In U.S the Corporate profits grew in the business sector. Companies before taxes in the second quarter gained profit by 0.5% more than the first quarter, with record decline of 2.7% in the previous quarter. Compared with the second quarter of 2011, the profits of companies in the business sector recorded 6.1% profit.

Macroeconomic data showed that the world's largest economy grew at a rate higher than the initial estimated for the second quarter of this year. The attention of investors got attracted by Ben Bernanke's speech from Federal Reserve Chairman on Friday.

According to recent data published by the U.S. Commerce Department U.S. (GDP) grew for the second quarter at a rate of 1.7%, more than the initial estimates which indicated growth of 1.5%. In the first quarter of this year the U.S. economy grew at an annual rate of 2% after 4.1% growth in the fourth quarter of 2011.

Indicator of private consumption grew in the United States at an annual rate of 1.7%, "the lowest rate in years" compared with initial estimates growth of 1.5%. High consumption of services in the second quarter of the year was the largest since the fourth quarter of 2006, mainly due to an increase in electricity and fuel consumption due to the hot weather is usually in the United States.

European stock markets closed slightly low as a result of a meeting between German Chancellor Angela Merkel and Italian Prime Minister Mario Monti. During the trading day indicators fluctuated after good growth data released in the U.S. states. Sectors leading the decline were the banking and commodity sectors.

FTSE 100's closes done as 5743.53,-0.56%.German DAX 30 Index closes in 7010.57,+0.11%.

Wall Street closed positive direction for the first time in three days, after the Fed statement that economic activity in the United States continued to grow in the past month due to the improvement in retail sales and the housing market.

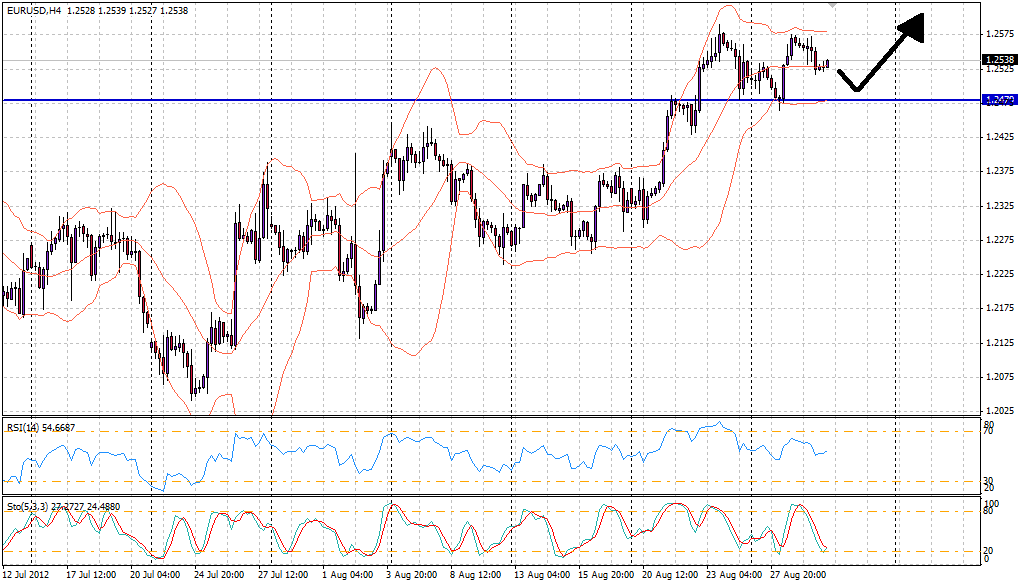

EUR/USD

In yesterday’s trading the pair reached the highest level at 1.2572, while the lowest level at 1.2517. To close at 1.2529 price levels.

EUR/USD found new support levels at 1.2480, if the price stays above these levels indicates upward trend. EUR/USD" title="EUR/USD" width="1019" height="583">

EUR/USD" title="EUR/USD" width="1019" height="583">

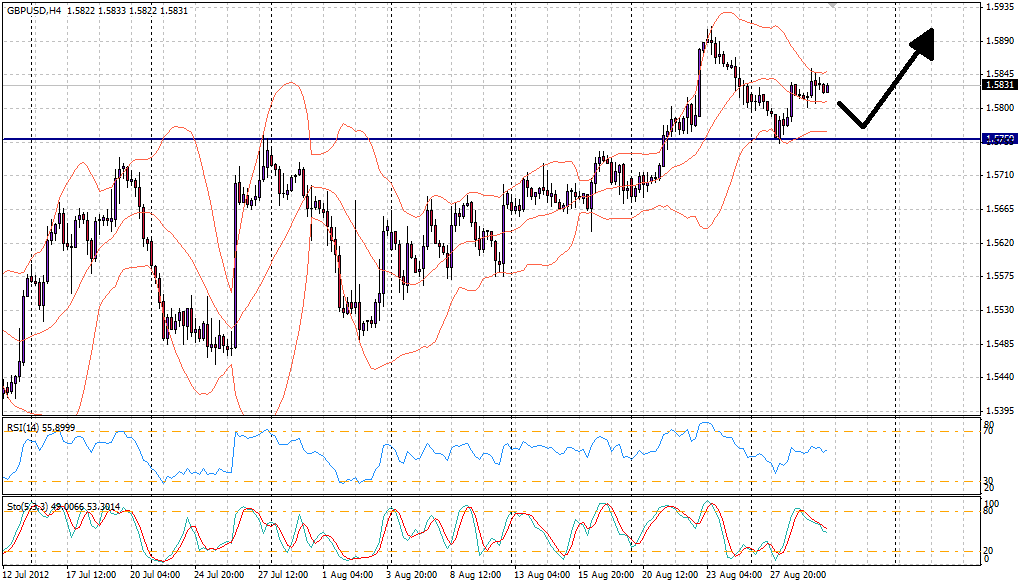

GBP/USD

In yesterday’s trading the pair reached its highest level at 1.5854 and the lowest level at 1.5802 per. To close in price levels 1.5833.

Sterling found new support levels at 1.5760 dollars per pound, if the price stays above these levels indicates upward trend. GBP/USD" title="GBP/USD" width="1019" height="580">

GBP/USD" title="GBP/USD" width="1019" height="580">

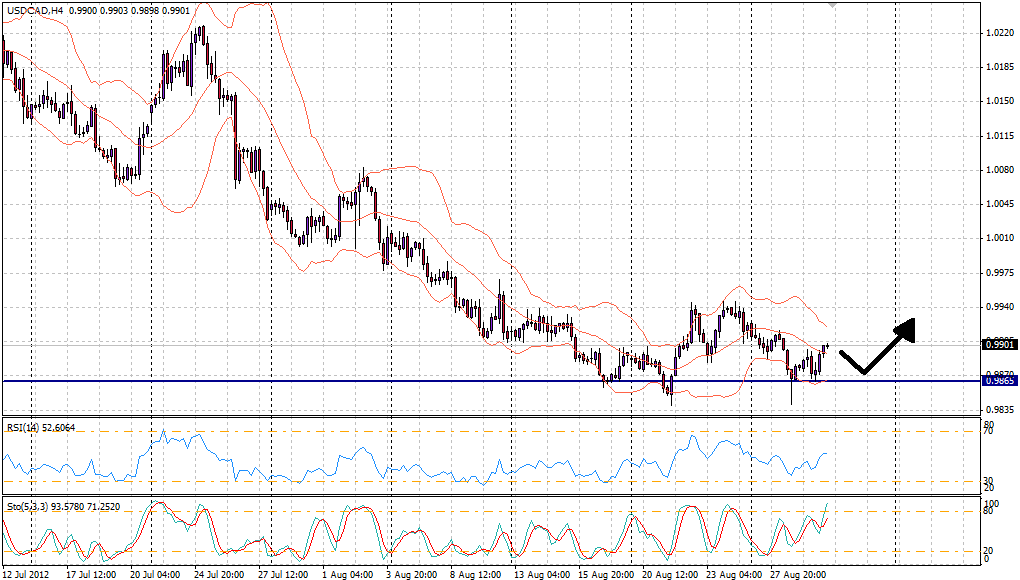

USD/CAD

In trading yesterday, USD/CAD the highest level at 0.9897 against the Canadian dollar touching its lowest level at 0.9864. To close at 0.9892 price levels.

The pair found dollar new support levels at 0.9865, if the price stay above these levels indicates upward trend. USD/CAD" title="USD/CAD" width="1020" height="580">

USD/CAD" title="USD/CAD" width="1020" height="580">

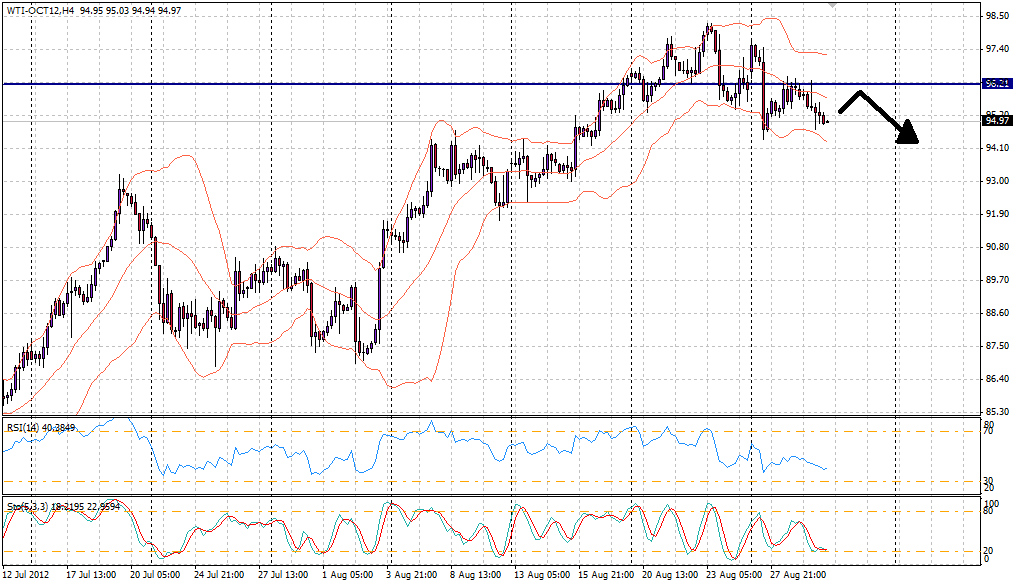

WTI

U.S. light crude futures on the New York Mercantile Exchange (NYMEX) closed at 95.11 levels per barrel, after falling from a peak of $ 96.34 per barrel, where touched its lowest level at 94.73 dollars per barrel.

Crude oil found new resistance levels at 96.20 dollars per barrel, if the price is below these levels indicates a downward trend.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Corporate Profits Grow

Published 08/30/2012, 08:49 AM

Updated 03/09/2019, 08:30 AM

Corporate Profits Grow

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.