Here are the latest charts and statistics for the Commitment of Traders (COT) data published by the Commodities Futures Trading Commission (CFTC).

The latest COT data is updated through Tuesday, Jan. 18, and shows a quick view of how large traders (for-profit speculators and commercial entities) were positioned in the futures markets. All currency positions are in direct relation to the US Dollar where, for example, a bet for the euro is a bet that the euro will rise versus the dollar. In contrast, a bet against the euro will be that the euro will decline versus the dollar.

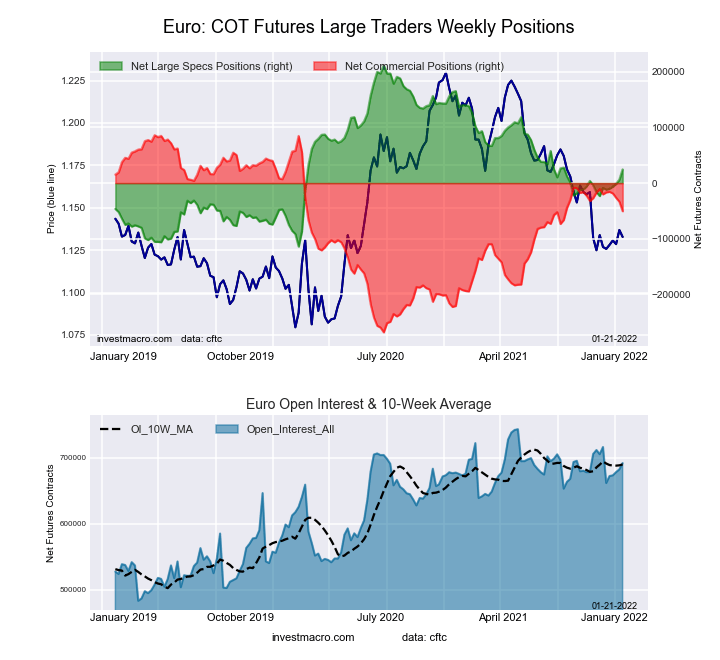

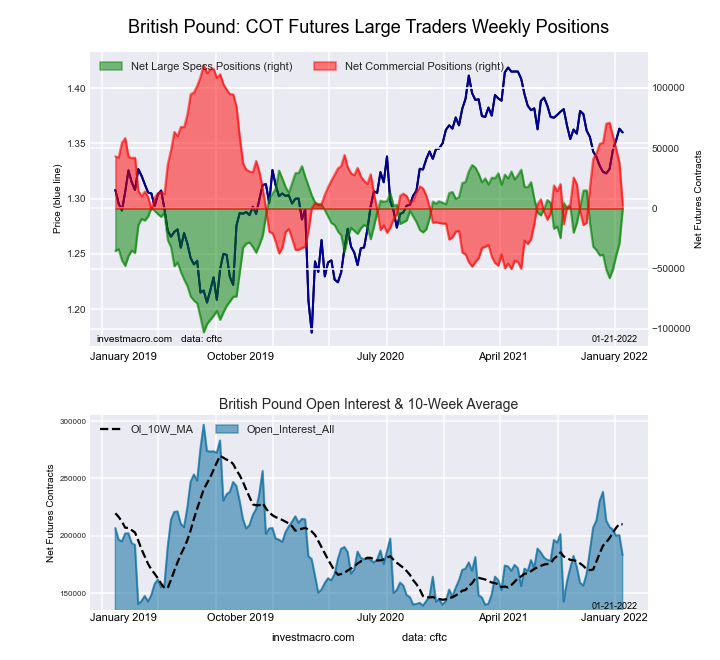

Highlighting the COT currency data is the trend changes in speculator sentiment we are seeing in the euro and the British pound sterling. Speculators have been boosting their bets for the euro and pound sterling over the past weeks and have now pushed their bets in both currencies to their best levels since September.

Euro positions have gained five consecutive weeks (a 5-week total rise of +36,463 contracts). They have now been in the bullish territory for two straight weeks after spending thirteen out of the past fourteen weeks in bearish territory. This week’s net position of +24,584 contracts marks the best position since Sept. 14, when positions were in a downtrend and on their way into negative territory.

British pound speculator bets, meanwhile, have risen sharply with four straight weeks of gains (a 4-week rise by +57,439 contracts) and have now settled into a current position of just -247 net contracts. The net position had been at a multi-year bearish high of -57,686 contracts as recently as Dec. 21 before a turnaround in sentiment.

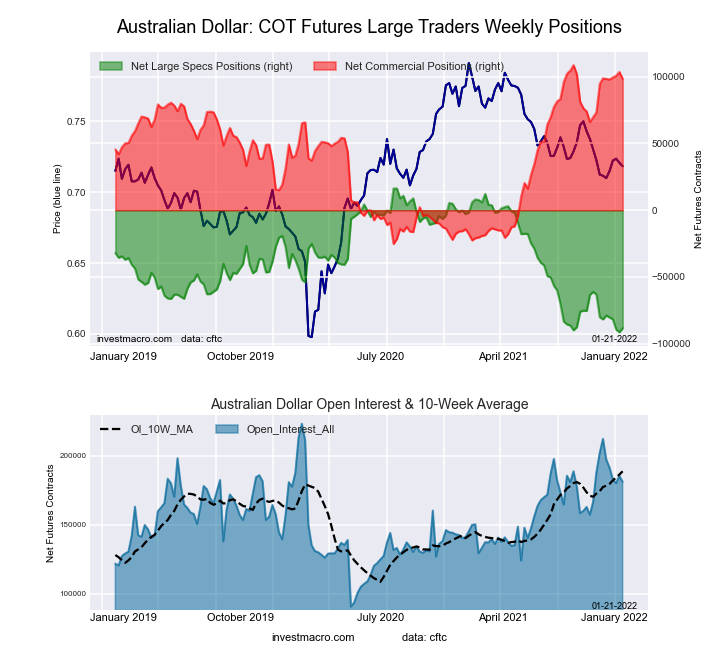

Joining the Euro (18,579 contracts) and British pound sterling (28,919 contracts) with positive changes this week were the yen (6,646 contracts), New Zealand dollar (273 contracts), Canadian dollar (14,868 contracts), Australian dollar (3,032 contracts) and the Mexican peso (9,371 contracts).

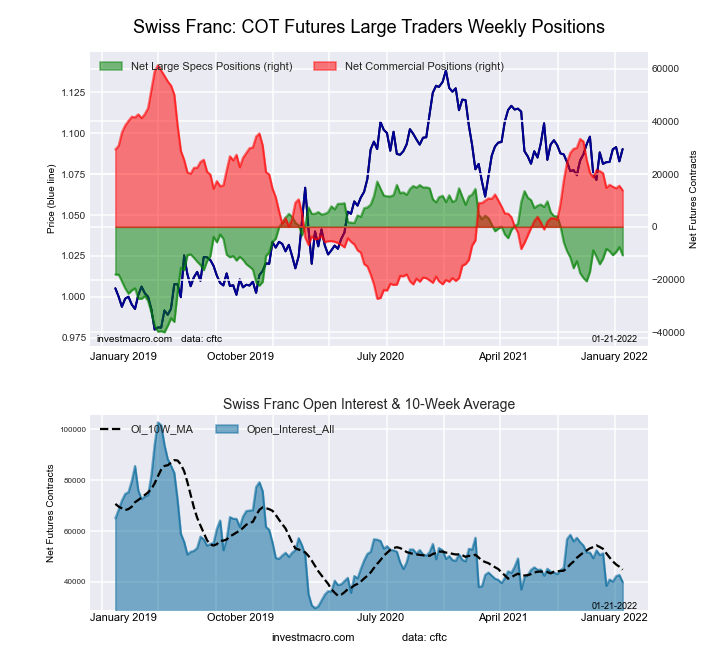

The currencies with declining bets were the US Dollar Index (-1,458 contracts), USD/BRL (-557 contracts), USD/CHF (-3,150 contracts), USD/RUB (-3,195 contracts) and Bitcoin (-172 contracts)

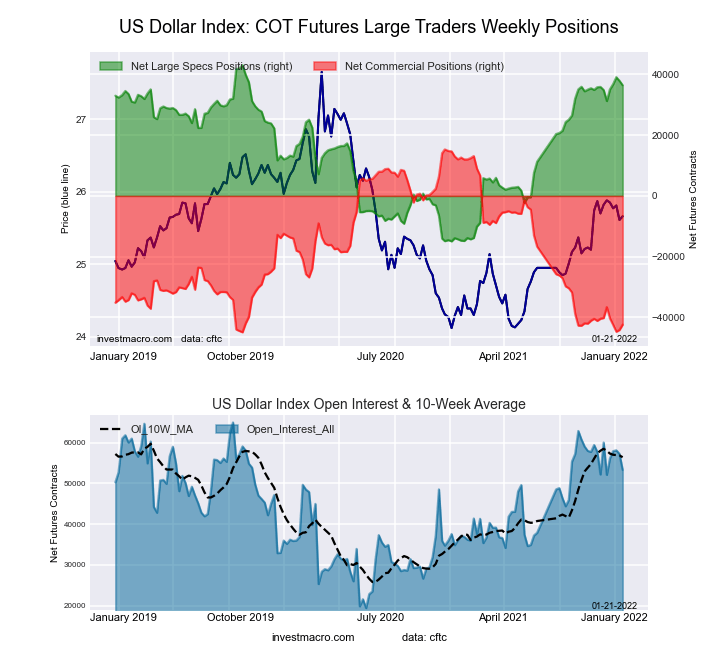

US Dollar Index Futures

The US Dollar Index large speculator standing this week was a net position of 36,434 contracts in the data reported through Tuesday. This was a weekly lowering of -1,458 contracts from the previous week, which had a total of 37,892 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 88.6 percent. The commercials are Bearish-Extreme with a score of 4.1 percent, and the small traders (not shown in chart) are Bullish-Extreme with a score of 81.8 percent.

Euro Currency Futures

The Euro Currency large speculator standing this week was a net position of 24,584 contracts in the data reported through Tuesday. This was a weekly gain of 18,579 contracts from the previous week, which had a total of 6,005 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish with a score of 42.5 percent. The commercials are Bullish with a score of 61.5 percent, and the small traders (not shown in chart) are Bearish-Extreme with 17.3 percent.

British Pound Sterling Futures

The British Pound Sterling large speculator standing this week was a net position of -247 contracts in the data reported through Tuesday. This was a weekly gain of 28,919 contracts from the previous week, which had a total of -29,166 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 73.8 percent. The commercials are Bearish with a score of 31.4 percent, and the small traders (not shown in the chart) are Bullish with a score of 50.3 percent.

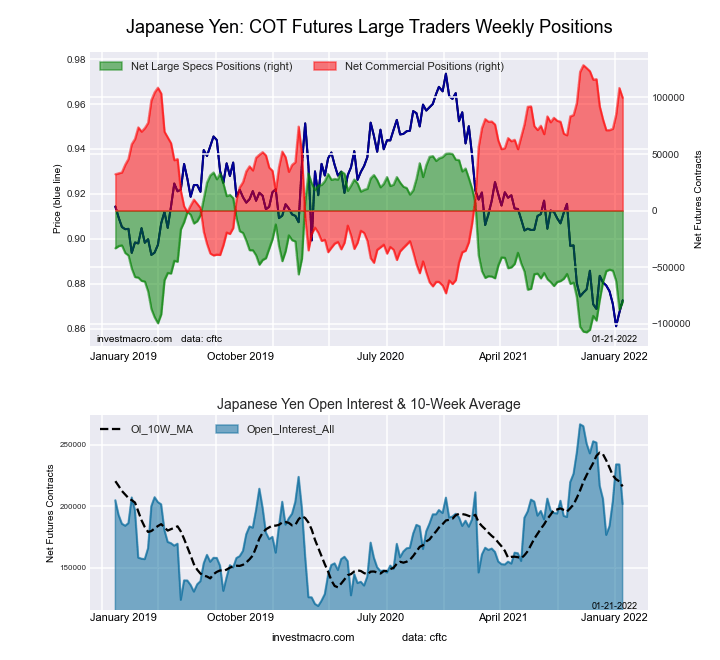

Japanese Yen Futures

The Japanese Yen large speculator standing this week was a net position of -80,879 contracts in the data reported through Tuesday. This was a weekly boost of 6,646 contracts from the previous week, which had a total of -87,525 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 16.9 percent. The commercials are Bullish-Extreme with a score of 85.7 percent, and the small traders (not shown in the chart) are Bearish-Extreme with 9.0 percent.

Swiss Franc Futures

The Swiss Franc large speculator standing this week was a net position of -10,810 contracts in the data reported through Tuesday. This was a weekly reduction of -3,150 contracts from the previous week, which had a total of -7,660 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 51.1 percent. The commercials are Bearish with a score of 46.4 percent, and the small traders (not shown in the chart) are Bullish with a score of 54.5 percent.

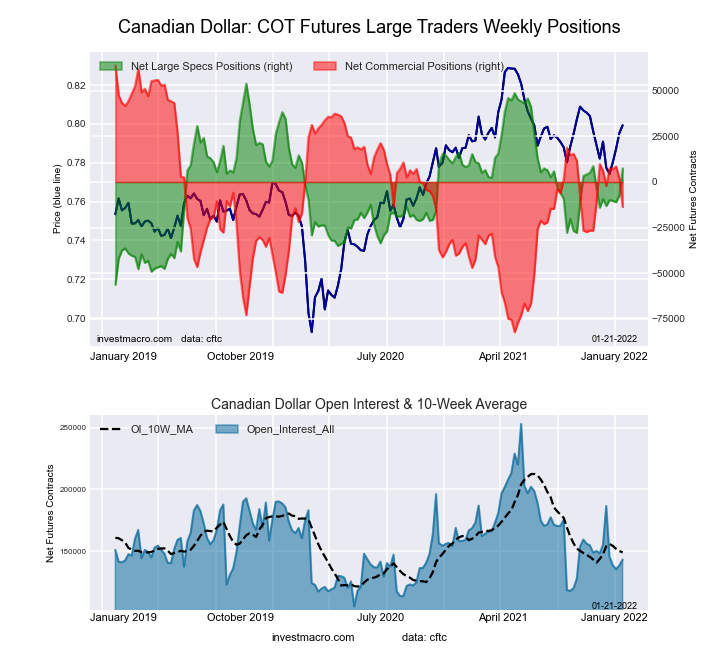

Canadian Dollar Futures

The Canadian Dollar large speculator standing this week was a net position of 7,492 contracts in the data reported through Tuesday. This was a weekly advance of 14,868 contracts from the previous week, which had a total of -7,376 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 57.9 percent. The commercials are Bearish with a score of 46.9 percent, and the small traders (not shown in the chart) are Bearish with a score of 42.2 percent.

Australian Dollar Futures

The Australian Dollar large speculator standing this week was a net position of -88,454 contracts in the data reported through Tuesday. This was a weekly increase of 3,032 contracts from the previous week, which had a total of -91,486 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bearish-Extreme with a score of 2.8 percent. The commercials are Bullish-Extreme with a score of 92.4 percent, and the small traders (not shown in the chart) are Bearish with a score of 27.9 percent.

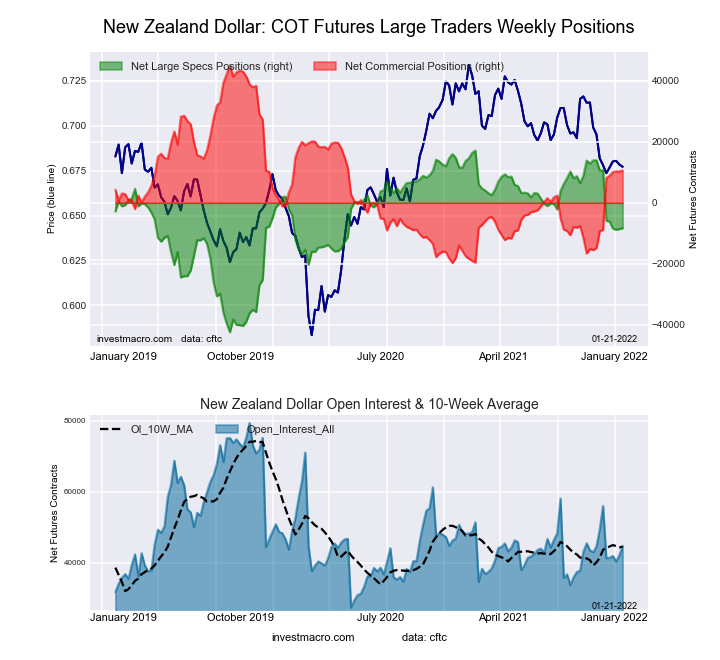

New Zealand Dollar Futures

The New Zealand Dollar large speculator standing this week was a net position of -8,331 contracts in the data reported through Tuesday. This was a weekly advance of 273 contracts from the previous week, which had a total of -8,604 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish with a score of 57.3 percent. The commercials are Bearish with a score of 46.8 percent, and the small traders (not shown in the chart) are Bearish with a score of 25.6 percent.

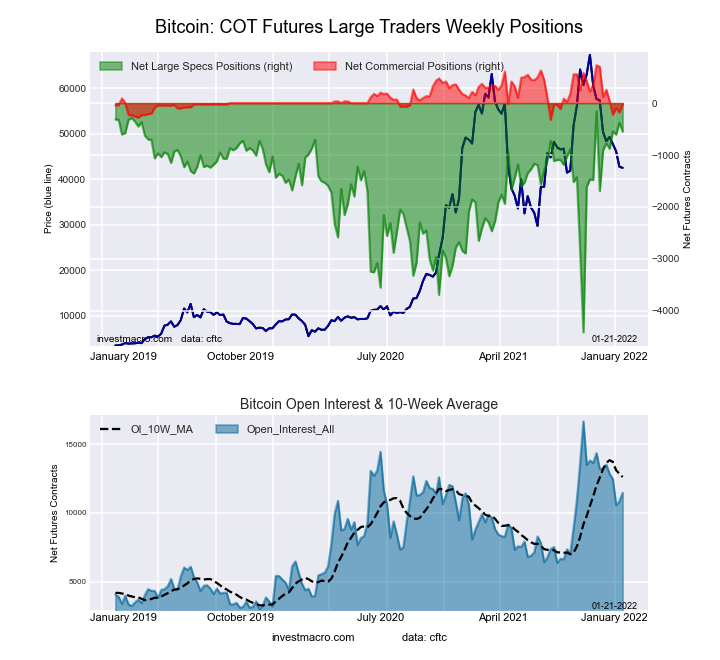

Bitcoin Futures

The Bitcoin large speculator standing this week was a net position of -549 contracts in the data reported through Tuesday. This was a weekly decline of -172 contracts from the previous week, which had a total of -377 net contracts.

This week’s current strength score (the trader positioning range over the past three years, measured from 0 to 100) shows the speculators are currently Bullish-Extreme with a score of 90.9 percent. The commercials are Bearish with a score of 28.5 percent, and the small traders (not shown in the chart) are Bearish with a score of 25.9 percent.