Well it looks like the relative “safety” of corporate bonds will not be spared from the upcoming sell-off in risk and one that could become that fast flight to liquidity detailed last December judging by many of the charts.

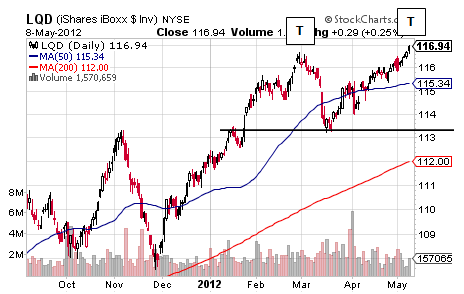

Sticking to corporate bonds here as told by LQD and a popular corporate bond ETF, it seems that there may be a decent sell-off relatively soon judging by the Double Top above that confirms at $113.23 for a target of $109.46 for a potential decline of 6%.

What makes the Double Top’s target interesting is the fact that it is below LQD’s 200 DMA and something that has not happened in earnest since 2008 with the first real bobble in July 2007.

Should LQD confirm its Double Top, it will provide a strong signal of a drop toward its 200 DMA with any flirtation with what has been the bottom of an Ascending Trend Channel sending the message that a much bigger drop – a fast flight to liquidity-type drop – will happen whether before, during or after the election.

It is this possibility of corporate bonds selling off too, then, that confirms a serious sell-off in the risk assets and one that is more than likely to qualify as a correction even if timing, as always, is a bit vague as is déjà vu.

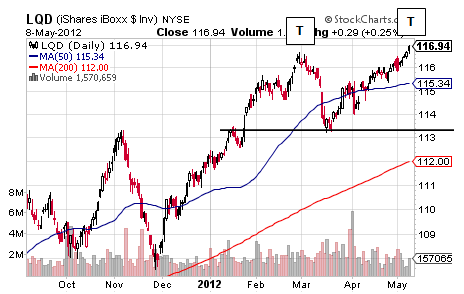

Sticking to corporate bonds here as told by LQD and a popular corporate bond ETF, it seems that there may be a decent sell-off relatively soon judging by the Double Top above that confirms at $113.23 for a target of $109.46 for a potential decline of 6%.

What makes the Double Top’s target interesting is the fact that it is below LQD’s 200 DMA and something that has not happened in earnest since 2008 with the first real bobble in July 2007.

Should LQD confirm its Double Top, it will provide a strong signal of a drop toward its 200 DMA with any flirtation with what has been the bottom of an Ascending Trend Channel sending the message that a much bigger drop – a fast flight to liquidity-type drop – will happen whether before, during or after the election.

It is this possibility of corporate bonds selling off too, then, that confirms a serious sell-off in the risk assets and one that is more than likely to qualify as a correction even if timing, as always, is a bit vague as is déjà vu.