Gold is falling fast, having lost about 3% to $1940 from Monday's peak. On Monday, the bulls are locally capitulating after an unsuccessful attempt to push the price above $2000.

It would be a mistake to attribute gold's fall to an expensive dollar. Since the start of the year, the dollar index and gold have had a more than 80% correlation versus -0.34% in 2021, reflecting that investors see gold and the dollar as defensive assets amid the Russia-Ukraine conflict.

Yesterday the dollar index slowed its rise towards the end of the day. It reversed to a decline on Wednesday morning, while gold has been actively declining since the beginning of the week, reinforcing their close correlation.

Gold's recent retreat could be a sign of hope for a détente in the European conflict and a desire to lock in profits from the powerful movement of recent days. As it is difficult to find signs of de-escalation in the news, we are leaning towards the second option.

With EUR/USD near 1.08, GBP/USD near 1.30 and USD/JPY one step away from 130, the dollar is near historical extremes. The same can be seen in the Dollar Index, which since last week has been trading above 100, a psychologically crucial round level.

Since the beginning of February, gold has found support on the declines toward its 50-day moving average in the last rally. If a test of this level in the coming days also confirms the resilience of this support, we could see a new high soon.

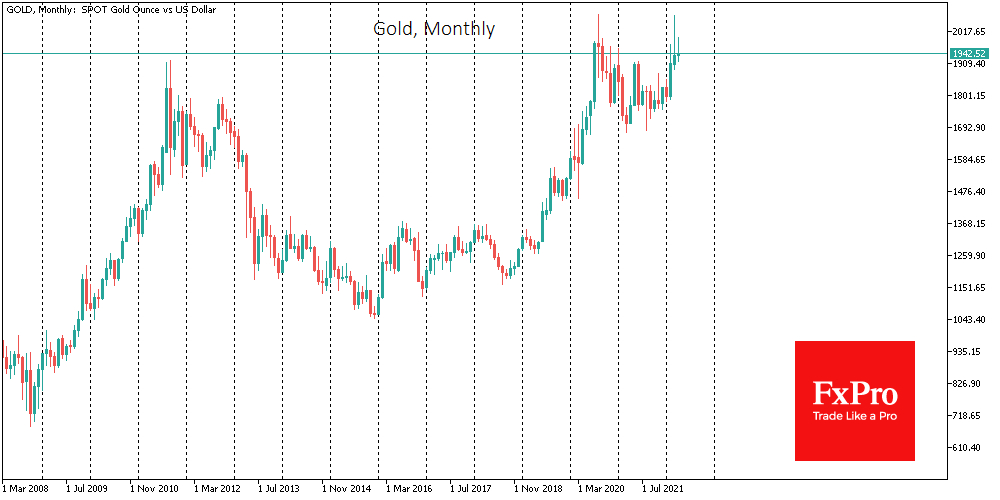

On the long-term gold chart, the pullback from the highs in 2020 and the subsequent smooth recovery is a handle in a "cup-and-handle" pattern, whereby a cup has formed over eight years since 2012. This pattern will gain strength should gold consolidate above $2000 with a final target near $3000.