Investing.com’s stocks of the week

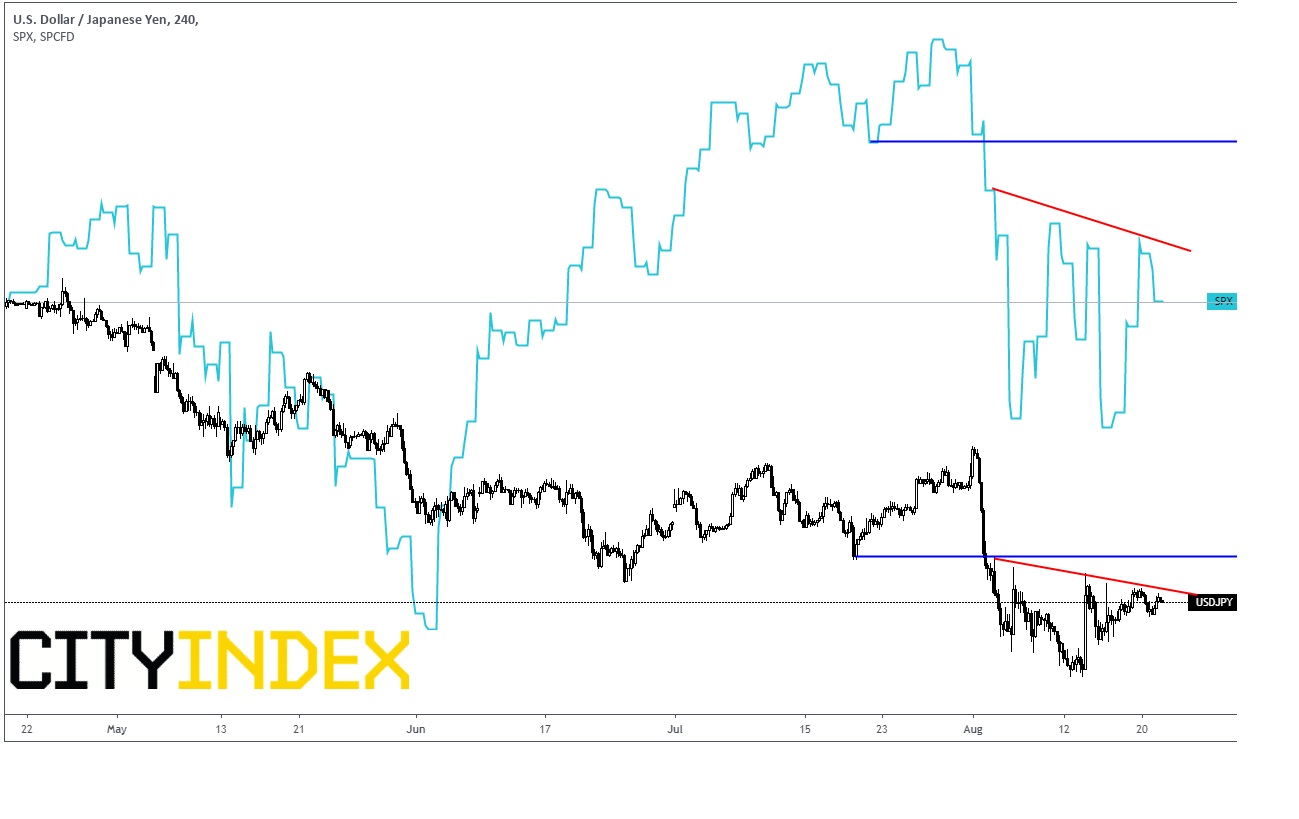

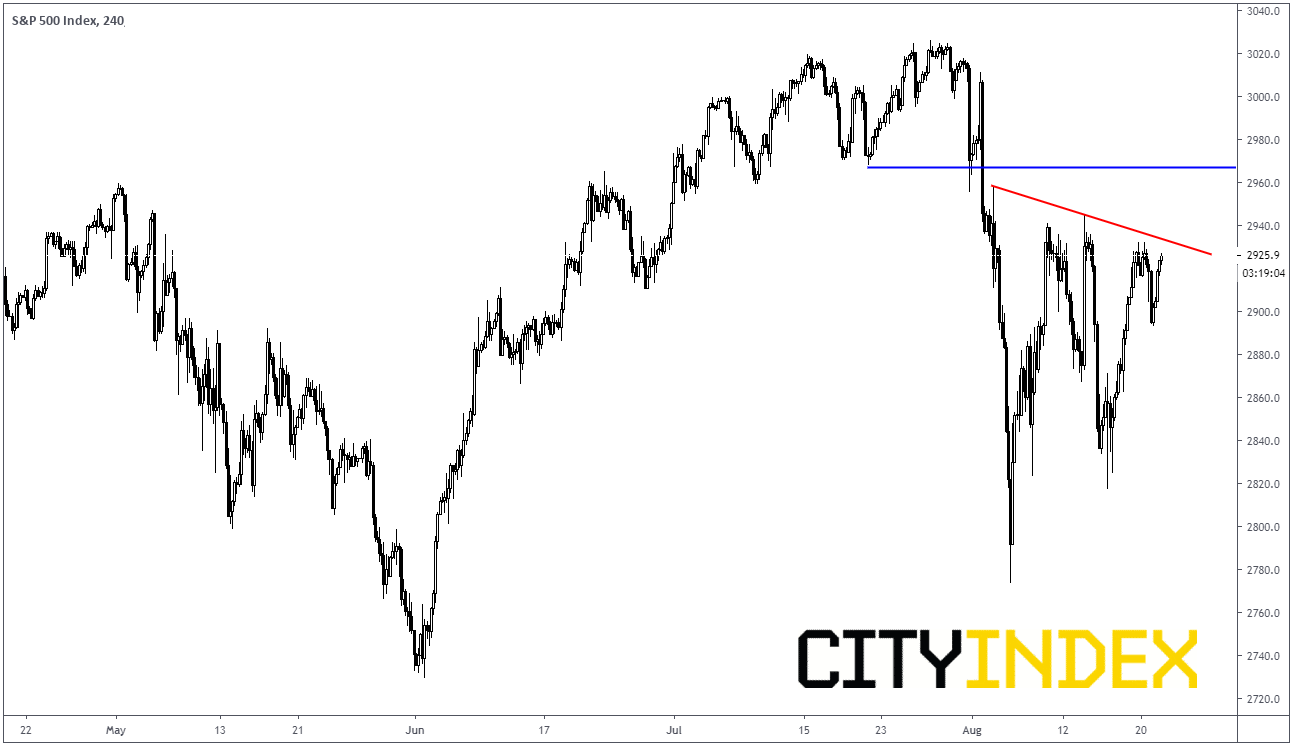

Just from looking at a chart of the price action, one can see that the USD/JPY and the S&P 500 are strongly correlated. As you can see from the 240-minute chart below, the 2 instruments generally move together:

When stocks sell off, USD/JPY tends to sell off as well. The reverse is also true: As stocks go bid, USD/JPY tends to go bid as well. The reason is that the Yen is considered to be an extremely safe asset.

We have some important events occurring over the next few days, which may add some volatility to the 2 instruments:

Today: July FOMC meeting minutes

Thursday: PMI manufacturing data

Friday: Fed Chairman Powell speaks at Jackson Hole

If the S&P 500 takes out the Trendline resistance at 2933, there is room to move up to horizontal resistance near 2965.

If that happens, keep an eye on USD/JPY. If the currency pair continues to move with the S&P 500, USD/JPY could take out the trendline at 106.42 and there will be room to run up to horizontal resistance near 107.25.

If you are looking to trade USD/JPY, you may want to watch the S&P 500!