.

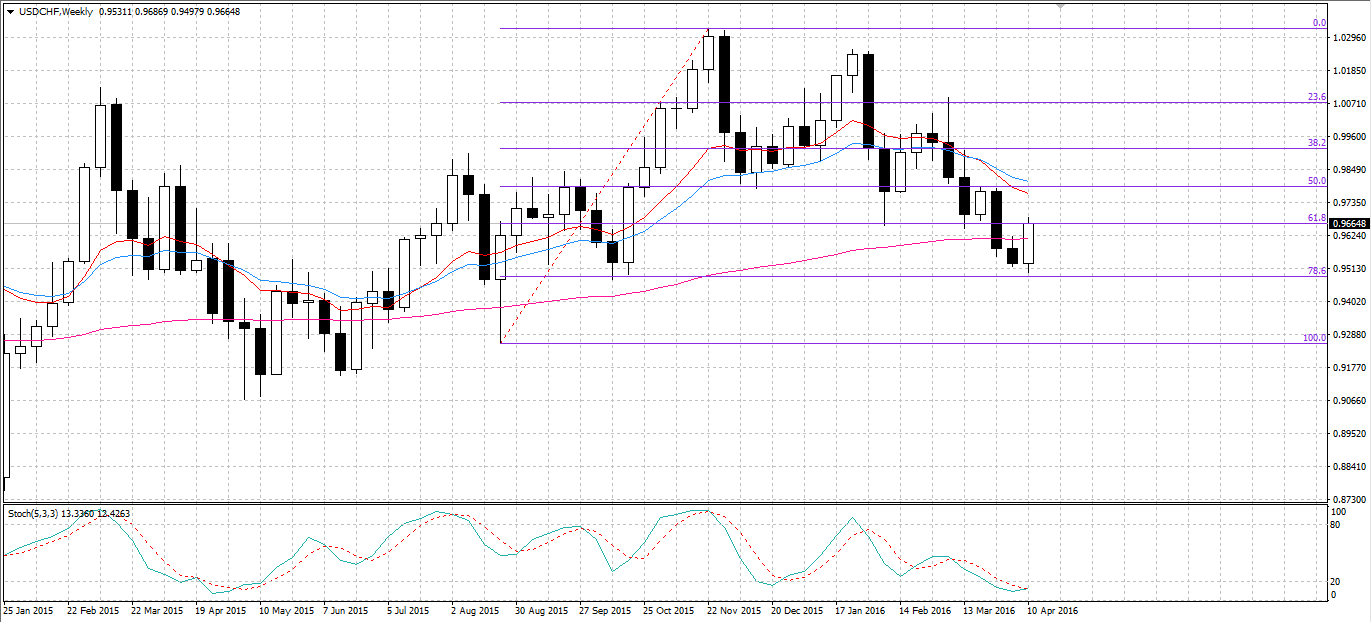

Looking at the weekly chart, it is evident that the recent low represents a long-term zone of support for the pair. Specifically, the support found at the 0.9502 mark represents a 78.6% Fibonacci retracement level. Even after moving above the recent low, the weekly stochastic oscillator is signalling that the USD/CHF is heavily oversold. As a result of this, buying pressure should begin to mount so long as no particularly damning US results are posted in the impending Friday announcements. Furthermore, the 100 period EMA is actually now crossing the 12 and 20 period EMA’s which could be signalling that a strong upturn is forming.

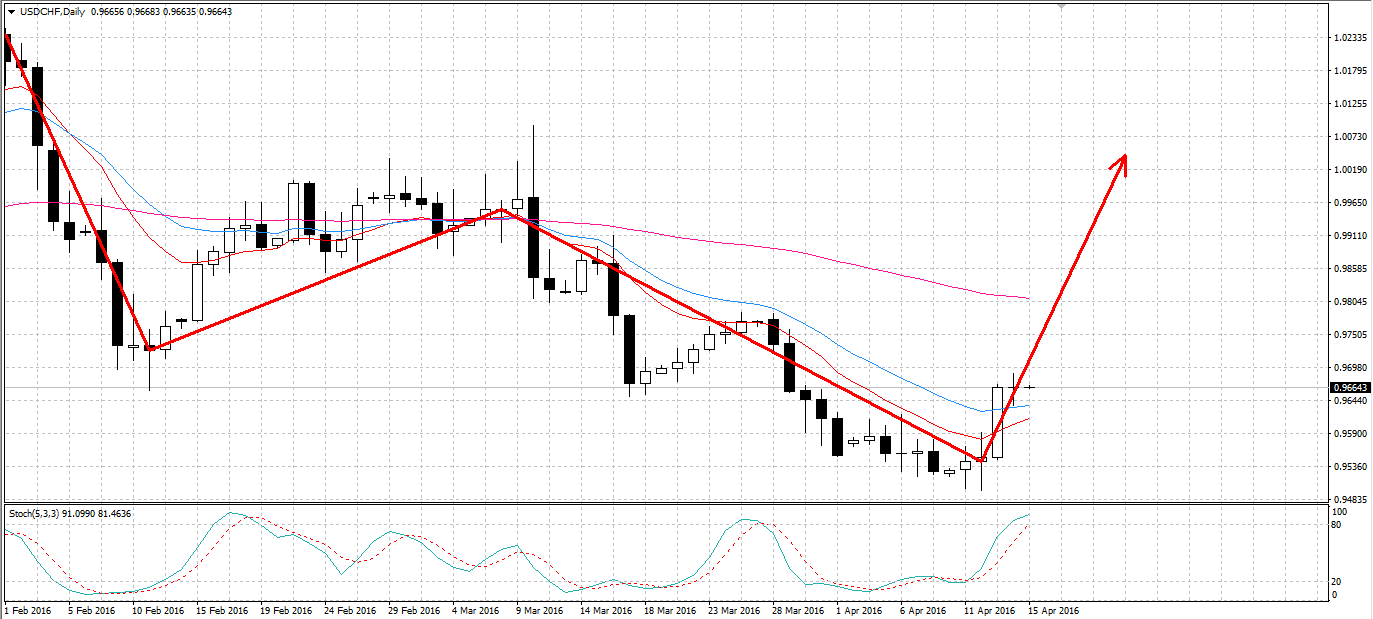

Additionally, Fibonacci retracement on the weekly chart confirms that the resistance at 0.9785 coincides with a 50.0% Fibonacci level. As a result, any upwards movement should encounter some fairly tough resistance at this point and the pair is unlikely to move far beyond here. However, a potential Zig-Zag pattern formation on the daily chart could generate some additional momentum which might in turn cause the pair to break resistance and have a go at parity.

Ultimately, a combination of technical indicators is signalling that this pair could climb higher in the near future. However, with a slew of important US fundamental indicators being released today, there remains a high chance of another strong sentiment swing dropping the pair back to 0.9502 in the short term.

by Matthew Ashley