Cosan Limited (NYSE:CZZ) reported impressive results for third-quarter 2017. Adjusted net income of R$267.4 million ($84.6 million) improved remarkably from the year-ago quarter’s tally of R$19.1 million ($5.9 million).

Revenue Grows Y/Y

The quarter’s net revenues came in at R$3,711 million ($1,174.4 million), increasing 13.4% year over year.

The company operates under two business segments: Cosan S.A. and Cosan Logistica S.A. While Cosan S.A includes Raizen Energia, Raizen Combustiveis, Comgas, Moove and Cosan Corporate, Cosan Logistica comprises the Rumo Logistica business.

Fuel volumes sold increased 4.2% year over year driven by 5.4% growth in gasoline sales volume and 8.4% growth in diesel volumes sold. These were partially offset by a fall in sales volume of ethanol, aviation and other products.

Sugar volume sold grew 16.7% year over year to 1.4 million tons. Of the total, roughly 79.9% was exported while the rest was sold domestically. Ethanol volume sold increased 27.3% year over year to 1.1 million cbm, including 39.1% of export volume and the rest was domestic volume.

Total natural gas sales volume grew 4.6% year over year while lubricants sales volume inched up 0.5%. For Rumo, total volume transported increased 17.7% year over year.

Margin Falls on Higher Costs

Cosan’s cost of sales and services sold in the quarter jumped 18.2% year over year. It represented 64.8% of net revenues, up from 62.2% in the year-ago quarter. Gross margin fell 260 basis points year over year to 35.2%. Selling, general and administrative expenses decreased 5.1% year over year to R$471.2 million ($149.1 million), representing 12.7% of net revenues. Financial expenses were R$522.8 million ($165.4 million).

Balance Sheet

Exiting the third quarter, Cosan’s cash and cash equivalents were R$5,802 million ($1,836.1 million), up from R$3,937 million ($1,193 million) in the previous quarter. Loans and borrowings increased 4% sequentially to R$21,316 million ($6,745.6 million).

Outlook

For 2017, Cosan anticipates pro forma net revenues to be R$45-R$48 billion for Cosan S.A. Earnings before interest, tax, depreciation and amortization (EBITDA) are projected to be within R$4.9-R$5.3 billion (revised from R$4.8-R$5.3 billion expected earlier). Guidance for Cosan S.A.’s and Rumo’s businesses is discussed below:

Raizen Energia (guidance for crop year April 2017-March 2018): Management expects crushed sugarcane volumes to be 59-63 million tons. Sugar volume produced is likely to come in a range of 4.3-4.7 million tons.

Ethanol volume production is expected to be in the range of 2-2.3 billion liters while volume of energy sold is expected within 2.2-2.4 million MWh (up from the previous expectation of 2-2.2 million MWh). EBITDA is likely to come within R$3.9-R$4.3 billion while capital spending is anticipated within R$2.3-R$2.6 billion (up from R$2.1-R$2.4 billion expected earlier).

Raizen Combustiveis: EBITDA is predicted in a range of R$2.7-R$3 billion and capital expenditure is likely to be within R$800-R$1,000 million.

Moove: EBITDA is expected in the R$160-R$180 million range (up from R$140-R$160 million expected earlier).

Comgas: Volume of gas sold is likely to fall within 4.3-4.4 million cbm (versus the previous projection of 4-4.3 million cbm) while EBITDA is projected in a range of R$1.7-R$1.73 billion (versus R$1.6-R$1.7 billion expected earlier). Capital expenditure is likely to be in the range of R$450-R$500 million.

Rumo: EBITDA is predicted in a range of R$2.6-R$2.8 billion and capital expenditure is expected within R$2-R$2.2 billion.

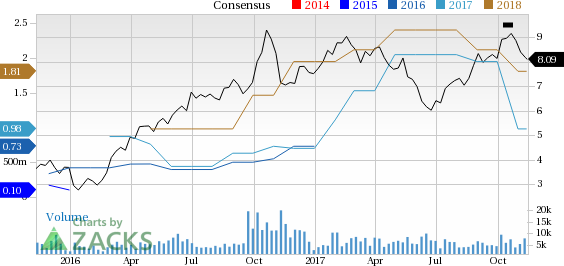

Cosan Limited Price and Consensus

Kraton Corporation (KRA): Free Stock Analysis Report

Internationa Flavors & Fragrances, Inc. (IFF): Free Stock Analysis Report

Cosan Limited (CZZ): Free Stock Analysis Report

Monsanto Company (MON): Free Stock Analysis Report

Original post

Zacks Investment Research