Membership-based warehouse retailer Costco (NASDAQ:COST) stock has trimmed its losses to (-7.7%) on the year. The retail giant operates 830 warehouses worldwide, including the majority of 574 locations in the US. It has fared much better than rival consumer retailers Target (NYSE:TGT) and Walmart (NYSE: NYSE:WMT). Consumers are buying food and household items in bulk to mitigate runaway inflation as they look for bargains. This is a similar tailwind to the pandemic stockpiling trend. This is evidenced by the 6.8% rise in traffic and 7.6% in average transaction worldwide in its fiscal Q3 2022 earnings.

Membership grew 6% to 64.4 million households and 116.6 million cardholders in the quarter. Executive memberships rose by 800,000 in the quarter representing over 71% of worldwide sales and 43% of its whole membership base. Membership renewal rates hit all-time highs of 92.3% in the US and Canada. Inflationary pressures on consumers have convinced management to hold off on increasing its membership fees. Warehouse memberships are growing in popularity during inflationary times. Costco is a key benefactor of this trend as it continues to expand with 17 new warehouses and expects to open an additional ten warehouses for 27 locations this year.

Supply chain issues kept it from opening two warehouses but are set to open by the late second half of the year. Costco Logistics transitions from vendor drop ship to direct ship from its inventory averaging over 58,000 stops a week. This helps lower costs and improve delivery times. Prudent investors looking to gain exposure with the best membership warehouse retailer can patiently watch for opportunistic pullbacks in shares of Costco.

Fiscal Q3 2022 Earnings Release

On May 26, 2022, Costco released its fiscal third-quarter 2022 results for the quarter ending May 2022. The Company reported an earnings-per-share (EPS) profit of $3.04 excluding non-recurring items versus consensus analyst estimates for a profit of $3.02, a $0.02 beat. Revenues rose 18.5% year-over-year (YoY) to $52.6 billion, beating consensus analyst estimates for $51.49 billion. The Company reported total comparable store sales up 10.7% and adjusted e-commerce comparable sales up 7.9%.

Conference Call Takeaways

Costco Senior Vice President of Finance and Investor Relations Bob Nelson led the conference call as its CEO was out of the country on vacation. There was a $77 million pre-tax charge with its new employee agreement to adjust benefit accrual accounting for one additional vacation day. The FX headwinds in the US were 10.7% and 12.8% in Canada, excluding gas inflation. Shopper frequency rose 6.8% worldwide and up 5.6$ in the US, with average transaction rising 7.6% worldwide and 10.4% in the US. He noted that the best performing categories were candy, bakery, deli, sundries, toys, jewelry, kiosks, home furnishing, apparel, and tires.

The worst performing categories were liquor, office, hardware, and sporting goods. Membership fee income rose to $984 million or 1.91% of sales. Renewal rates hit all-time highs of 92.3%. While inventory levels rose 26% versus 19% in the last quarter, most of it was inflation-related, not unit related. Additionally, the Company beefed up stock in categories with lower inventory last year, including TVs, sporting goods, lawn and garden, and seasonal products. Gross margins did fall by 99 basis points, excluding the negative impact of gas inflation. He concluded that the Company had sold its hot dog and soda combination for $1.50 since its introduction in the mid-80s, and rumors of a price increase are false.

COST Opportunistic Pullback Price Levels

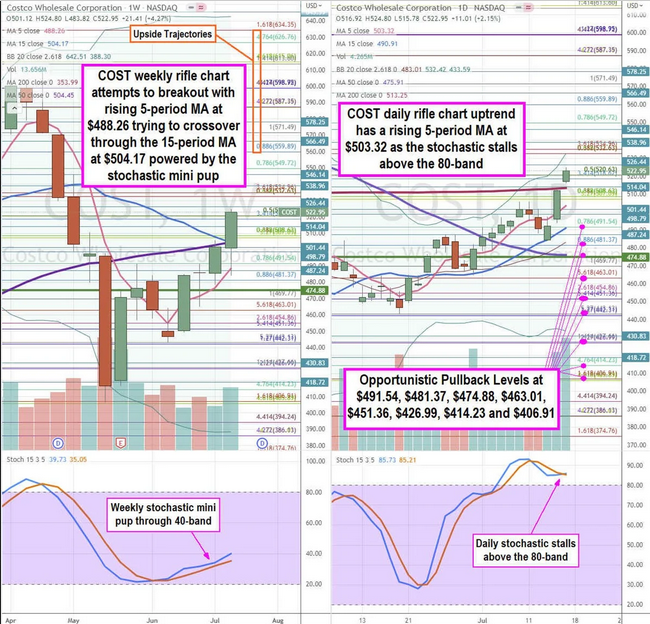

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for COST stock. The weekly rifle chart downtrend put in a bottom at the $406.93 Fibonacci (fib) level. The weekly 5-period moving average (MA) is rising at $488.26 attempting to crossover through the weekly 15-period MA at $504.17 which also overlaps the weekly 50-period MA at $504.45. The weekly upper Bollinger Bands (BBs) sit at $641.51. The weekly lower BBs sit at $388.30. The weekly stochastic has a bullish mini pup attempting to rise through the 40-band.

The weekly market structure low (MSL) buy triggered on the breakout above $474.88. The daily rifle chart has a pup breakout with a rising 5-period MA support rising at $503.32 with a rising 15-period MA at $490.91. The daily 200-period MA sits at $513.25. The daily upper BBs sit at $532.42 and lower BBs at $433.59. The daily stochastic is above the 80-band and stalling for a cross up or fall under the 80-band. Prudent and patient invests can watch for opportunistic pullback levels at the $491.54 fib, $481.37 fib, $474.88 weekly MSL trigger, $463.01 fib, $451.36 fib, $426.99 fib, $414.23 fib, and $406.91 fib. The upside trajectories range from the $559.89 fib level up towards the $634.35 fib level.