Costco Wholesale Corporation (NASDAQ:COST) continues to be one of the dominant retail wholesalers based on the breadth and quality of merchandise offered. Let’s delve deeper to know more about this Issaquah, WA-based company’s stock.

Driving Forces

Costco’s strategy to sell products at heavily discounted prices helps it to remain on a growth track as cash-strapped customers continue to reckon the company as a viable option for low-cost necessities. A differentiated product range enables it to provide an upscale shopping experience for its members, boosting its market share gains and sales per square foot.

Moreover, the company maintains a healthy membership renewal rate. Also, it is gradually expanding its eCommerce capabilities in the U.S., Canada, U.K., Mexico, Korea and Taiwan.

Costco continues to make prudent use of its cash flow through share repurchases and dividend payouts. This highlights its efforts to maximize shareholders’ returns amid difficult economic conditions. Further, the company’s current resources are reasonably adequate to support expenditures associated with its ongoing expansion initiatives.

Going forward, Costco has one of the highest square footage growth rates in the industry, and remains committed to opening new clubs in the domestic and international markets. We believe the company’s diversification strategy is a natural hedge against risks that may arise in specific markets.

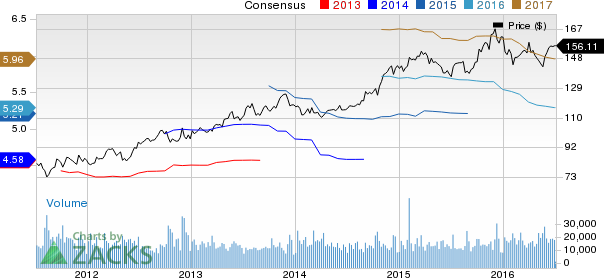

COSTCO WHOLE CP Price and Consensus

The Overhangs

While the aforementioned factors bode well, the company’s top-line performance has been soft for a while now. Evidently, its sales have missed the Zacks Consensus Estimate for six straight quarters now. Also, investors are worried about Costco's sluggish comparable-store sales (comps) performance. Comps remained flat in the third quarter of fiscal 2016, following an increase of 1% in the second quarter. While lower gasoline price is impacting U.S. comps, currency fluctuations are hurting international comps.

Further, Costco faces stiff competition and remains sensitive to macroeconomic factors. Also, cautious consumer spending has been weighing upon its sector’s performance. Costco competes with Fred's, Inc. (NASDAQ:FRED) , Burlington Stores, Inc. (NYSE:BURL) and Dollar General Corporation (NYSE:DG) .

DOLLAR GENERAL (DG): Free Stock Analysis Report

COSTCO WHOLE CP (COST): Free Stock Analysis Report

FREDS INC (FRED): Free Stock Analysis Report

BURLINGTON STRS (BURL): Free Stock Analysis Report

Original post

Zacks Investment Research