The muni bond market was buffeted by a number of headwinds in the first half of the year.

Extremely Heavy Supply

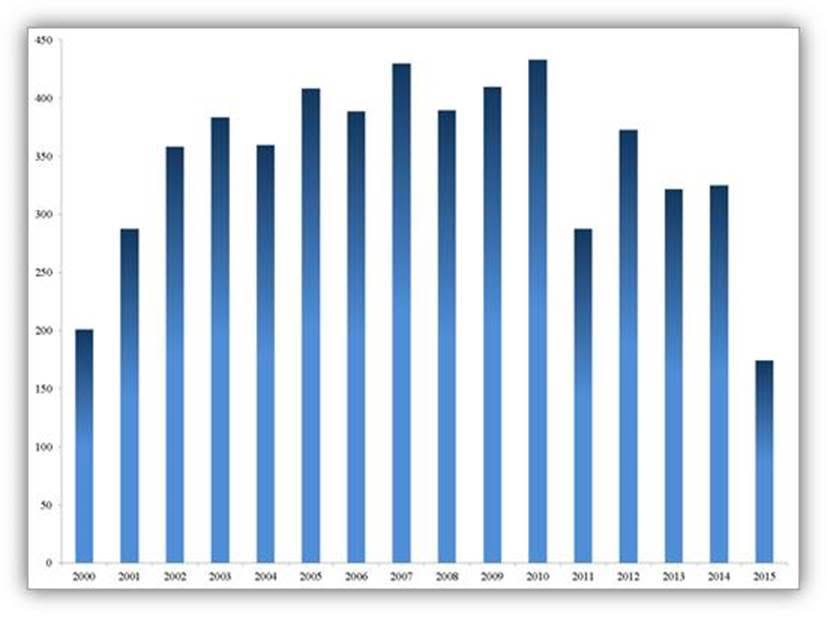

Through May 2015 total supply in the muni market was approximately $179 billion. The large increase in monthly supply can be seen from the following municipal bond issuance calendar. In January, there was a 52% increase year-over-year, 111% in February, 45% in March, and 50% in April. As we have written, the majority of this issuance has been to refinance older, higher-coupon bonds through current refundings of older bonds that are currently callable, or advance refunding of bonds with call dates within three or four years. This supply onslaught has made longer municipal bond yields cheaper to US Treasuries than they have been in a long time. Many longer bonds of AA quality are trading at yield levels of 4% or higher.

Municipal Bond Calendar

Source: The Bond Buyer

Extreme Volatility in the Treasury Market

The price of oil has been highly correlated with the volatility in the Treasury market. At the same time, the market has see-sawed between concern over deflation from the oil drop and quantitative easing by the European Central Bank, as well as a better economic number in the US after a tepid first quarter. In addition, the slight rebound in the price of oil has contributed to market volatility.

The 30-year US Treasury bond started the fourth quarter of 2014 at approximately a 3.20 yield, moved to a 2.20 by the end of January 2015, and has rebounded to the 3.20 range recently. This volatility made it difficult for municipal dealers to hedge inventory; thus, there has been a slight drop in liquidity of the dealer community.

Source: Bloomberg

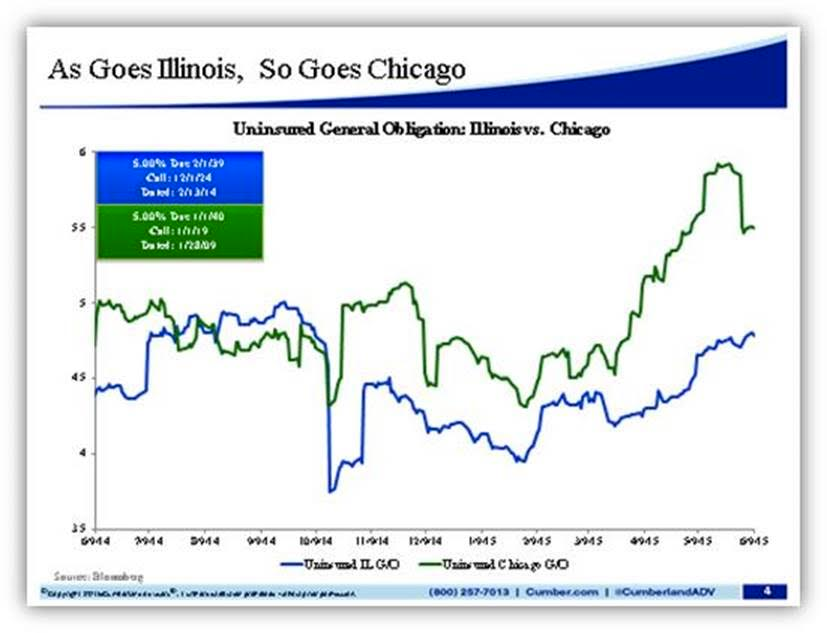

Ongoing Pension Woes in Illinois and Chicago

The State of Illinois saw its pension reform legislation overturned by the Illinois Supreme Court, which cited state constitutional protection of pension rights. This sent state-issued bonds climbing in yield and dropping in price and caused an even greater rise in the yields of general-obligation bonds issued by the City of Chicago.

Source: Bloomberg

So why are we optimistic going forward?

Supply is starting to slow down. There is more refunding supply for sure, but the increase in supply is attenuating, and we think that this trend will continue in the second half of the year. As a result, there should be less supply pressure in the longer end of the market. We think that as this supply abates, the 4% tax-free yield will appear more and more compelling, especially compared to a comparable Treasury yield, which is currently at a 3.20% yield (125% yield ratio and clearly higher for the many bonds trading at cheaper than 4%). We think there is a tremendous amount of defensiveness built into the 4% tax-free yield. Even if Treasury bond yields rise later in the year in response to a Fed rate hike, the current cheapness of the muni yield should shield them from dramatic downside risk.

The Fed rate hike, whenever it comes, should result in better relative performance for muni bonds. Below is a chart showing the ratio of munis to Treasuries the last time we had a Fed rate hike back in 2004. As you can see, long muni ratios came down during the Fed rate hike and were in the 90% range compared to Treasuries. We are coming out of the economic straightjacket that has constricted the economy for the past seven years. The Fed’s quantitative easing is done. The actual tapering of Fed buying produced lower yields, not higher. Inflation levels remain low, and below Fed targets. So we believe a return to normalcy is in the cards when it comes to tax-free bonds, and that means eventually much lower yield ratios than currently. And this should certainly be true with a Fed that will be very cautious about raising shorter-term rates.

Source: Bloomberg

Pension issues should become more manageable over time. Many states are trying to achieve some longer-term solutions, which include longer working years for current workers, a reduction in cost of living adjustments that were out of line with current inflation, greater contributions by current workers, and other measures. Illinois will clearly require some changes in their state constitution to achieve the necessary changes, but that is doable as well. Chicago is NOT Detroit. This is a vibrant city with population growth the last five years (like many US cities). It will require political cooperation – which clearly poses hurdles but is also doable. A better stock market the past couple of years has also helped pensions.

So, in summary – lower supply, already cheap yields, a return to normalcy regarding yield ratios, and a slow but steady progress on pensions all should combine to provide a better backdrop to the muni market in the second half of this year.

John Mousseau, CFA, Executive Vice President & Director of Fixed Income.