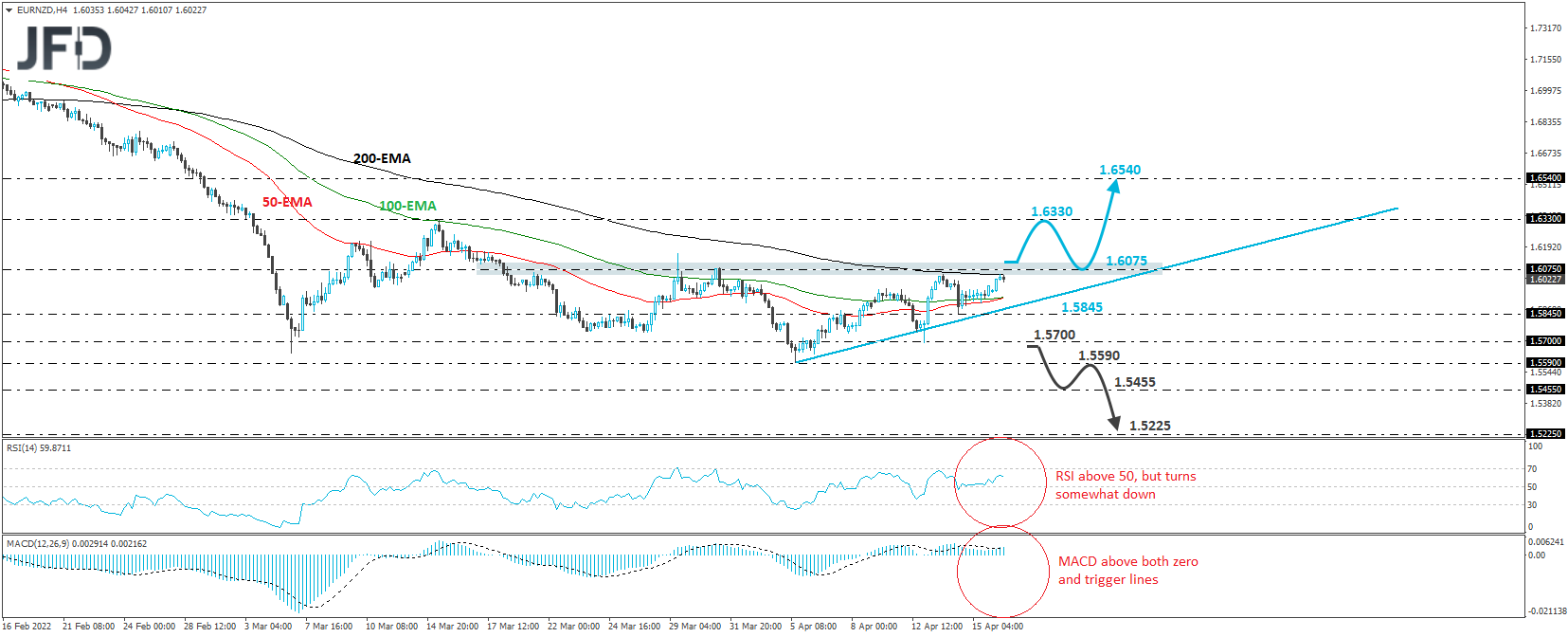

EUR/NZD traded slightly higher on Friday after hitting support at the 1.5845 barrier. However, although the advance continued somewhat today, it remained limited near the 200-EMA and the 1.6075 key resistance zone, which stopped the rate from drifting further north on Thursday and back on Mar. 31.

Thus, although we can draw a very short-term upside support line from the low of April 5th, we prefer to wait for a break above 1.6075 before becoming confident in further advances. Such a break will confirm a forthcoming higher high on the 4-hour chart and pave the way towards the 1.6330 zone marked by the high of Mar. 15.

The bulls may take a break after testing that zone, thereby allowing the rate to correct lower. However, suppose they are willing to recharge from near the upside line taken from the low of Apr. 5. In that case, we expect the forthcoming positive wave to overcome the 1.6330 zone and perhaps extend towards the 1.6540 territory, defined as resistance by the inside swing low of Jan. 5.

Our short-term oscillators see that the RSI is above 50 but has just ticked down, while the MACD stands slightly above both its zero and trigger lines. Both indicators detect positive speed, supporting further advances, but the fact that the RSI ticked down makes us careful that a small retreat may be on the cards before the next leg north.

To start examining the bearish case, we would like to see a clear dip below 1.5700, marked by the low of Apr. 13. The rate will already be below the upside line taken from the low of Apr. 5, and the bears may initially target the low of Apr. 5, at 1.5590.

Another break, below 1.5590, would confirm a forthcoming lower low on the daily chart and perhaps aim for the 1.5455 zone, defined as a support by the low of July 13th, 2017. Another break, below 1.5455, could carry larger bearish implications, perhaps paving the way towards the low of Jun. 27, 2017, at 1.5225.