Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday, Jan. 11, 2022, and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets. All currency positions are in direct relation to the US dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar. In contrast, a bet against the euro will be that the euro will decline versus the dollar.

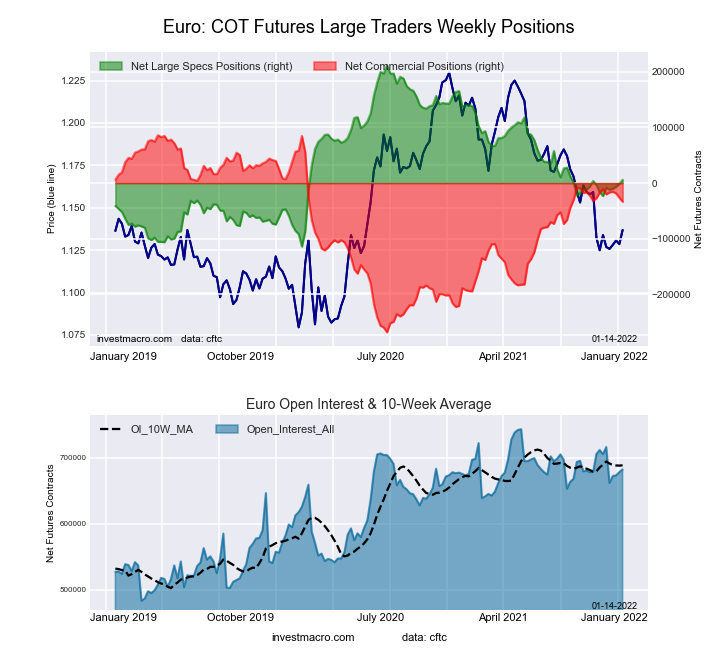

Highlighting the COT currency data bounces back into bullish territory for the euro in the currency futures contracts. Euro speculators boosted their bets for a fourth consecutive week and brought the overall speculator position into its first bullish standing in the past nine weeks (the current net position is now +6,005 contracts).

Euro bets had spent from March 2020 through September 2021 in bullish territory, with the Euro price reaching as high as 1.2350 before faltering. Speculator bets dropped into bearish territory in October as the euro was in the middle of a downtrend that reached a low of approximately 1.12 on Nov. 24.

Since then, the euro has climbed above 1.14, and the speculator positions have tipped their toes back into bullish territory. Could a bullish trend change follow?

Joining the Euro (7,559 contracts) with positive changes this week were the Swiss franc (1,869 contracts), British pound sterling (10,005 contracts), New Zealand dollar (241 contracts), Canadian dollar (3,649 contracts), Russian ruble (2,288 contracts), Bitcoin (227 contracts) and the Mexican peso (5,039 contracts).

The currencies with declining bets were the US Dollar Index (-1,186 contracts), yen (-25,263 contracts), Australian dollar (-2,120 contracts) and the Brazil real (-9,736 contracts).

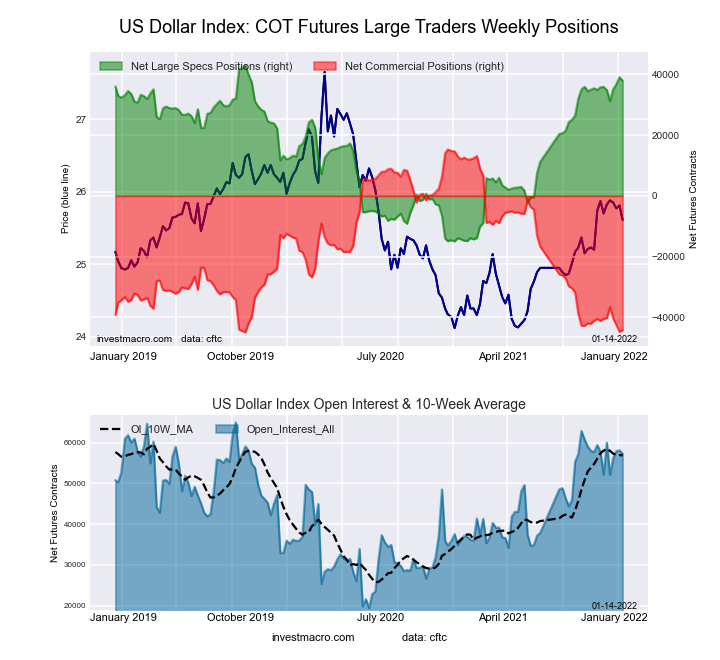

US Dollar Index Futures

The US Dollar Index large speculator standing this week resulted in a net position of 37,892 contracts in the data reported through Tuesday. This was a weekly decrease of -1,186 contracts from the previous week, which had a total of 39,078 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 91.1 percent. The commercials are Bearish-Extreme with a score of 1.2 percent, and the small traders (not shown in chart) are Bullish-Extreme with a score of 84.9 percent.

Euro Currency Futures

The euro currency large speculator standing this week resulted in a net position of 6,005 contracts in the data reported through Tuesday. This was a weekly gain of 7,559 contracts from the previous week, which had a total of -1,554 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 36.8 percent. The commercials are Bullish with a score of 66.3 percent, and the small traders (not shown in chart) are Bearish-Extreme with a score of 19.8 percent.

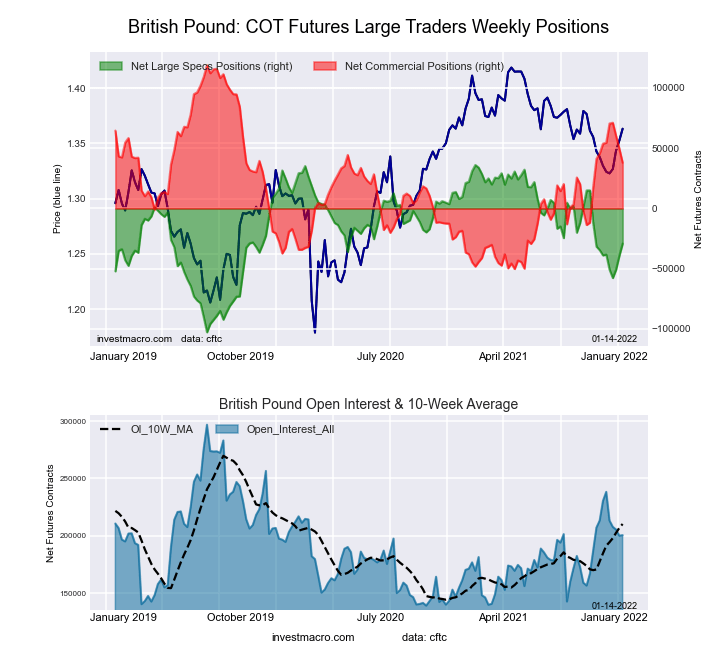

British Pound Sterling Futures

The British Pound Sterling large speculator standing this week resulted in a net position of -29,166 contracts in the data reported through Tuesday. This was a weekly rise of 10,005 contracts from the previous week, which had a total of -39,171 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 53.0 percent. The commercials are Bullish with a score of 52.2 percent, and the small traders (not shown in the chart) are Bearish with a score of 37.3 percent.

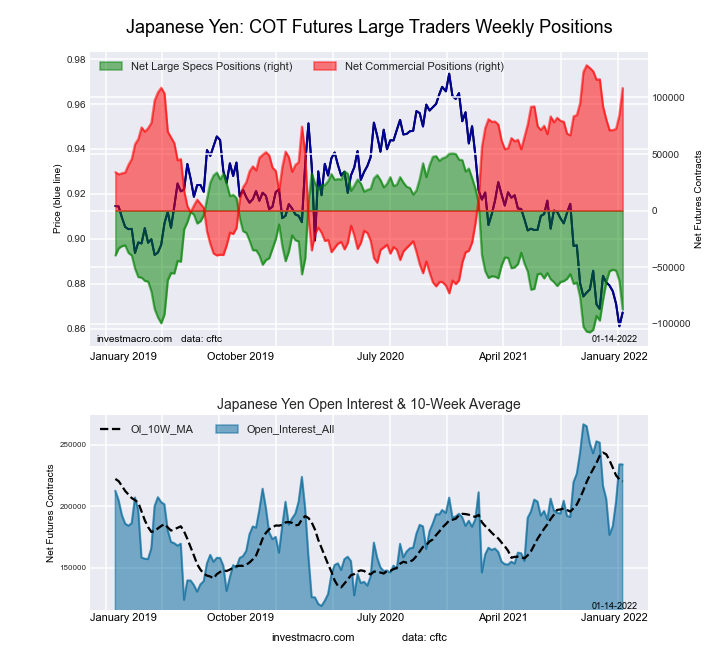

Japanese Yen Futures

The Japanese Yen large speculator standing this week resulted in a net position of -87,525 contracts in the data reported through Tuesday. This was a weekly fall of -25,263 contracts from the previous week, which had a total of -62,262 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 12.7 percent. The commercials are Bullish-Extreme with a score of 90.0 percent, and the small traders (not shown in the chart) are Bearish-Extreme with a score of 4.6 percent.

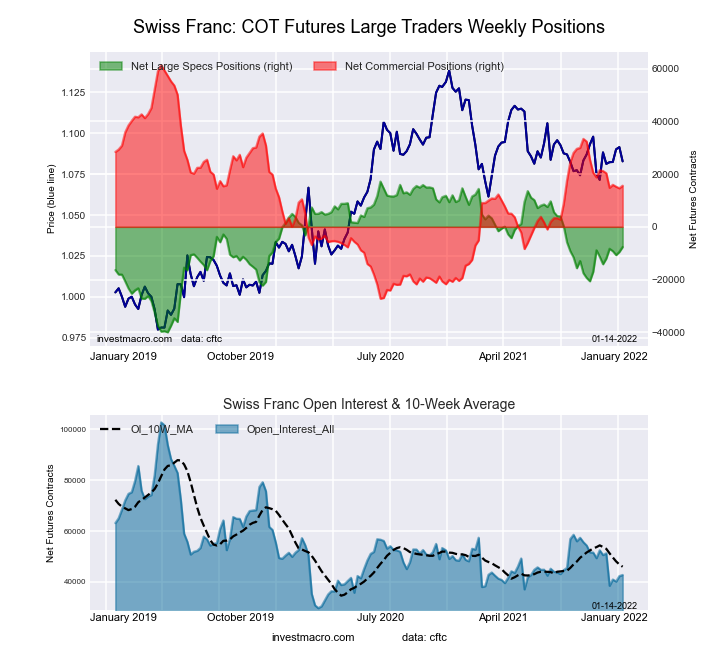

Swiss Franc Futures

The Swiss Franc large speculator standing this week resulted in a net position of -7,660 contracts in the data reported through Tuesday. This was a weekly rise of 1,869 contracts from the previous week, which had a total of -9,529 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 56.6 percent. The commercials are Bearish with a score of 48.4 percent, and the small traders (not shown in the chart) are Bearish with a score of 40.0 percent.

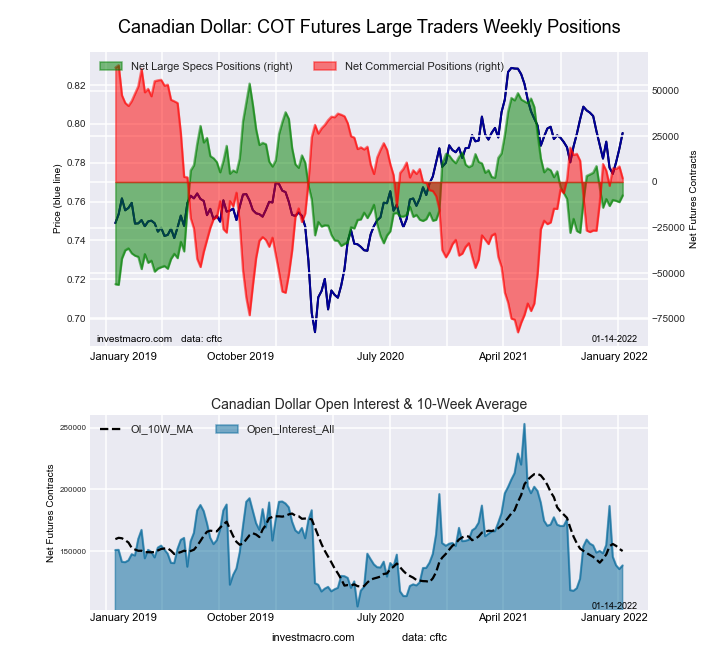

Canadian Dollar Futures

The Canadian Dollar large speculator standing this week resulted in a net position of -7,376 contracts in the data reported through Tuesday. This was a weekly gain of 3,649 contracts from the previous week, which had a total of -11,025 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 44.4 percent. The commercials are Bullish with a score of 57.6 percent, and the small traders (not shown in the chart) are Bearish with a score of 40.5 percent.

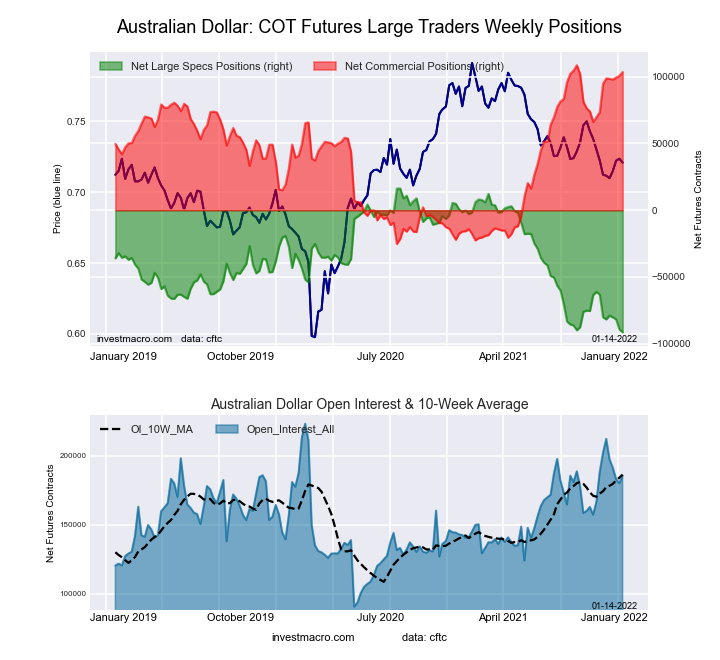

Australian Dollar Futures

The Australian Dollar large speculator standing this week resulted in a net position of -91,486 contracts in the data reported through Tuesday. This was a weekly fall of -2,120 contracts from the previous week, which had a total of -89,366 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 0.0 percent. The commercials are Bullish-Extreme with a score of 96.2 percent, and the small traders (not shown in the chart) are Bearish with a score of 22.9 percent.

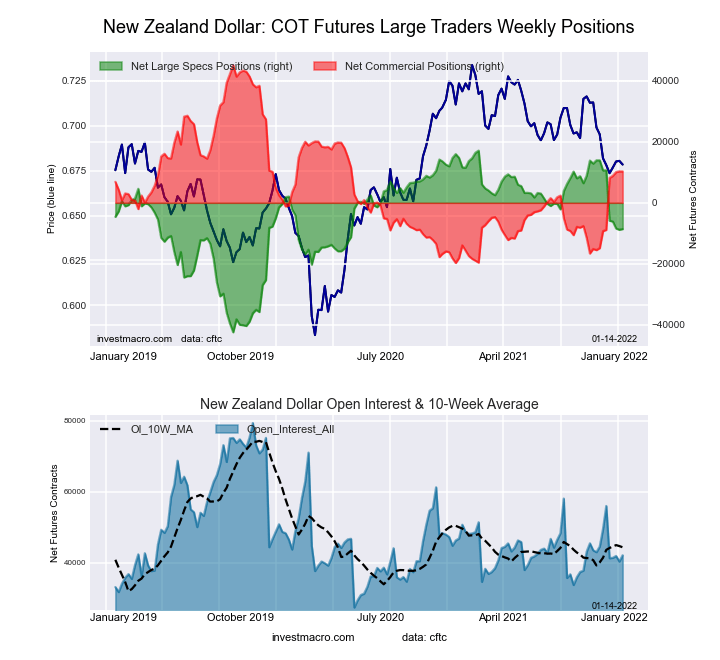

New Zealand Dollar Futures

The New Zealand Dollar large speculator standing this week resulted in a net position of -8,604 contracts in the data reported through Tuesday. This was a weekly increase of 241 contracts from the previous week, which had a total of -8,845 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 56.8 percent. The commercials are Bearish with a score of 46.3 percent, and the small traders (not shown in the chart) are Bearish with a score of 32.4 percent.

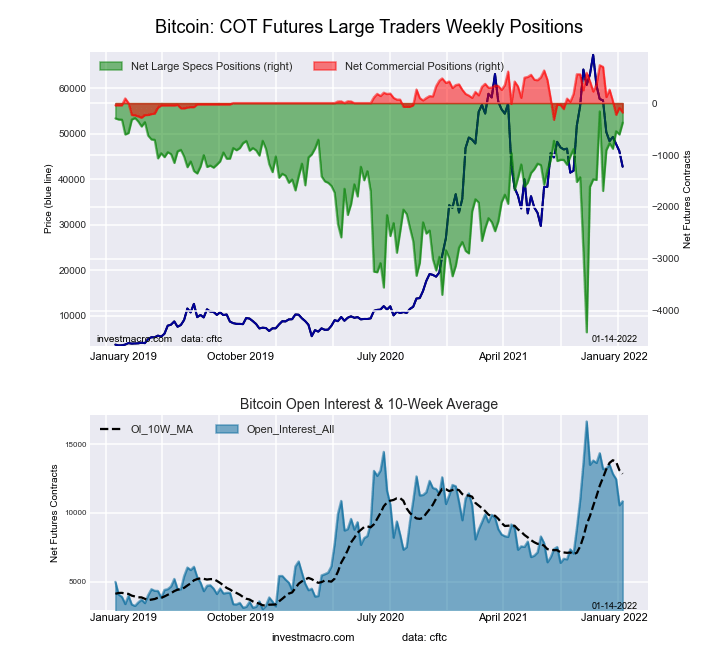

Bitcoin Futures

The Bitcoin speculator standing this week resulted in a net position of -377 contracts in the data reported through Tuesday. This was a weekly boost of 227 contracts from the previous week, which had a total of -604 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 94.9 percent. The commercials are Bearish-Extreme with a score of 13.2 percent, and the small traders (not shown in the chart) are Bearish with a score of 25.6 percent.