US markets were closed on Monday for President’s Day so European and Asian markets took their cues from corporate earnings and last week’s trends. London’s FTSE ended the day nicely higher by over 1% while Asian markets were also buoyed by the BOJ continuing their asset purchases.

This week, our analysis looks at COT (Commitment of Traders) report data and forex open position data to identify possible opportunities in the forex markets. We examine a number of instruments and conclude that GBP/USD and EUR/USD could present opportunities for traders in the days ahead.

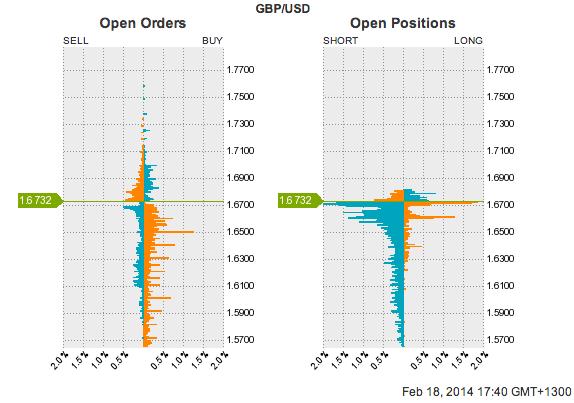

GBP/USD

First up is cable, and the currency put in a big performance last week, jumping on news that the BOE are to raise rates earlier than expected.

Comments from BOE Governor, Mark Carney, saw GBP/USD climb over 180 pips on the day and the currency continued that momentum over the next few sessions. This led to a significant one-sided condition develop in the currency and Oanda open position data indicated that, by the close on Friday, only 20% of open positions held were short positions. Such conditions often signal reversals and sure enough GBP/USD fell around 60 pips on Monday.

Open positions have since moved back to around 25% short and 75% long, indicating that some longs may have taken profits yesterday.

Looking at the order book now, it seems that there are plenty of buyers below the market which indicates that GBP/USD will find plenty of support down to 1.65.

Given that the market is still one-sided, the favoured strategy is to look for a correction towards 1.66. This should alleviate the overbought condition and allow longs back into the market.

GBP/USD" title="GBP/USD" height="242" width="474">

GBP/USD" title="GBP/USD" height="242" width="474">

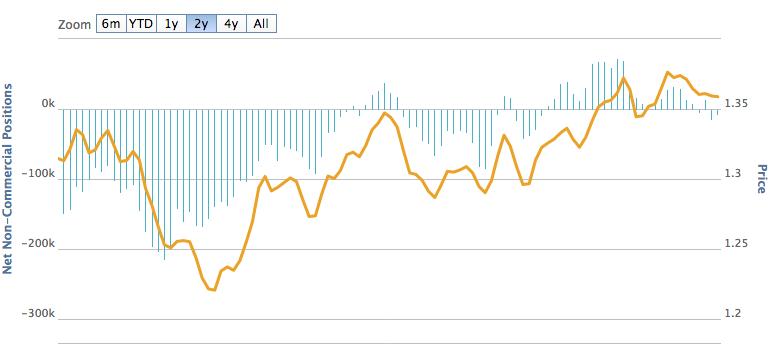

EUR/USD

Turning to the euro now and EUR/USD is also in a one-sided condition with around 24% of open trades short positions.

Looking at the COT data and it appears that non-commercial traders have only recently turned negative on the currency with -6,929 net positions as of last week.

From an historical perspective, it is clear to see a pattern around this.

Usually, when net non-commercial traders turn negative, the currency also makes a move south. This has been the case several times over the last 2 years.

The technical picture also shows that EUR/USD is losing momentum and struggling to make it past it’s recent highs. With this in mind, traders should look to sell EUR/USD over the next week or so and target a move back to 1.34, the lower Bollinger Band®.