Oil prices are going up because the largest members of the OPEC+ cartel are facing a shortage. The US has increased its production since August without increasing the number of drilling rigs, only boosting output from existing ones. These conditions offer a positive outlook for the market, although there are signs of local overheating of prices.

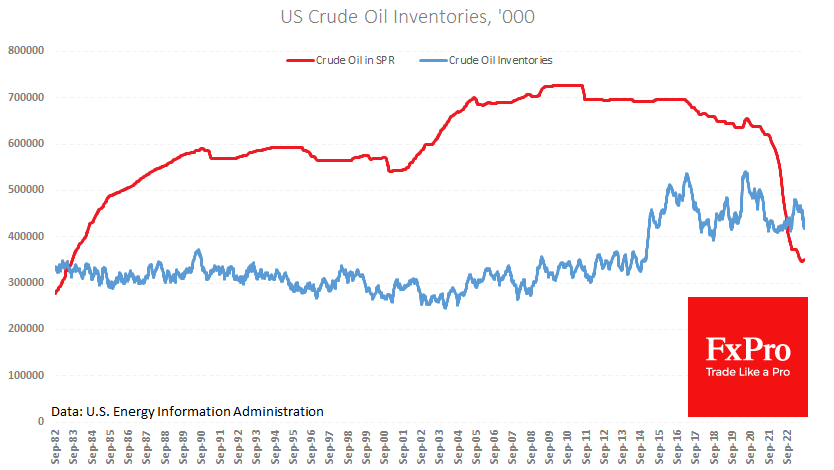

Last week, commercial crude oil inventories increased by 5.56 million barrels, 2.1% below the level from a year ago. WTI crude oil prices are roughly the same as a year ago, and their increase in August was the main contributor to inflation rise.

Formally, the current situation is similar to last year. However, having mostly the same input conditions this time last year, the US presidential administration was selling SPR with the fastest speed. The strategic reserve has been restocked in the past week with 0.29 million barrels. Officials have not mentioned further selling of assets because they are currently at their lowest point in 40 years.

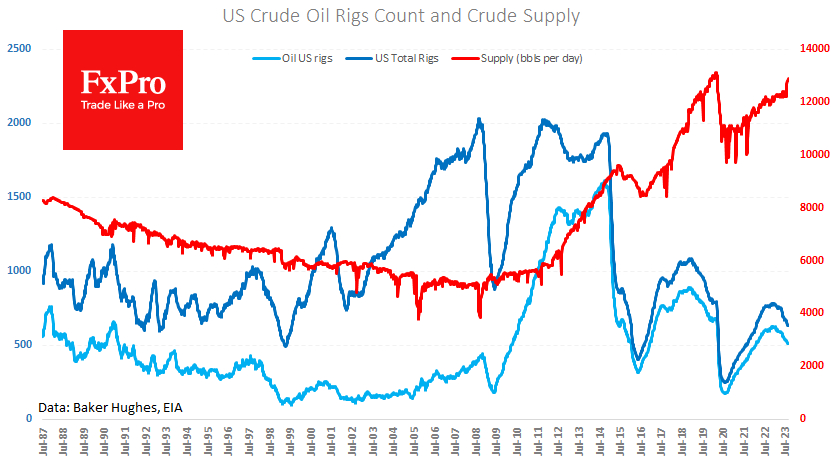

Last week, the daily average production rose to 12.9 million barrels, up from the previous three weeks' average of 12.8 million. In the first seven months of this year, production was consistently at 12.2 million barrels. Surprisingly, since the beginning of the year, US companies have decreased their drilling activities. The most recent data shows that the number of oil drillers was only 513, an 18% decrease from the peak of 627 in December last year.

What a change from the scenario we saw after 2009, with almost 10-fold growth within the following five years. From our point of view, drilling activity correlates with interest rates. Also, the Fed guarantees that this factor will continue to be in effect for a long time, which unintentionally leads to favorable situations for oil by reducing supply.

The technical chart backs up the bullish view on oil. The dip in the latter part of August allowed for another push, which is where we are currently. Long-term moving averages (MA) favor the bullish outlook. The potential target is $95 per barrel WTI, with a 161.8% Fibonacci retracement from June's end to August's peak.

The weekly timeframes show solid backing in nearing the 200-week MA. Recently, the 50-week MA initiated a fresh buying wave after a correction occurred at the end of last month.

Daily timeframes encountered the "golden cross" pattern during this period, which previously took place in oil in September 2020 and spurred a threefold price increase in the next one and a half years. It's unlikely for this level of intensity to reoccur, but the power and significance of the signal shouldn't be underestimated.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Could Crude Oil Reach $95 Soon?

Published 09/14/2023, 09:25 AM

Updated 03/21/2024, 07:45 AM

Could Crude Oil Reach $95 Soon?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.