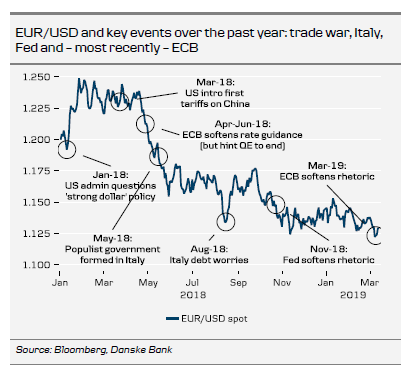

Following the ECB's surprisingly dovish message last week, signalling no hikes in 2019, we see significantly less upside for EUR/USD this year.

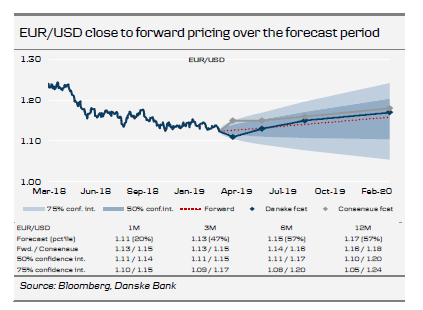

We recommend hedging USD-denominated income via risk reversals: this allows one to profit from some dollar strength near term (as per our call), yet still secures a worst-case rate without locking in the negative carry from the outset.

For shorter-term horizons (up to 3 months), we recommend hedging USD-denominated expenses via FX forwards, as we see a risk of more USD strength. For longer-term maturities (over 3 months), consider incorporating optionality, which enables one to gain from a EUR/USD increase; this could be done by means of knock-in forwards, which allows one to sell EUR/USD above the current spot should USD weaken over time (as per our call), while still securing a worst-case rate.

Hedge USD-denominated income via risk reversals

We see potential further USD strength short term and limited risk of significant USD weakening this year, and notably our EUR/USD forecast is now running close to forwards on all horizons (vs previously above) and across tenors. As a result, we recommend hedging USD-denominated income via risk reversals: this allows one to profit from some dollar strength near term (as per our call), yet still secures a worst-case rate without locking in the negative carry from the outset.

Hedge USD-denominated expenses via (knock-in) forwards

For shorter-term horizons (up to 3 months), we recommend hedging USD-denominated expenses via FX forwards, as we see a risk of more USD strength. For longer-term maturities (over 3 months), consider incorporating optionality, which enables one to gain from a EUR/USD increase; this could be done by means of knock-in forwards, which allow one to sell EUR/USD above the current spot should USD weaken over time (as per our call), while still securing a worst-case rate.