The Japanese yen has had a dismal year, losing as much as 25% against the US dollar. In October, the ailing Japanese yen fell below the 150 level and there was increasing talk of Tokyo implementing another currency intervention to save the currency. A strong turnaround in November by the yen has put intervention talk on the back-burner, but the currency still claims the ignominious title of the world’s worst-performing major currency in 2022.

Could we be close to a peak in yen weakness to the dollar? The Bank of Japan has rigorously maintained its ultra-accommodative policy, and the cap on JGBs has been a major contributor to the yen’s slide. The changing of the guard at the BoJ, with Governor Kuroda retiring after a decade at the helm, could result in some fresh thinking at the top, perhaps in the form of a policy tweak.

As well, market expectations that the Fed is poised to slow its pace of rate hikes have helped the yen improve in recent weeks. Inflation has been creeping higher in Japan, although it has been much lower than the red-hot levels we are seeing in other major economies. If inflation hits the BoJ’s target of 2%, the BoJ could respond by raising rates, which would be a seismic change in policy. This would require much stronger wage growth, but clearly the conversation has begun to change after decades of deflation, and the yen stands to benefit if the BoJ makes any changes in its ultra-loose policy.

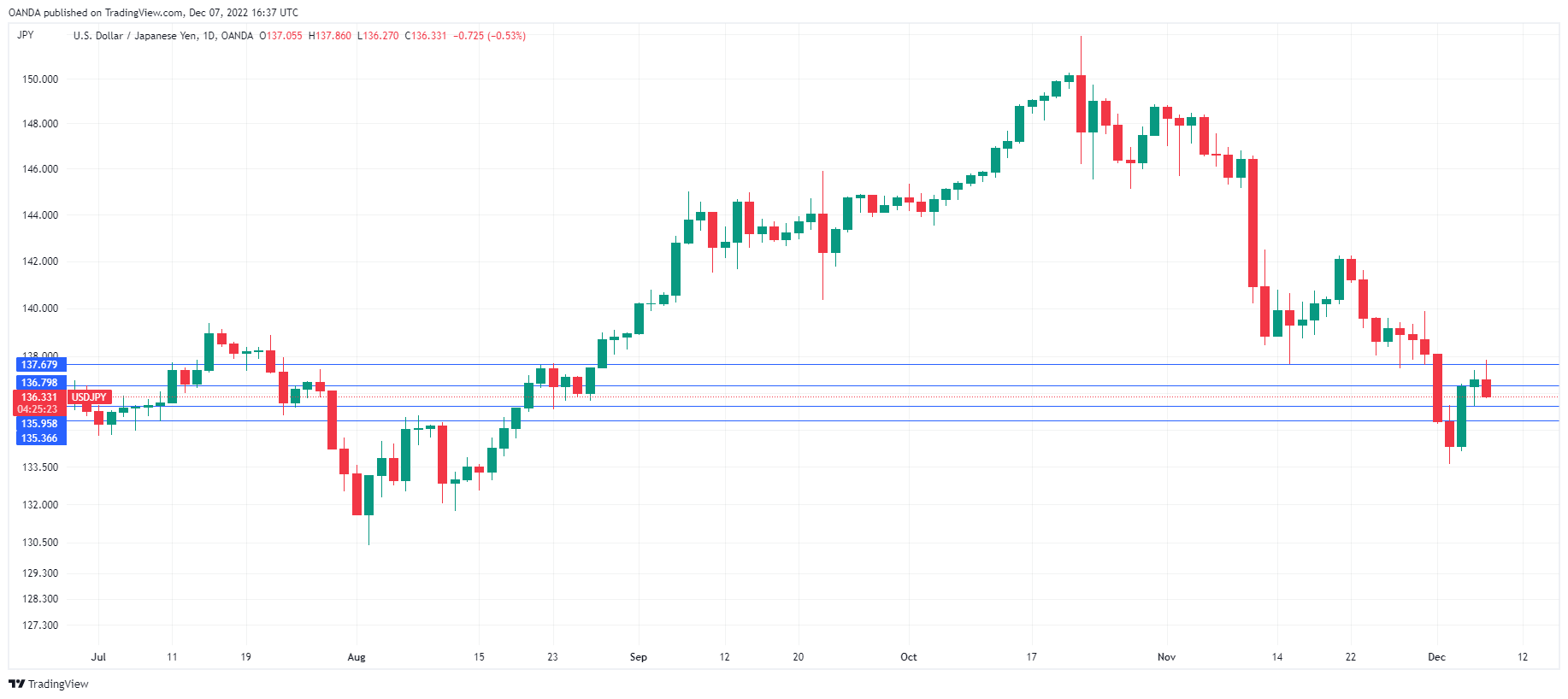

USD/JPY Technical

- USD/JPY faces resistance at 1.3681 and 1.3766

- There is support at 1.3596 and 1.3535