Analysts at Citigroup (NYSE:C). began coverage on shares of Cotiviti Holdings (NYSE:COTV) in a note issued to investors on Thursday, The Fly reports. The firm set a "market perform" rating on the stock.

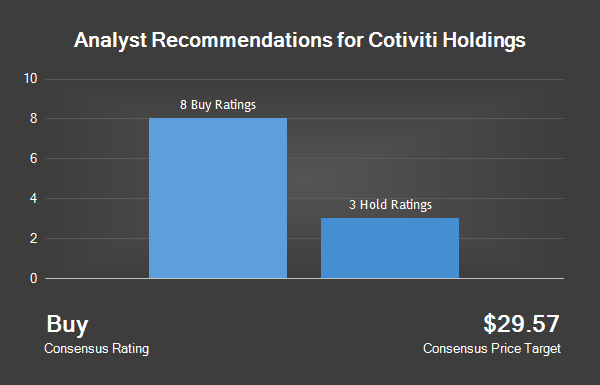

Several other research analysts have also recently issued reports on COTV. Barclays (LON:BARC) PLC set a $36.00 price objective on Cotiviti Holdings and gave the stock a "buy" rating in a research note on Thursday, November 10th. Zacks Investment Research cut Cotiviti Holdings from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, January 10th. Goldman Sachs Group (NYSE:GS) cut Cotiviti Holdings from a "buy" rating to a "neutral" rating and set a $35.00 price objective for the company. in a research note on Friday, January 20th. Finally, William Blair restated an "outperform" rating on shares of Cotiviti Holdings in a research note on Thursday, February 23rd. Four investment analysts have rated the stock with a hold rating and eight have issued a buy rating to the stock. Cotiviti Holdings currently has a consensus rating of "Buy" and a consensus target price of $30.50.

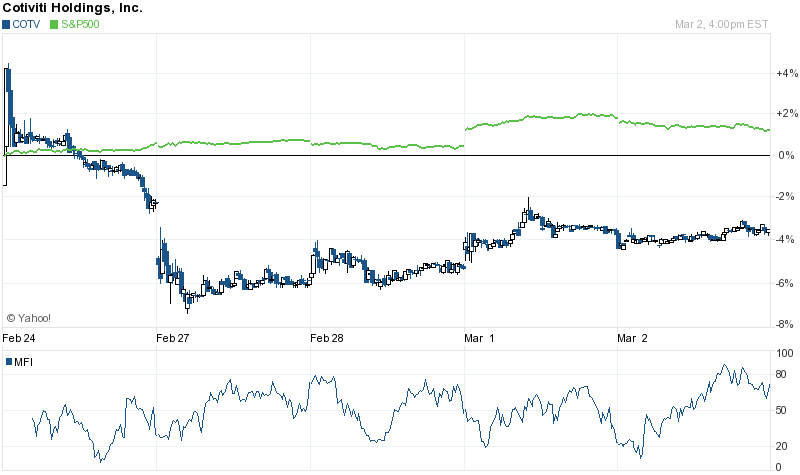

Cotiviti Holdings traded up 0.52% on Thursday, reaching $38.31. The company's stock had a trading volume of 196,908 shares. Cotiviti Holdings has a 12-month low of $17.00 and a 12-month high of $41.38. The firm has a 50-day moving average of $35.52 and a 200 day moving average of $33.42. The company has a market capitalization of $3.48 billion and a price-to-earnings ratio of 69.65.

Cotiviti Holdings last announced its quarterly earnings data on Wednesday, February 22nd. The company reported $0.39 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.34 by $0.05. The firm earned $167.90 million during the quarter, compared to analysts' expectations of $161.40 million. During the same quarter in the previous year, the business earned $0.32 earnings per share. The company's revenue for the quarter was up 10.8% compared to the same quarter last year. On average, equities research analysts anticipate that Cotiviti Holdings will post $1.51 EPS for the current fiscal year.

This report was first posted by [[site]] and is the property of of [[site]]. If you are viewing this report on another website, it was copied illegally and republished in violation of U.S. & international copyright & trademark laws. The legal version of this report can be viewed at [[permalink]].

In other Cotiviti Holdings news, Director Douglas Present sold 50,000 shares of the firm's stock in a transaction that occurred on Tuesday, January 17th. The stock was sold at an average price of $34.16, for a total value of $1,708,000.00. Following the sale, the director now directly owns 18,544 shares of the company's stock, valued at $633,463.04. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Also, SVP Jonathan Olefson sold 5,000 shares of the firm's stock in a transaction that occurred on Thursday, February 9th. The shares were sold at an average price of $36.00, for a total value of $180,000.00. Following the completion of the sale, the senior vice president now directly owns 5,000 shares in the company, valued at $180,000. The disclosure for this sale can be found here. Over the last three months, insiders sold 74,527 shares of company stock worth $2,620,016.

A number of hedge funds have recently modified their holdings of the stock. Prudential Financial (NYSE:PRU) raised its stake in shares of Cotiviti Holdings by 126.2% in the third quarter. Prudential Financial Inc. now owns 125,516 shares of the company's stock valued at $4,209,000 after buying an additional 70,016 shares during the last quarter. JPMorgan Chase (NYSE:JPM). raised its stake in shares of Cotiviti Holdings by 31.3% in the third quarter. JPMorgan Chase & Co. now owns 1,108,517 shares of the company's stock valued at $37,169,000 after buying an additional 264,118 shares during the last quarter. PNC Financial Services Group (NYSE:PNC). acquired a new stake in shares of Cotiviti Holdings during the third quarter valued at approximately $2,039,000. Her Majesty the Queen in Right of the Province of Alberta as represented by Alberta Investment Management Corp acquired a new stake in shares of Cotiviti Holdings during the third quarter valued at approximately $1,131,000. Finally, Peregrine Capital Management acquired a new stake in shares of Cotiviti Holdings during the third quarter valued at approximately $10,314,000.

About Cotiviti Holdings

Cotiviti Holdings, Inc is a provider of analytics-driven payment accuracy solutions. The Company is focused primarily on the healthcare sector. The Company operates through two segments: Healthcare, and Global Retail and Other. Through its Healthcare segment, the Company offers prospective and retrospective claims accuracy solutions to healthcare payers in the United States.