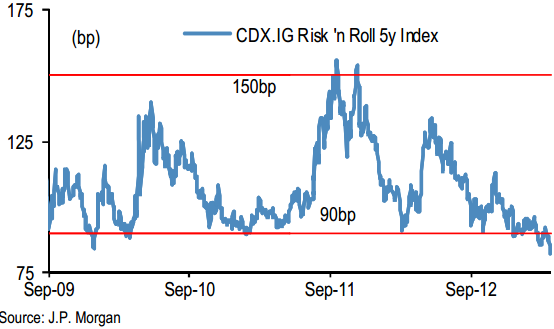

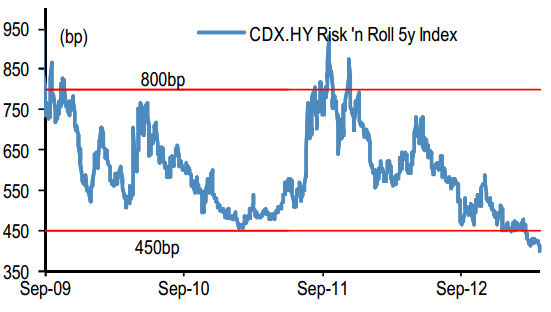

U.S. corporate CDS are tightening to new lows, as the Fed continues to pump liquidity into the market. The JPMorgan CDX indices which measure spreads for the "on-the-run" CDX (and include rolling into the most current series) are showing the tightest spreads in years. In fact the HY CDX spread is now at levels not seen since 2007.

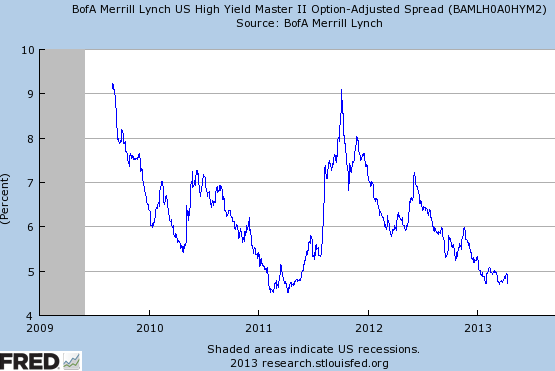

Bond spreads have been tighter as well, but have not kept up with the action in the credit default swap market. The chart below shows how HY bond spreads performed over the same period (compared with the chart above).

Part of the reason for cash bonds' underperformance vs. their synthetic cousins, is the unease with fixed rate products such as corporate bonds. Selling CDS is a way to increase corporate credit exposure without taking on rate risk (as opposed to buying corporate bonds).

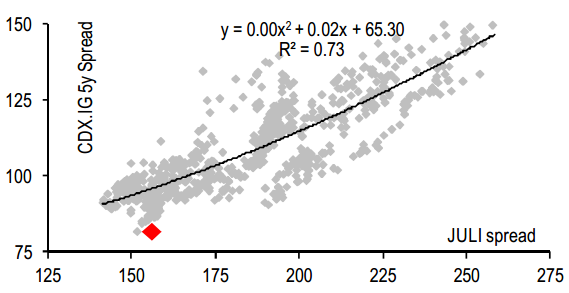

The same trend is taking place in the investment grade universe. The JULI spread is JPMorgan's investment grade bond index spread, which is regressed against the 5-year IG CDX below. CDX spreads have tightened considerably more than bond spreads.

In the past, market participants would close this gap by buying corporate bonds and cheaper CDS protection - entering into a rate swap. With rate swaps expected to move onto the clearinghouse, there is risk of having to post margin on both the bonds (at the prime broker) and the swaps (at the clearinghouse) - making it less appealing to for traders to execute this arb. Regulation is creating a bit of a market distortion.

The upshot of the latest market moves is that credit risk appetite continues to increase, approaching the pre-crisis frothy levels. At the same time, investors remain cautious on interest rates.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Corporate CDS Tightens To Multi-Year Lows; Bonds Lag

Published 04/12/2013, 12:24 AM

Updated 07/09/2023, 06:31 AM

Corporate CDS Tightens To Multi-Year Lows; Bonds Lag

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.