Cosan Limited (NYSE:CZZ) recently reported impressive results for the first quarter of 2018.

The Brazilian company’s adjusted net income totaled R$154 million ($47.4 million), surging 218.8% from the year-ago tally of R$48.3 million ($15.4 million). However, the bottom line was down roughly 67.4% from R$326.6 million ($100.5 million) recorded in the previous quarter.

Revenues Increase Y/Y

In the reported quarter, Cosan’s net revenues were R$3,543.4 million ($1,090.3 million), reflecting year-over-year growth of 27.2%. On a sequential basis, the top line decreased 4.7%.

The company operates under two business segments: Cosan S.A. and Cosan Logistica S.A. While Cosan S.A includes Raizen Energia, Raizen Combustiveis, Comgas, Moove and Cosan Corporate; Cosan Logistica comprises the Rumo Logistica business.

Fuel volumes sold increased 3% year over year on the back of 55.1% growth in ethanol volume sold, 6.2% rise in diesel volume and 8.1% increase in aviation-fuel volumes. However, this was partially offset by 12.6% decline in gasoline volumes.

Sugar volume sold increased 11.4% year over year to 1.2 million tons. Of the total, roughly 76.4% was exported while the rest was sold domestically. Ethanol volume sold increased 60% to 1.3 million cbm, including 14% of export volume and the rest of domestic volume.

Total natural-gas sales volume grew 6.3% year over year while lubricants sales volume increased 8%. For Rumo, total volume transported expanded 18% year over year.

Rise in Cost of Sales Lowers Gross Margin

Cosan’s cost of sales and services sold in the reported quarter marked an increase of 28.2% year over year to R$2,512.7 million ($773.1 million). It represented 70.9% of net revenues versus 70.3% in the year-ago quarter. Gross profit increased 24.7% year over year to R$1,030.7 million ($317.1 million) while gross margin decreased 60 basis points (bps) year over year to 29.1%.

Selling, general and administrative expenses slipped 1.4% year over year to R$458.4 million ($141 million), representing 12.9% of net revenues. Financial expenses were R$520.7 million ($160.2 million), down 15.8% year over year.

Balance Sheet & Capital Expenditure

Exiting the first quarter, Cosan’s cash and cash equivalents were R$6,103 million ($1,849.4 million), up from R$4,555 million ($1,376.1 million) at the end of the previous quarter. Loans and borrowings increased 1.3% sequentially to R$21,977 million ($6,659.7 million).

In the reported quarter, the company’s capital expenditure totaled R$609.2 million ($187.4 million), reflecting growth of 10.9% over the year-ago quarter.

Outlook

For 2018, Cosan anticipates pro forma net revenues to be R$50-R$53 billion for Cosan S.A. Earnings before interest, tax, depreciation and amortization (EBITDA) are projected to be R$4.9-R$5.4 billion. The guidance for Cosan S.A.’s and Rumo’s businesses is discussed below:

Raizen Energia (guidance for crop-year April 2018-March 2019): Management expects crushed sugarcane volumes to be 62-66 million tons (down from 63-67 million tons expected earlier). Sugar volume produced is likely to be 4.2-4.6 million tons.

Ethanol volume production is expected to be 2.3-2.6 billion liters while the volume of energy sold is expected to be 2.5-2.7 million MWh. EBITDA is likely to be R$3.4-R$3.8 billion while capital spending is anticipated to be R$2.4-R$2.7 billion.

Raizen Combustiveis: EBITDA is predicted to be R$2.85-R$3.15 billion and capital expenditure is likely to be R$800-R$1,000 million.

Moove: EBITDA is expected to be R$200-R$230 million.

Comgas: Volume of gas sold is likely to be 4.4-4.6 million cbm while EBITDA is projected to be R$1.77-R$1.87 billion. Capital expenditure is likely to be R$450-R$500 million.

Rumo: EBITDA is predicted to be R$3.05-R$3.25 billion and capital expenditure is expected to be R$1.9-R$2.1 billion.

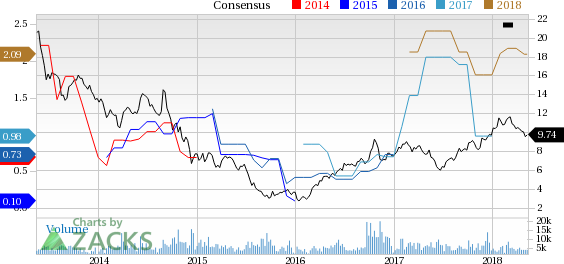

Cosan Limited Price and Consensus

FMC Corporation (FMC): Free Stock Analysis Report

Cal-Maine Foods, Inc. (CALM): Free Stock Analysis Report

Cosan Limited (CZZ): Free Stock Analysis Report

Bunge Limited (BG): Free Stock Analysis Report

Original post

Zacks Investment Research