U.S. equities have outperformed (albeit at much higher volatility) U.S. corporate credit this year -- both HY and IG.

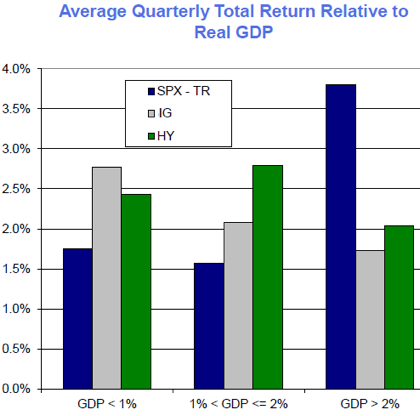

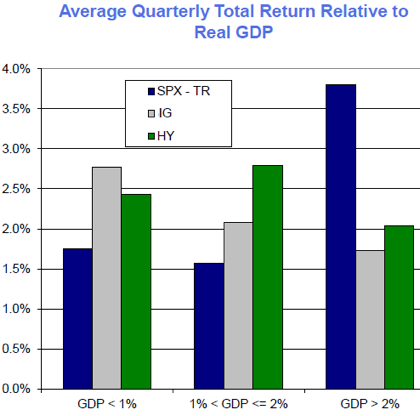

But is this outperformance consistent with the current economic environment in the U.S.? Here is how the asset classes have performed during different ranges of GDP growth from 1980 to today.

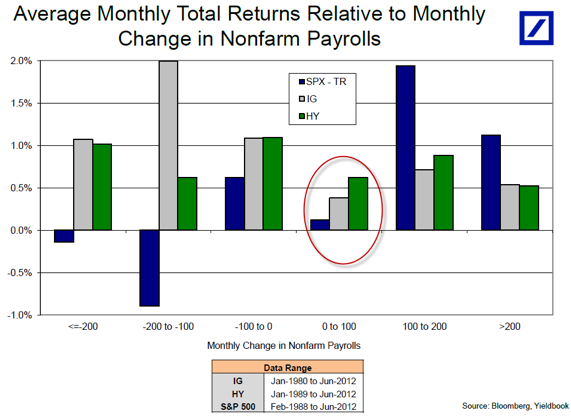

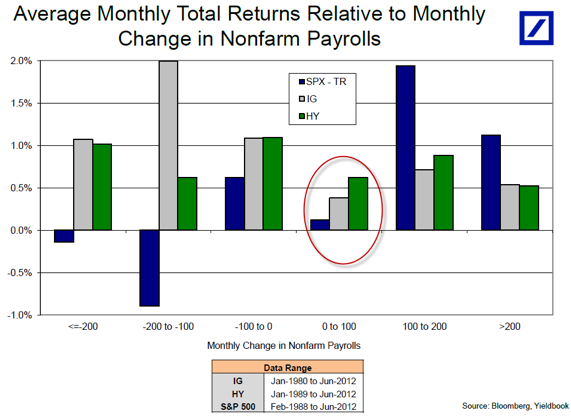

Since we are likely to be in the middle bucket for 2012, credit should, again, outperform equities. If we make this comparison using nonfarm payroll's monthly changes, we get a similar result.

Either we are going to return to first-quarter like job growth in the U.S. later this year, which seems unlikely, or equities look expensive relative to credit.

But is this outperformance consistent with the current economic environment in the U.S.? Here is how the asset classes have performed during different ranges of GDP growth from 1980 to today.

Since we are likely to be in the middle bucket for 2012, credit should, again, outperform equities. If we make this comparison using nonfarm payroll's monthly changes, we get a similar result.

Either we are going to return to first-quarter like job growth in the U.S. later this year, which seems unlikely, or equities look expensive relative to credit.