I’ve been amazed at the ineptitude of the European leaders. Not just the political ones. The actions and statements by the ECB have been counterproductive. The ECB has directly contributed to the instability. The Banque de France and Bundesbank have added very little. The Finance Ministries have been worse. Where's the leadership? Are these people all idiots?

Actually, I don’t think they are. If that were the case, then how could you explain the bumbling? One possible answer is that it’s deliberate. That sounds conspiratorial. I think there is some evidence of that.

In my opinion the explosion that occurred over the past fortnight in Italian bonds could have been avoided. All it would have taken to contain the fear factor was for the ECB to have stepped into the market in a forceful manner and suck up the supply of bonds. When they failed to defend the market it led to widening spreads, which in turn lead to more sellers and finally margin increases and a crisis.

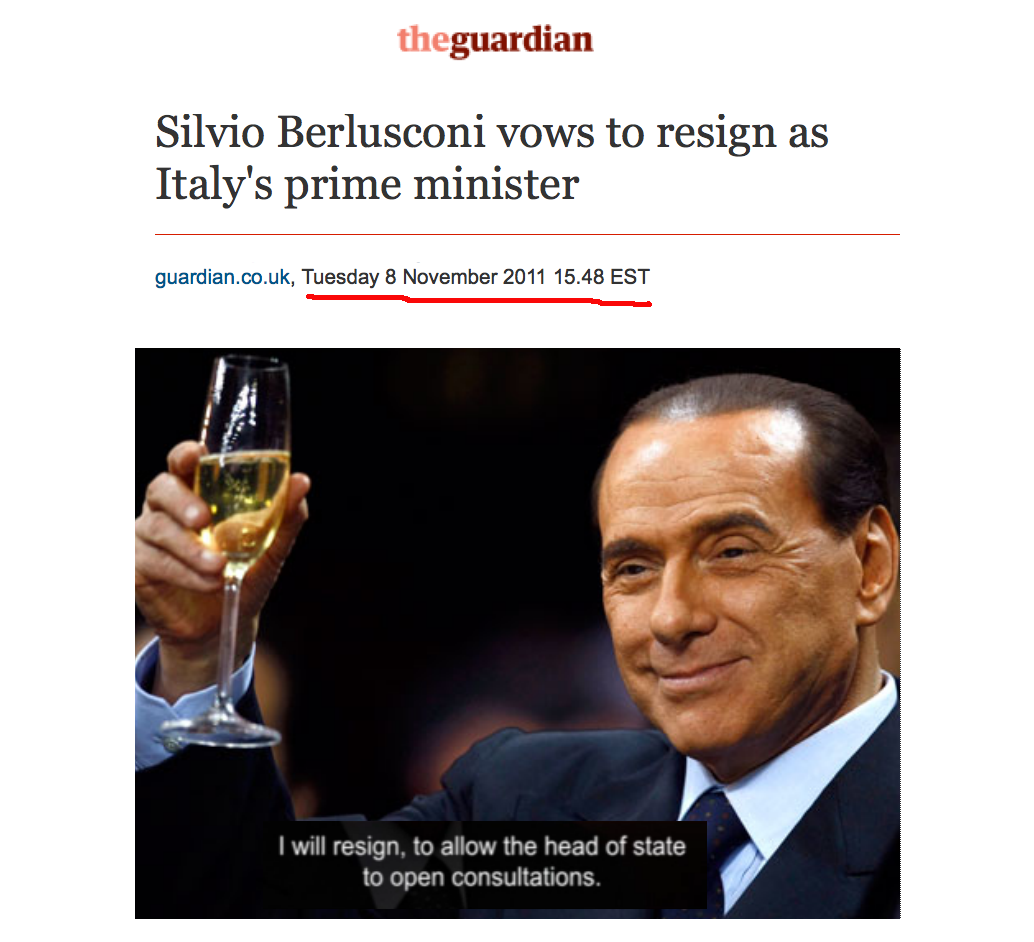

The market knew that there were milestones in spread levels that would automatically bring more selling. The ECB was also well aware of this. (Don't believe these folks are dumb, they're not) But they ignored it and day-by-day the pressure grew. After 6.75% was broached, it led to a quick collapse. It ended with Berlusconi resigning. The panic in the bond market ended the next day.

It’s been suggested in a number of publications that the ECB had a hand in the Italian blow out. As of yet there has been no comments from the government(s) involved nor the ECB.

The following is a close up of a chart created by Zero Hedge. This segment looks at November 8 through 11. The green circles are the timing of ECB interventions (note market reactions).

Notice that there was no intervention on November 8th. As a consequence, Italian 10-year bond yields went soaring past 7%. The consequence? That night Berlusconi was forced to throw in the towel. The next day the ECB initiated aggressive intervention. The lack of intervention on the 8th followed by the steady buying on the 9th, 10th and 11th was not an accident. It was a policy decision.

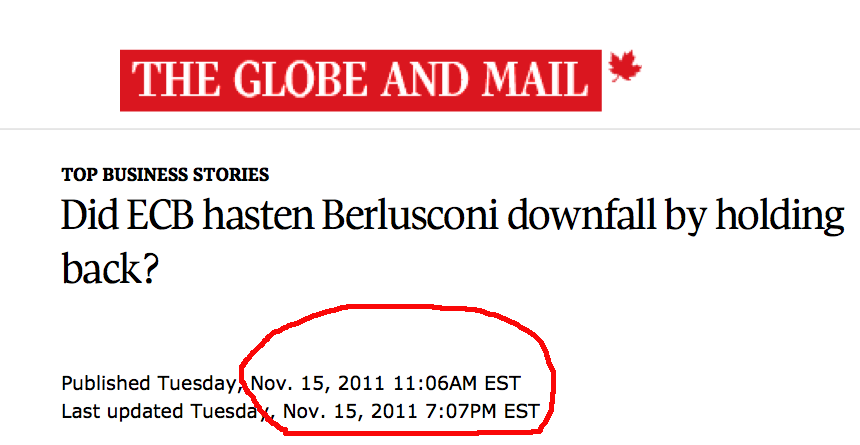

The following headline had it both right and wrong. The bond market did do Berlusconi in. But it was the ECB, behind the scenes, that engineered it so that it would happen.

To believe in the conspiracy concept, (the one where central banks determine the fate of political leaders) you have to ask/answer the critical question of:

Why in hell would “they” do that?

I was going through some German periodicals. I saw this ad for a brandy distiller. In English it reads:

Everything should go well for all!

Yes, things should be even better! Everyone should be able to work without worrying. All should be able to afford to travel, to fill their homes with beautiful things and to fulfill the heart's desires, both large and small.

That is what Germany wants! For itself and for all of the countries in Europe. Together, we will work to secure and raise the standard of living!

The ad is from 1940. The last line reads:

That is what Germany is fighting for. And only a German victory will realize the goal of a European economic community.

It does make you think. Are they manipulators or just bumblers?

Actually, I don’t think they are. If that were the case, then how could you explain the bumbling? One possible answer is that it’s deliberate. That sounds conspiratorial. I think there is some evidence of that.

In my opinion the explosion that occurred over the past fortnight in Italian bonds could have been avoided. All it would have taken to contain the fear factor was for the ECB to have stepped into the market in a forceful manner and suck up the supply of bonds. When they failed to defend the market it led to widening spreads, which in turn lead to more sellers and finally margin increases and a crisis.

The market knew that there were milestones in spread levels that would automatically bring more selling. The ECB was also well aware of this. (Don't believe these folks are dumb, they're not) But they ignored it and day-by-day the pressure grew. After 6.75% was broached, it led to a quick collapse. It ended with Berlusconi resigning. The panic in the bond market ended the next day.

It’s been suggested in a number of publications that the ECB had a hand in the Italian blow out. As of yet there has been no comments from the government(s) involved nor the ECB.

The following is a close up of a chart created by Zero Hedge. This segment looks at November 8 through 11. The green circles are the timing of ECB interventions (note market reactions).

Notice that there was no intervention on November 8th. As a consequence, Italian 10-year bond yields went soaring past 7%. The consequence? That night Berlusconi was forced to throw in the towel. The next day the ECB initiated aggressive intervention. The lack of intervention on the 8th followed by the steady buying on the 9th, 10th and 11th was not an accident. It was a policy decision.

The following headline had it both right and wrong. The bond market did do Berlusconi in. But it was the ECB, behind the scenes, that engineered it so that it would happen.

To believe in the conspiracy concept, (the one where central banks determine the fate of political leaders) you have to ask/answer the critical question of:

Why in hell would “they” do that?

I was going through some German periodicals. I saw this ad for a brandy distiller. In English it reads:

Everything should go well for all!

Yes, things should be even better! Everyone should be able to work without worrying. All should be able to afford to travel, to fill their homes with beautiful things and to fulfill the heart's desires, both large and small.

That is what Germany wants! For itself and for all of the countries in Europe. Together, we will work to secure and raise the standard of living!

The ad is from 1940. The last line reads:

That is what Germany is fighting for. And only a German victory will realize the goal of a European economic community.

It does make you think. Are they manipulators or just bumblers?