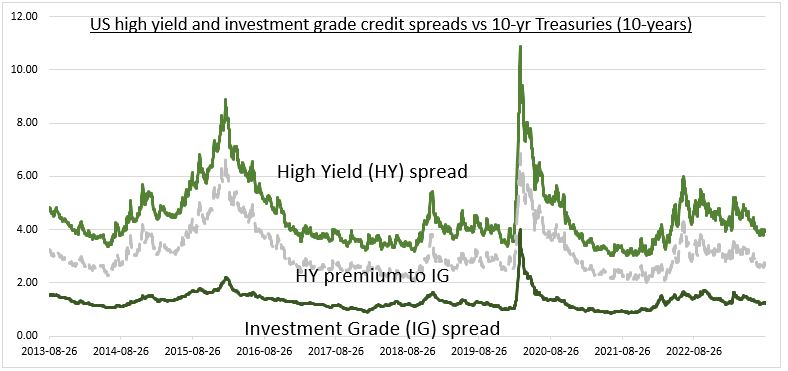

The US corporate bond market is sending a reassuring signal to stock investors that financing fundamentals remain supportive. Spreads of investment grade (Vanguard Intermediate-Term Corporate Bond Index Fund ETF Shares (NASDAQ:VCIT)) and non investment grade (SPDR® Bloomberg High Yield Bond ETF (NYSE:JNK)) bonds over US treasury yields have been falling (see chart).

This has blunted the increase in interest rates and signals optimism among bond investors. Q2 results showed earnings troughing, debt maturities were extended in the 2020 refinancing boom, and corporate debt/GDP has been falling. A default upcycle has started but seems well-controlled. High-yield bond default rates have risen to 4% and are at 2% for all grades. This is a fraction of the GFC peaks of 15% and 7%. This gives some flexibility to the coming economic slowdown (from c6% Q2 NOWCast) with an est. $2.5 trillion wall of refinancings over the next 2.5 years.

US junk bonds have been rallying, and yields falling (see chart), providing support to the equity market surge this year. High-yield or ‘junk’ bonds are those issued by companies with a less than investment-grade credit rating. They are also focused on deeply cyclical industries, with heavyweights in commodities, consumer discretionary, and retail, with a big underweight in technology. This combo makes them very sensitive to macro conditions, with a high correlation historically between junk bonds and stocks. They are a ‘canary-in-the-coalmine’ indicator.

75% of US corporate finance is raised via the bond market, making it crucial to the economy and explaining the Fed’s strong support in the 2020 crisis. This is different in Europe and China, where bank finance is much more important. The US corporate bond market has $10.2 trillion outstanding, with $1.3 trillion issued last year and an average daily trading volume of $39 billion. This is third behind the Treasury and Mortgage-Backed Securities markets. Overall US corporate debt/GDP is around 78%, below the global average of 96%, and has been falling.