Yesterday, we embarked on a mission to debunk seven of the most prevalent Wall Street myths.

Myths like the imminence of hyperinflation and the fragility of the residential real estate recovery, among others.

We recruited some helpful graphics to do the trick, too. And today, it’s time to finish the job.

We’ve got four more myths to discard. So without further ado, let’s get to it…

Myth #4: Corporate Profit Margins Can’t Possibly Climb Higher

Stock prices follow profits. It’s an immutable law of the market. But with profit margins at record highs, and revenue growth hard to come by, something’s got to give.

Naturally, it’s going to be stock prices, right?

Not so fast!

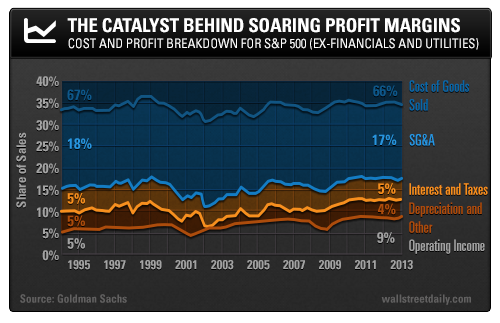

The common perception is that companies have done nothing but cost-cut their way to record profit margins. And obviously, that’s not sustainable over the long term. However, it turns out that cost cutting isn’t the only contributor to swelling profit margins.

“Rather than one major factor pushing margins to record levels, over the last 20 years almost every component of the income statement has shrunk relative to sales,” says Goldman Sachs’ (GS) Amanda Sneider.

More specifically, companies are paying less for raw materials, thanks to low inflation. They’re paying less for capital, thanks to low interest rates. They’re paying less for labor, thanks to productivity gains. Not to mention, favorable tax rates and technological innovations – like real-time inventory management – are helping drive costs down even more.

Add it all up, and record profit margins are much more sustainable than most pundits think.

As Goldman Sachs’ Jan Hatzius says, “Eventually, the pendulum will swing back in the direction of lower profits.” But that “eventually” isn’t now. Not with so much slack left in the labor market.

For an early warning sign, the key metric to track is hourly wage growth. Once it ticks above 4% (it’s currently at 2%), then we have to worry – as labor costs will start materially cutting into margins.

Myth #5: U.S. Stocks Are Downright Expensive

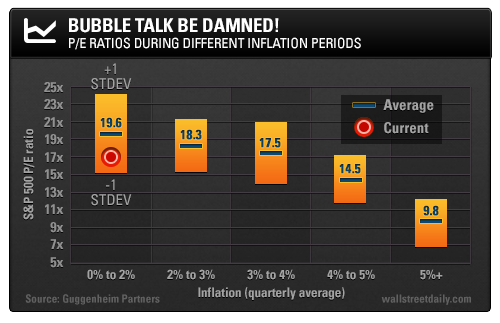

If record profit margins don’t spell doom for U.S. stocks, soaring valuations do, right? Wrong!

Although the stock market’s current price-to-earnings ratio of 17 is above the long-run average of 14, a collapse isn’t imminent.

As Morgan Stanley’s (NYSE:MS) Adam Parker says, “Market multiples rarely trade at average levels.”

They trade above or below the average, oftentimes for much longer than anyone anticipates. It’s only over long periods of time that valuations revert to their mean.

What’s more, all the stock bubble fearmongers are failing to take inflation into account right now.

How convenient… Because when we do, stocks aren’t expensive at all.

“Though the P/E ratio of the S&P 500 has been on an upward trend in recent years, historical ranges suggest there is further room for expansion due to low inflation,” says Guggenheim Partners’ Scott Minerd. “With inflation expected to remain below the Fed’s target through 2015, the P/E ratio could rise as far as 24X and still remain within historical norms.”

So the next time someone swears stocks are downright expensive, whip out this chart and set him or her straight.

Myth #6: The Stock Market = The Economy

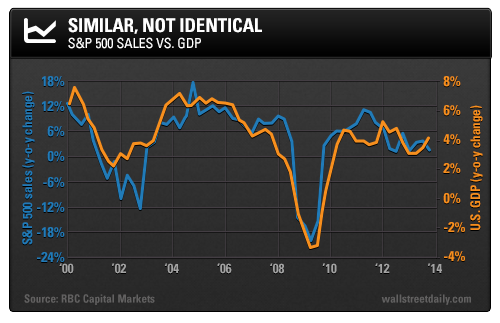

If I’ve said it once, I’ve said it too many times to count: Stock markets and individual economies are not identical.

Stocks might move in similar fashion to the prevailing economic trend. But by no means is a strong domestic economy a precursor for a surging stock market.

This makes sense, too. After all, nearly 50% of revenue from S&P 500 companies comes from overseas. And events in those economies aren’t identical to what happens in the U.S. economy.

If you want even more proof, here you go…

The chart from RBC Capital’s Jonathan Golub shows that the stock market and the economy clearly aren’t the same thing. Although they might move in similar directions, the magnitudes of the moves differ significantly.

Here’s a key takeaway: When the economy is on the cusp of accelerating, like it is now, we want to focus on small-cap stocks. They stand to directly benefit the most from the pickup, since the majority (if not all) of their business is tied to the domestic economy.

Myth #7: Wall Street Analysts Are Independent Thinkers

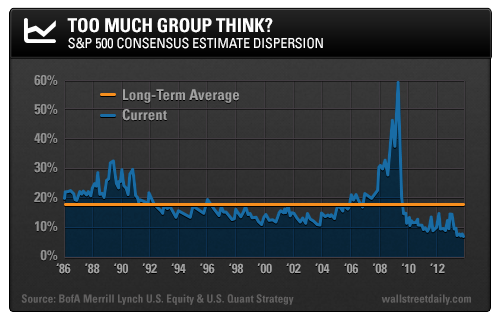

You’d think given the high sticker price of their Ivy League educations, traditional analysts would have learned to think independently during their time in school. Well, think again.

As I’ve noted before, analysts consistently exhibit herding behavior.

Their estimates for fourth-quarter profit growth serve as the latest proof. They’re almost identical!

“The average estimate for dispersion for S&P 500 companies ticked down in Q4 to 7% from 8% last quarter, the lowest reading since 1986 and below the long-term average of 18%,” according to Bank of America’s (NYSE:BAC) Savita Subramanian.

As Benjamin Franklin famously said, “If everyone is thinking alike, then no one is thinking.”

Indeed!

Remember that the next time you’re tempted to blindly follow an analyst’s lead (present company included). There’s no substitute for doing your own due diligence.